Boat Loans Explained

In a serial issue bonds mature at different intervals creating a string of short.

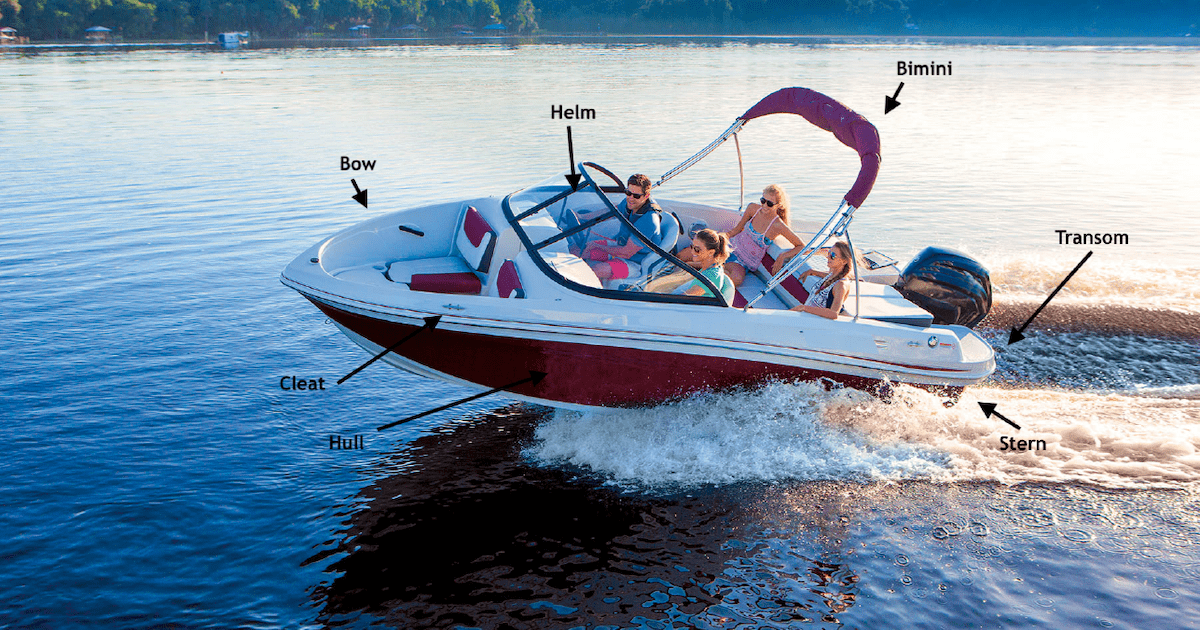

Boat loans explained. If a new boat isnt in the cards used boats offer a lot of value and in todays markets are a great option. Boat loans share some similarities with both vehicle and home mortgage financing. Personal loans allow you to borrow anywhere from 1000 to 100000 depending on your credit and if you choose to provide collateral. Additionally understand that while a used boat loan may come with a slightly higher interest rate than a new boat loan it is not any easier or harder to finance a used boat loan.

If youre not one of those lucky lads whose great grand aunt left them a small fortune when she passed away you might not be able to afford a pontoon boat off the top of your head or at least arent willing to spend all of your life savings on it at once. Boat loans are typically fixed rate fixed term simple interest loans secured by the boat being purchased. There are a few major differences between personal loans and 401k loans so consider the pros and cons of both before making a final decision. You have many choices when it comes to paying for your purchase.

Thrift savings plan loans. A boat loan is very similar in structure to an auto loan. You could go with a bank or you could finance your purchase with a lender who specializes in boat loans. Both take the same information into account for a purchase.

Your net worth your c redit rating shoot for upper 600s or higher income stability and debt to income ratios. How to get a pontoon boat loan explained. Similar to a home mortgage the bank can ask for your personal federal tax returns proof of assets and may ask for additional financial information depending on each situation. Boat loan calculator our boat loan calculator is a tool that you can use to determine if you can afford to purchase a boat.

By doing so youll know exactly how much youll get approved for and will have a good idea of the types. We spoke with tom smith president of sterling associates who explained the seven biggest benefits to working with a boat loan specialist. Before you take out a used boat loan get pre qualified. To use a boat loan calculator enter your desired loan amount loan term and interest you are expected to pay into the calculator.

An increased coupon rate on the longer term maturity instruments within a serial bond issue.

/avant-inv-26da12a807aa4f2bae2ac5158484fcff.png)

/shutterstock_381859822.yacht_.cropped-5bfc3ab2c9e77c005183cbc0.jpg)