Debt Consolidation Loans For Students

We are sure that the student loan crisis were in is no news to you as the student loan debt for the us.

Debt consolidation loans for students. Roughly 80 of student loan debt comes from federal loan programs. Lendingtree allows for you to compare debt consolidation loans from multiple lenders at once including the lenders below. Top 7 debt consolidation loans 1. Both federal and private lenders recognize that lower monthly payments help may be the best option if you dont get the job you want immediately after graduating from colleges.

Right now the loan has exceeded all our car loans and even our credit card debt. Federal student aid. The online lender focuses on debt consolidation loans with low rates flexible payments and ongoing support and financial guidance. Student debt consolidation program is the loan program that helps students to get loans for their federal education expenses while combining them into one debt loan.

How to use a federal direct consolidation loan to find relief from student loan debt. Here are seven of the best debt consolidation loans available today as well as tips on making sure you pick the best one for you. Payoff provides fixed rate debt consolidation loans to borrowers solely for the purpose of paying off credit card debt. How private student loan debt consolidation works.

One of the ways to overcome the debt crisis is through student loan consolidation. Debt consolidation is the combination of several credit accounts on one to pay off the loan as a rule at reduced rates. If youve ever used a debt consolidation loan to take care of credit card debt problems you may think you understand how a federal direct consolidation loan works for student loan debt. You apply for a consolidation loan through a private lender and qualify based on your credit score.

Lendingtree start shopping here. A private student debt consolidation loan works in much the same way as a credit card debt consolidation loan. As ways for debt consolidation loans you can receive. According to the company the average amount of debt borrowers pay off is 18000.

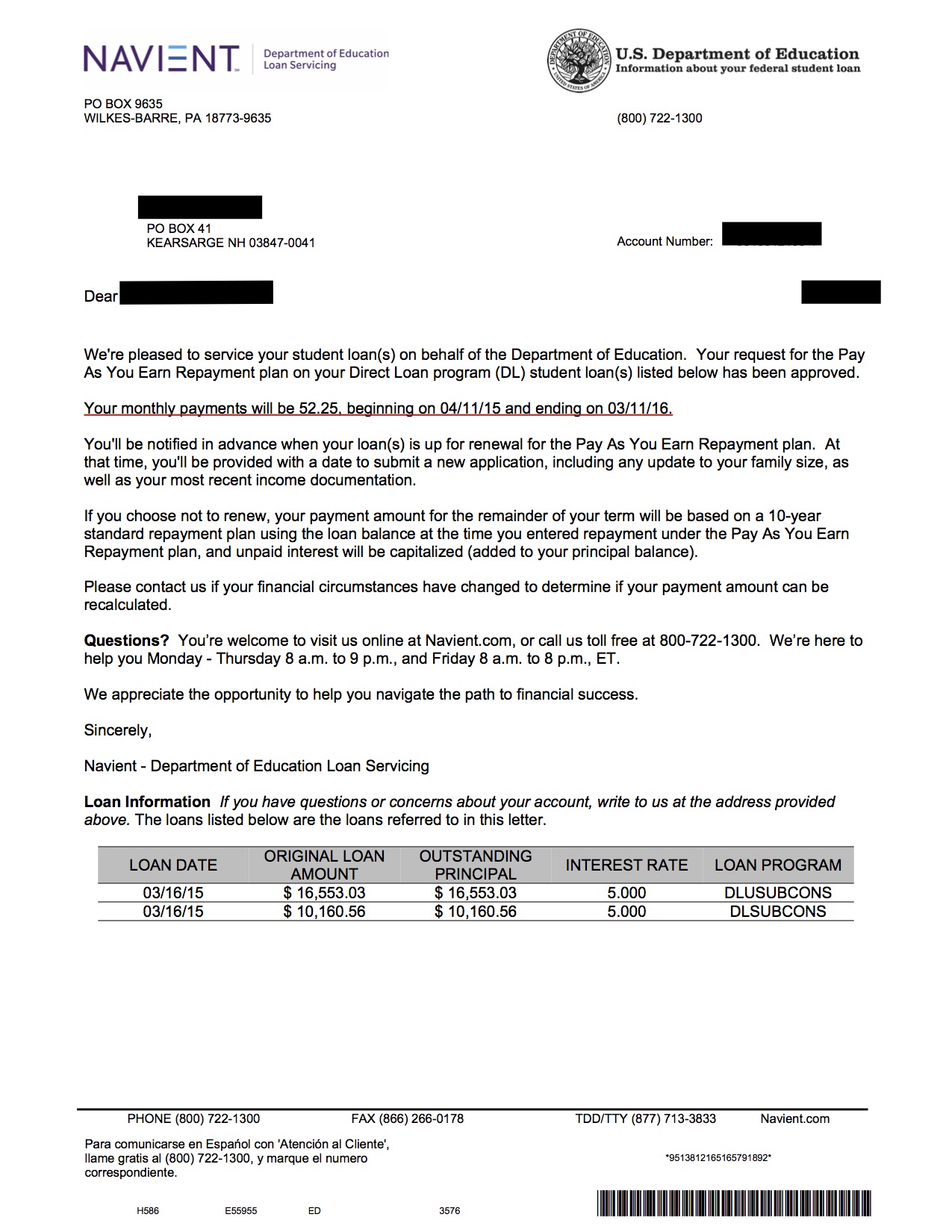

In this program interest rates are calculated accordingly to students previous loan rates. Loan consolidation for student loans was created to make it easier for millions of borrowers to pay off their debt. Citizens is at a massive 16 trillion in 2020 and increasing. In consumer lending this technique is common in developed western countries and the intermediary companies are engaged in debt consolidationat first glance this method of debt management seems to be beneficial.

/CourtneyKeating-EPlus-GettyImages-565c83113df78c6ddf626dda.jpg)