Are Credit Cards Secured Loans

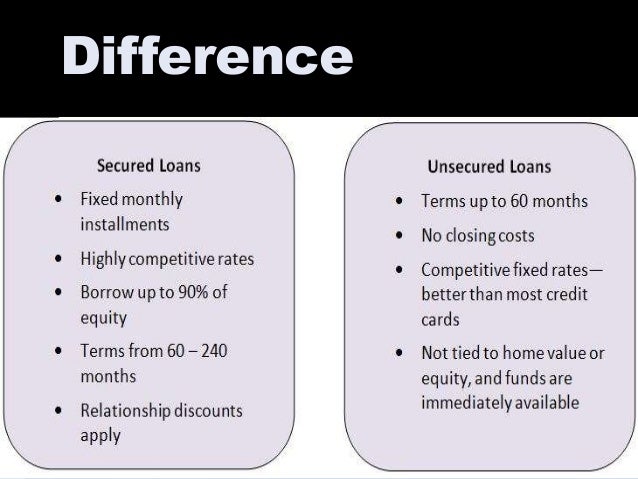

Certified federal credit union offers two specific types of secured loans.

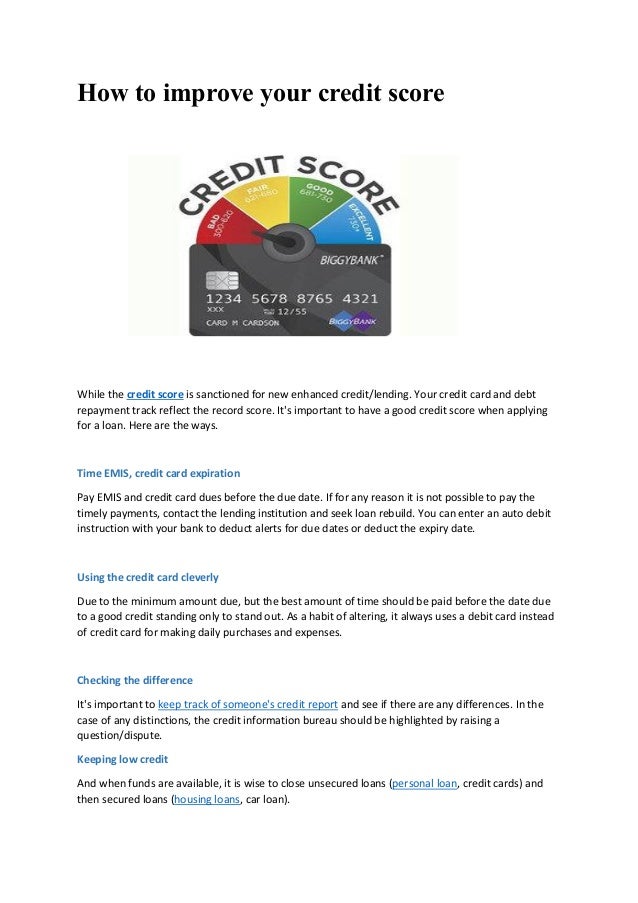

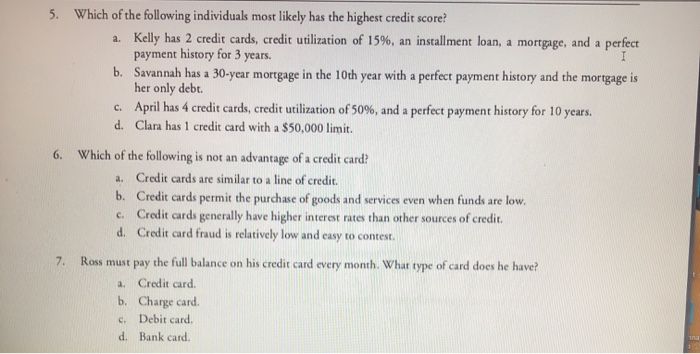

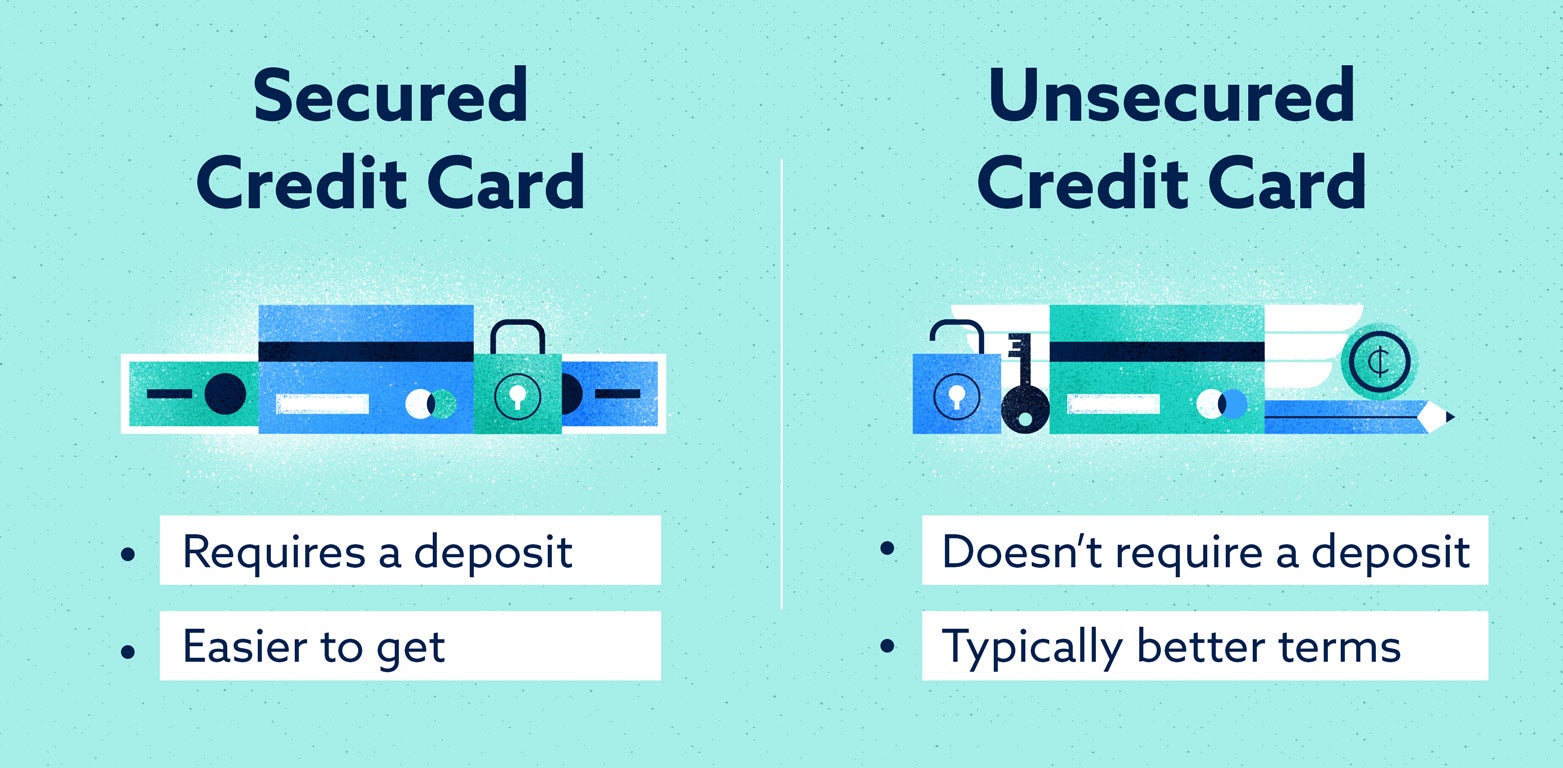

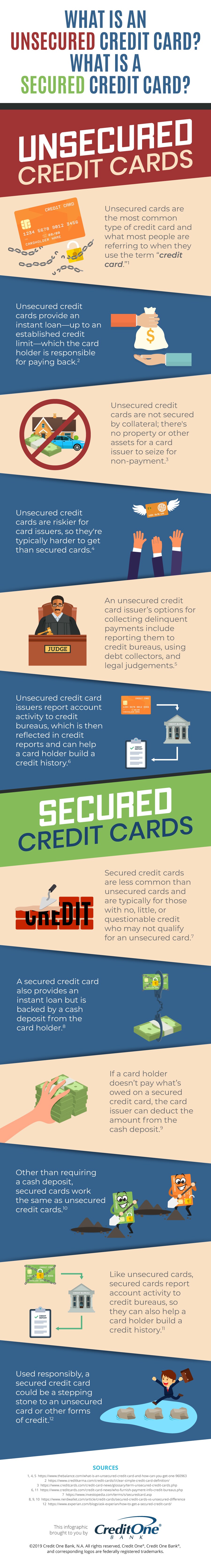

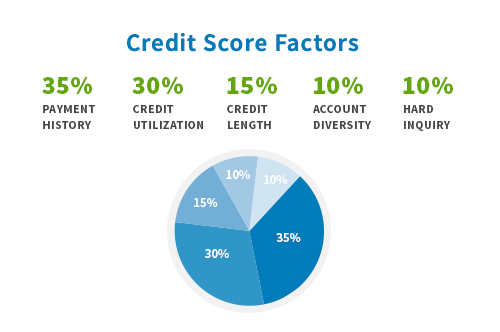

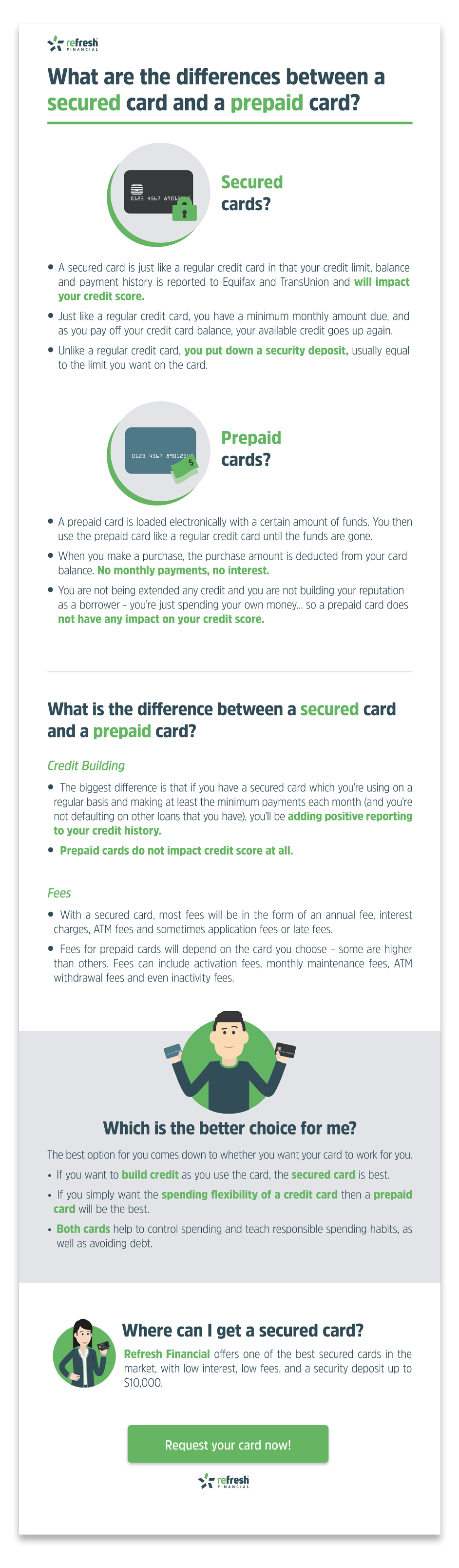

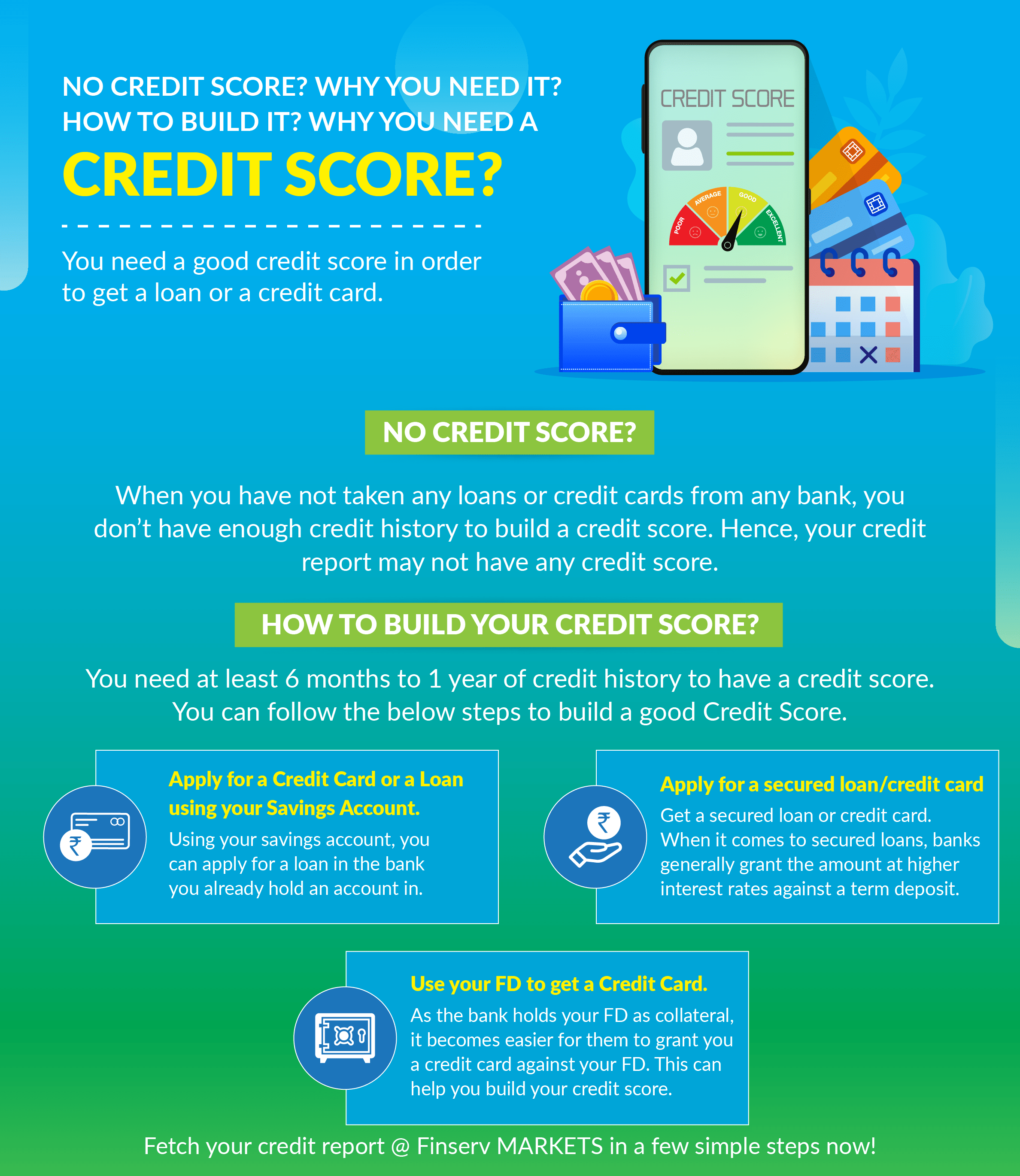

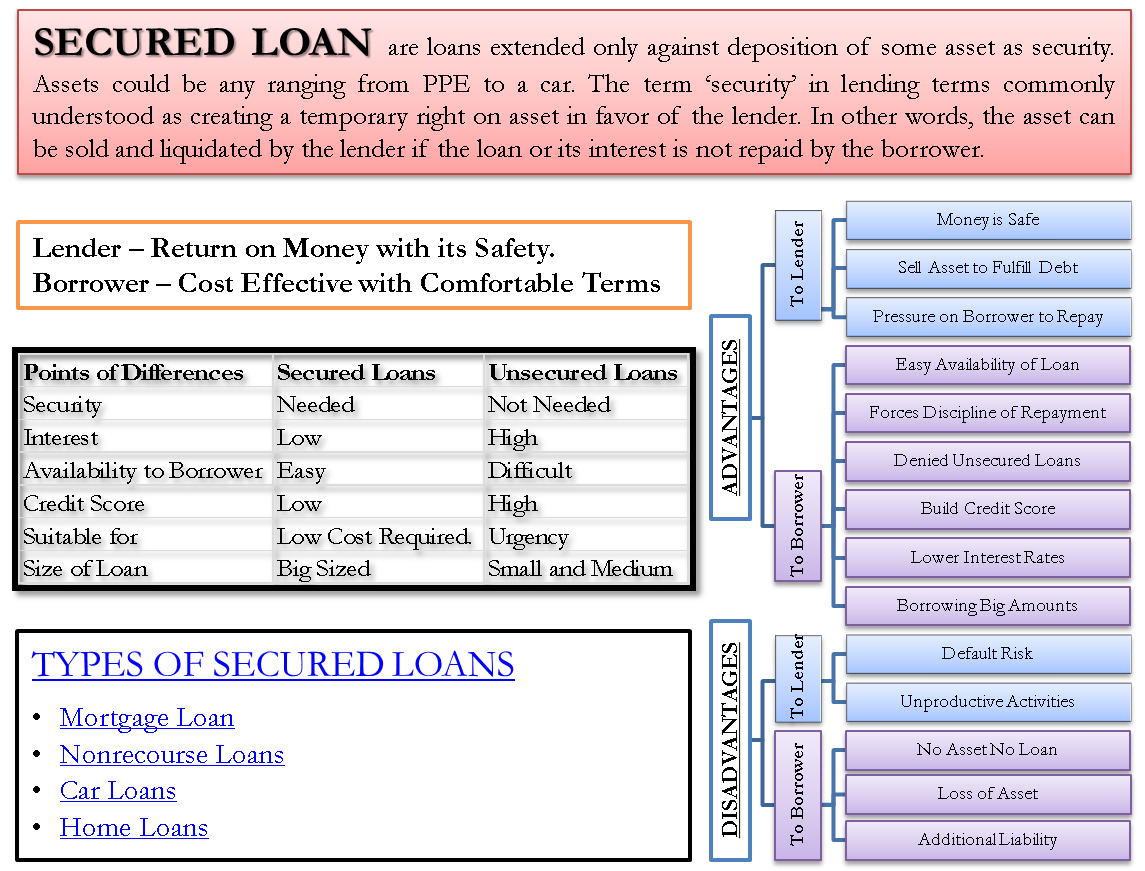

Are credit cards secured loans. Personal loans can be an inexpensive way to consolidate high interest debt fund a business endeavor cover an emergency or even pay for an unexpected tax bill. The most common types of unsecured loan are credit cards and personal loans. A secured credit card is a type of credit card that is backed by a cash deposit which serves as collateral should you default on payments. The deposit aside secured credit cards function like.

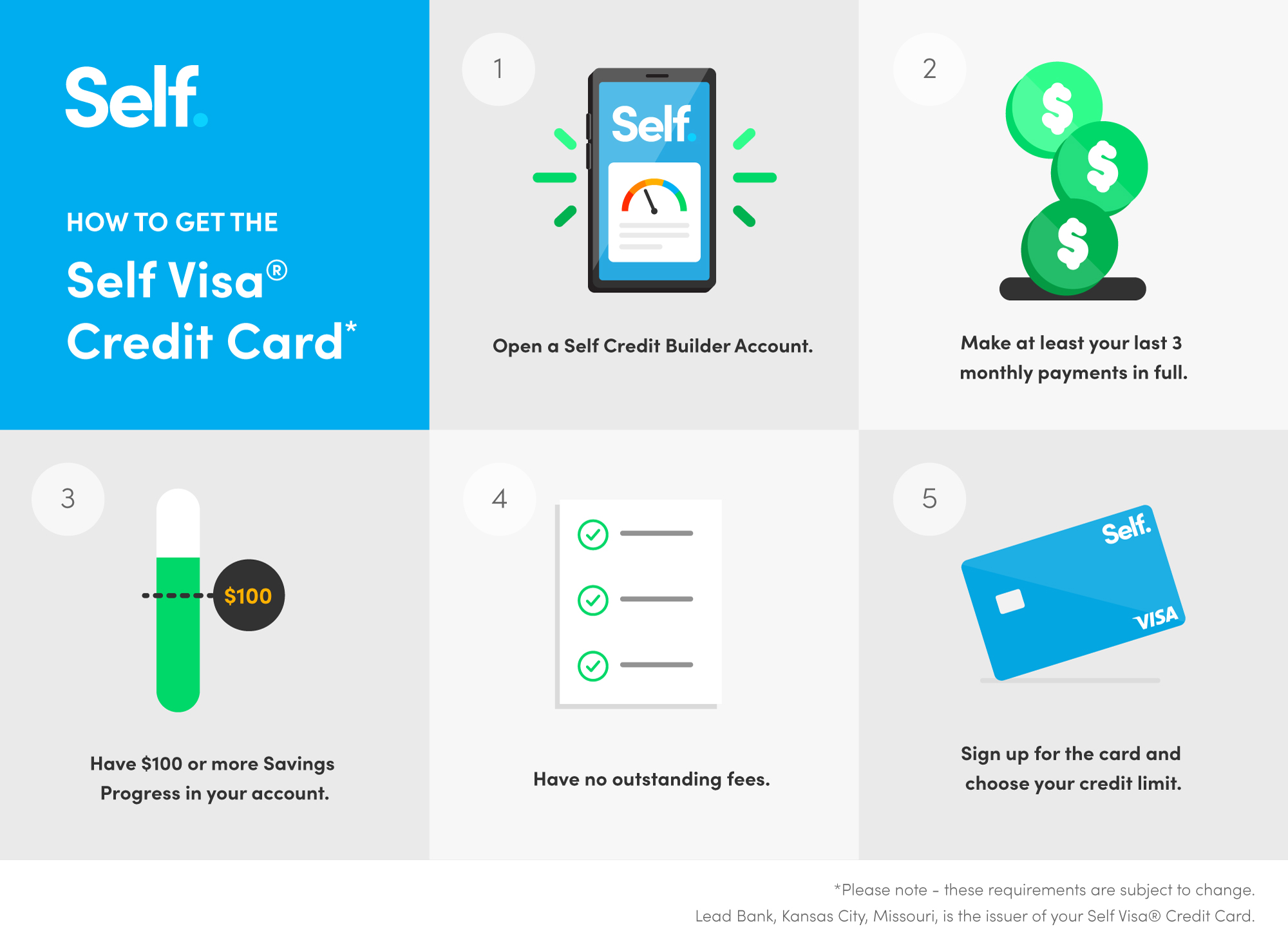

In both loan and credit card. A credit builder loan is a lesser known borrowing tool designed to establish or boost your credit. Up to 5000 secured credit limit union bank secured visa credit card. You may use the funds from a secured loan for any reason including consolidating higher interest rate debt paying for college or wedding expenses or taking a much needed vacation.

Its entirely up to you. Leverage the convenience and security of a credit card start building your credit history today. Found at select banks and credit unions these loans lock away an amount from 500 to 1500 in an account where your money stays until you pay off the loan. Checking or savings accounts.

Personal loans and credit cards both offer a way to borrow funds and have many of the same standard credit provisions. These loans are particularly attractive to borrowers because the terms and rates are lower than. Found at select banks and credit unions these loans lock away an amount from 500 to 5000 in an account where your money stays until you pay off the loan. If you want to.

Consumers who are looking for new ways to secure financing might want to consider a personal loan instead of credit cards or secured loans. Talk to one of our friendly loan experts if you. A credit builder loan is a lesser known borrowing tool designed to establish or boost your credit. With a secured credit card your spending limit is determined by the amount of your deposit.

A secured credit card is backed with a cash deposit that you are required to put down. The cash deposit acts as collateral against your credit card spending so it is more of a secure loan for the lender. How do they work. An unsecured loan on the other hand is not protected by any collateral.

Capital one can help you find the right credit cards. Account secured loans for any reason.

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

:max_bytes(150000):strip_icc()/how-to-get-a-credit-card-with-no-credit-history-960228_final-a41f121e97334815b26f1d506ec3bd1a.png)

/best-secured-creditcards-0af0ea8fc52b43bdafac3f0b404306cf.jpg)