Accounting For Mortgage Loans Held For Investment

This includes guidance on the accounting for interest income impairment purchased financial assets with credit deterioration refinancing and forclosures.

Accounting for mortgage loans held for investment. Interest expense is calculated on the outstanding amount of the loan for that period. Initial valuation of irlcs. Here39s are the typical hold ups. Closed loans held for sale 4.

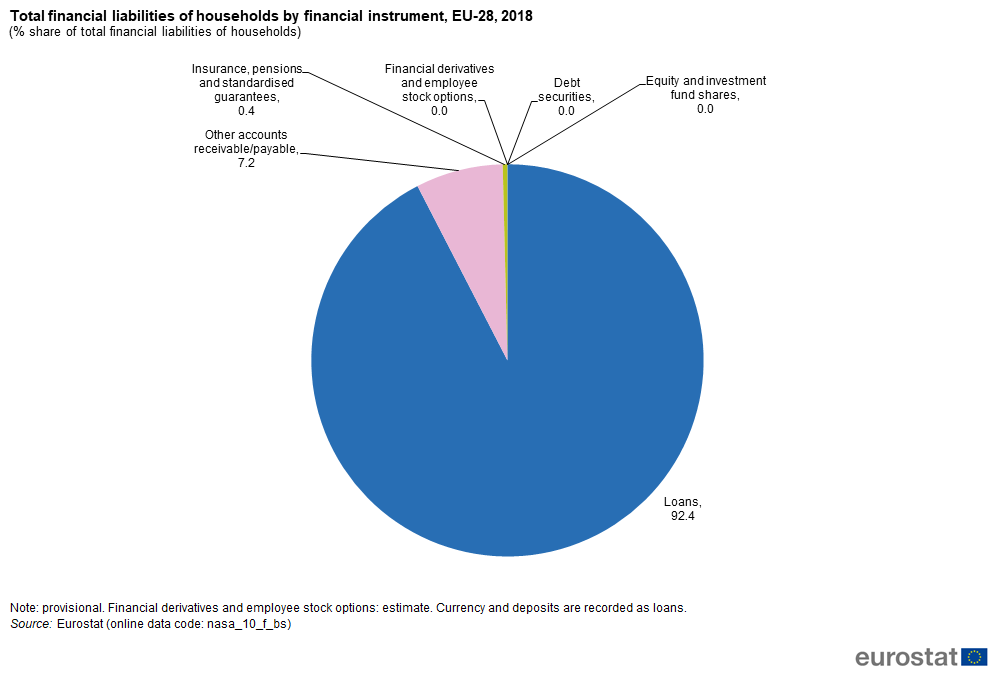

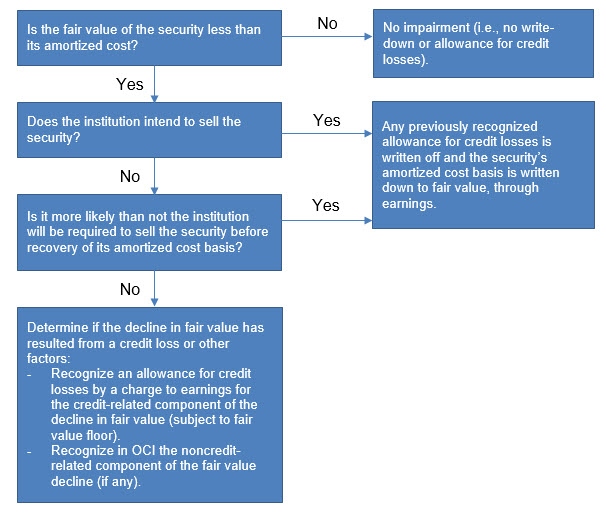

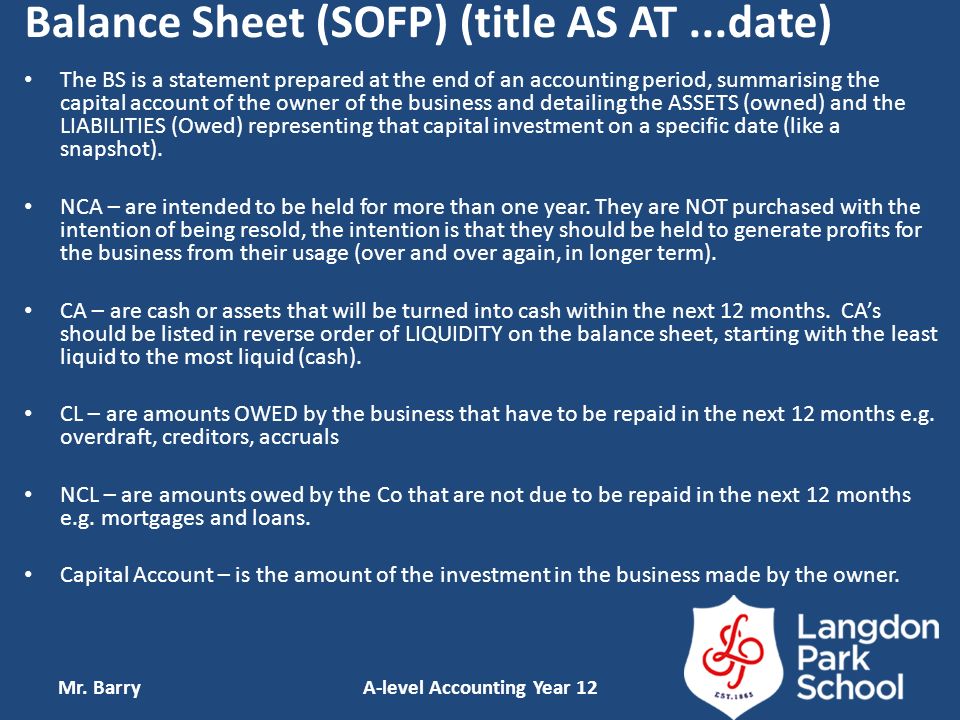

Mortgage servicing rights this white paper addresses the accounting and regulatory reporting requirements related to interest rate lock commitments forward mortgage loans sales commitments and closed loans held for sale. Background information related to the accounting of a hfs loans hfi loans and loans not held for sale and b debt securities classified as afs and debt securities classified as htm. Accounting for loan payables such as bank loans involves taking account of receipt of loan re payment of loan principal and interest expense. Consequently an institution would have to elect to account for these obligations at fair value.

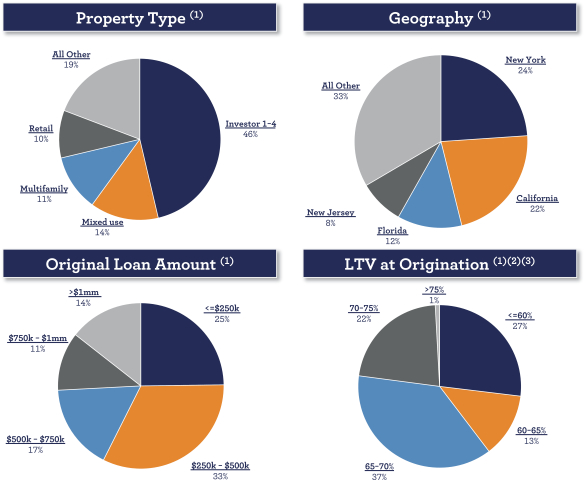

Investment securities are securities tradable financial assets such as equities or fixed income instruments that are purchased in order to be held for investment. Tfr the tfr instructions require that loans held for sale be reported along with the loan portfolio ie loans held for investment by loan category on the balance sheet on. The loans and investments guide provides guidance on the accounting for loans and investments after the adoption of the fasbs recognition and measurement standard and the new credit losses standard. Subtopic 948 310 mortgage bankingreceivables 3.

And lease financing receivables. Forward mortgage loan sales commitments 3. Commitments to originate mortgage loans to be held for investment and other types of loans are generally not derivatives. However as discussed in paragraph a33 of fas 149 the board concluded that commitments to originate mortgage loans that will be held for resale should be.

Originate 1 mortgage loans that will be held for investment purposes or 2 other types of loans ie other than mortgage loans are not subject to the requirements of fas 133. The federal deposit insurance corporation fdic and the other federal financial institution regulatory agencies have jointly issued the attached interagency guidance on certain loans held for salethe guidance addresses the appropriate accounting and reporting treatment for certain loans that are sold directly from the loan portfolio or transferred to a held for sale account. It39s one thing to be pre approved for a loan. Liability for loan is recognized once the amount is received from the lender.

Effective march 31 2001 loans held for sale will be reported as a separate asset category on the balance sheet schedule rc.

/quicken-loans-58046d043f8048f7a244b6aed0ecc154.png)

/ExxonBS09-30-2018copy2-5c7ecb5c46e0fb00019b8e8a.jpeg)

/Securitization_Market_Activity-9be299dd49fd4920a14e6185b7b7f71c.png)

/Clipboard01-5c7005ccc9e77c0001ddce7a.jpg)

/building-complete-financial-portfolio-357968-color-FINAL2-86933638b6844aa296049011de61d7fb.png)