Debt Settlement Loans For Bad Credit

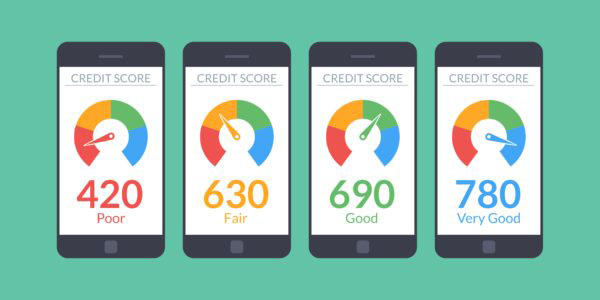

Lendingclub is reported to have a minimum credit score requirement of 600.

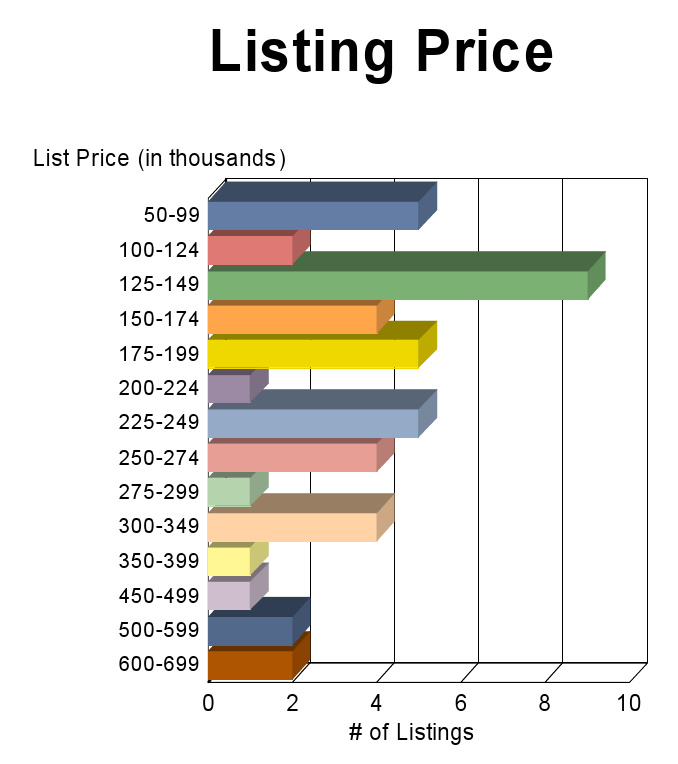

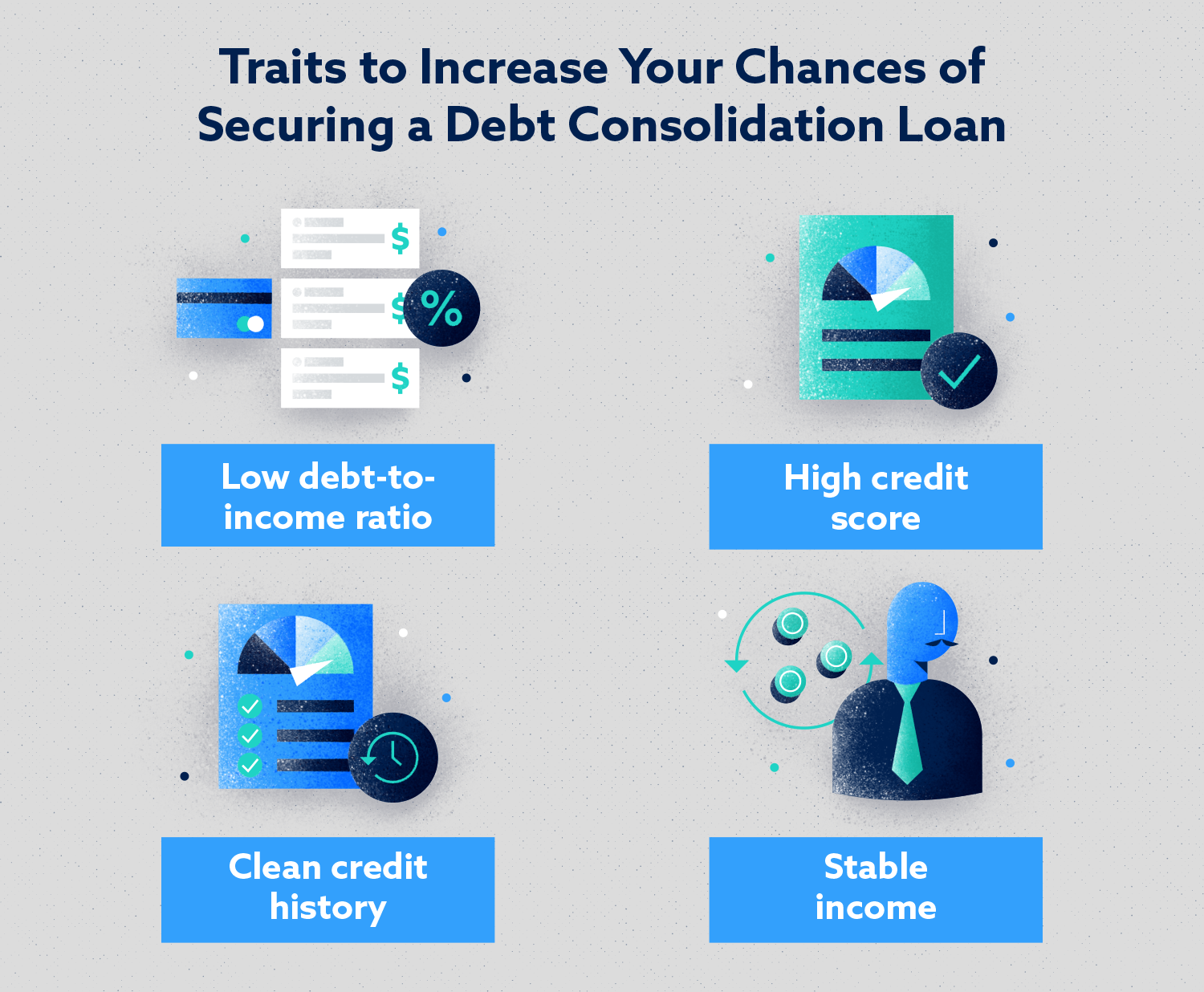

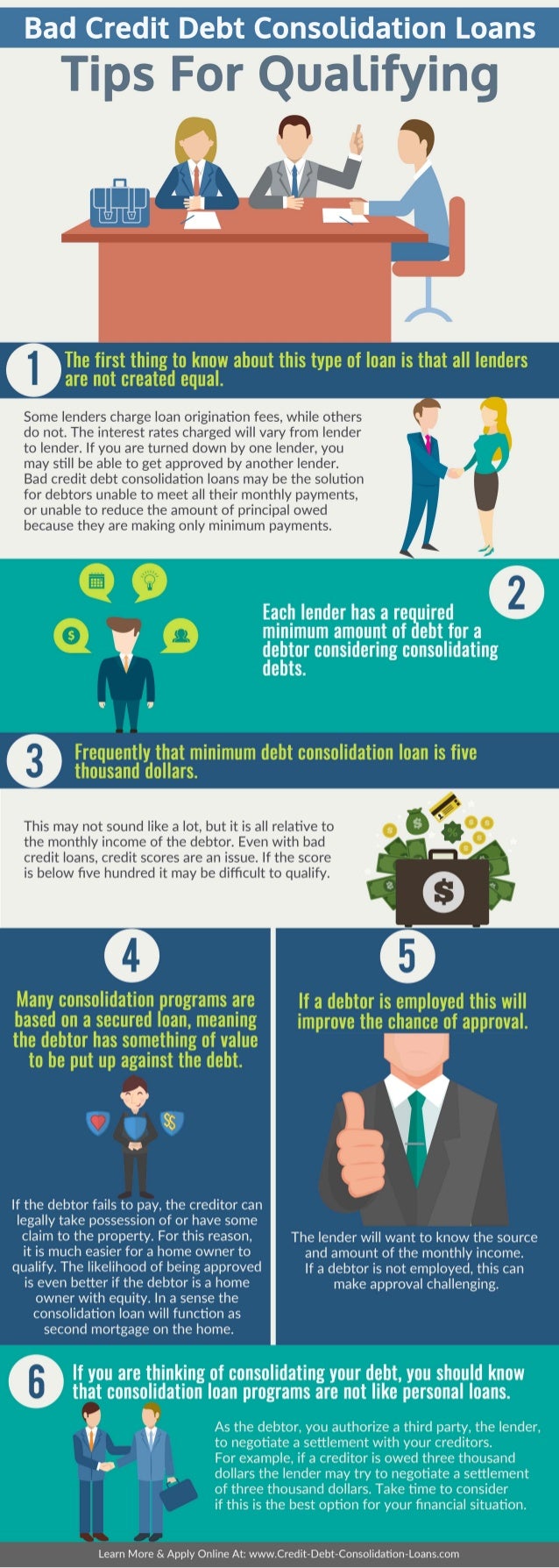

Debt settlement loans for bad credit. If you have bad credit its hard to climb out of debt. Getting a home equity loan with bad credit. The next level of debt relief will usually involve debt consolidation which is the process of using a new loan to pay off several smaller debts such as balances across multiple credit cards. Also settling multiple accounts hurts your score more than settling just one.

A large number of credit cards can carry interest rates in the high double digits. Poor credit is ok. Credit history plays a major role in the auto loan approval process both in the loan amount granted as well as the interest rate and expense associated with the loan. Ideally consolidation will net a lower interest rate which can reduce overall monthly payments.

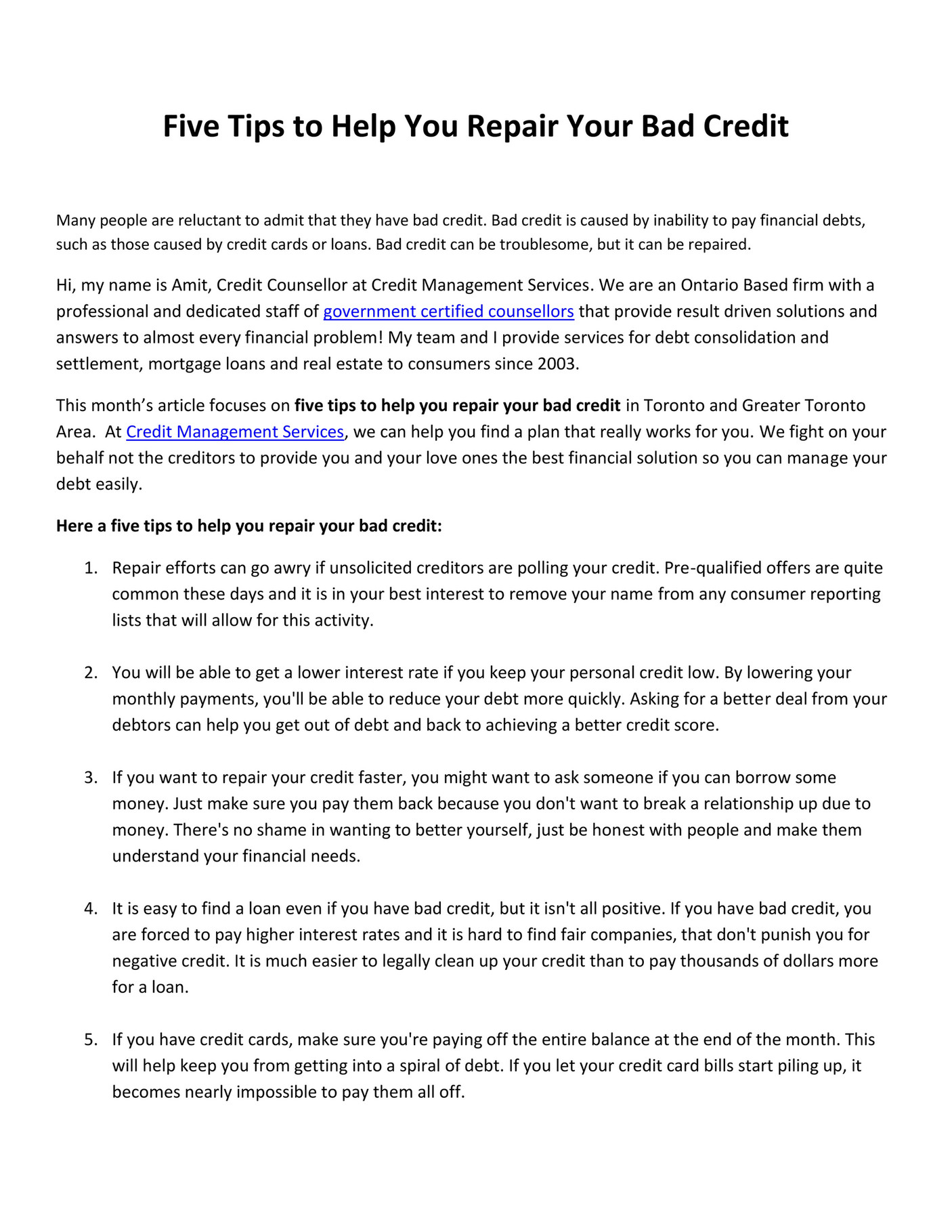

Bigger loansthen the impact of a debt settlement may be negligible. Severe debt and bad credit are a recipe for nightmares. Speak to the experienced counselors and debt relief specialists at united settlement 888 574 5454 and together we will examine the details of your specific financial situation and explore all avenues available to address your need for a debt consolidation loan even if you have bad credit. Negative credit history or no credit score are also invited to try to obtain gotten in touch with a loan provider.

If you have severe debt its hard to establish the good credit you need for solutions that can make dealing with debt a whole lot easier like debt consolidation loans. If youre considering debt consolidation loans for bad credit here are some online lenders you may want to check out. Your credit score will suffer under debt settlement and you may be contacted by debt collectors during the debt settlement process. Credit cards and other high interest unsecured debt debt not backed by collateral are the main reasons many people consider debt consolidation.

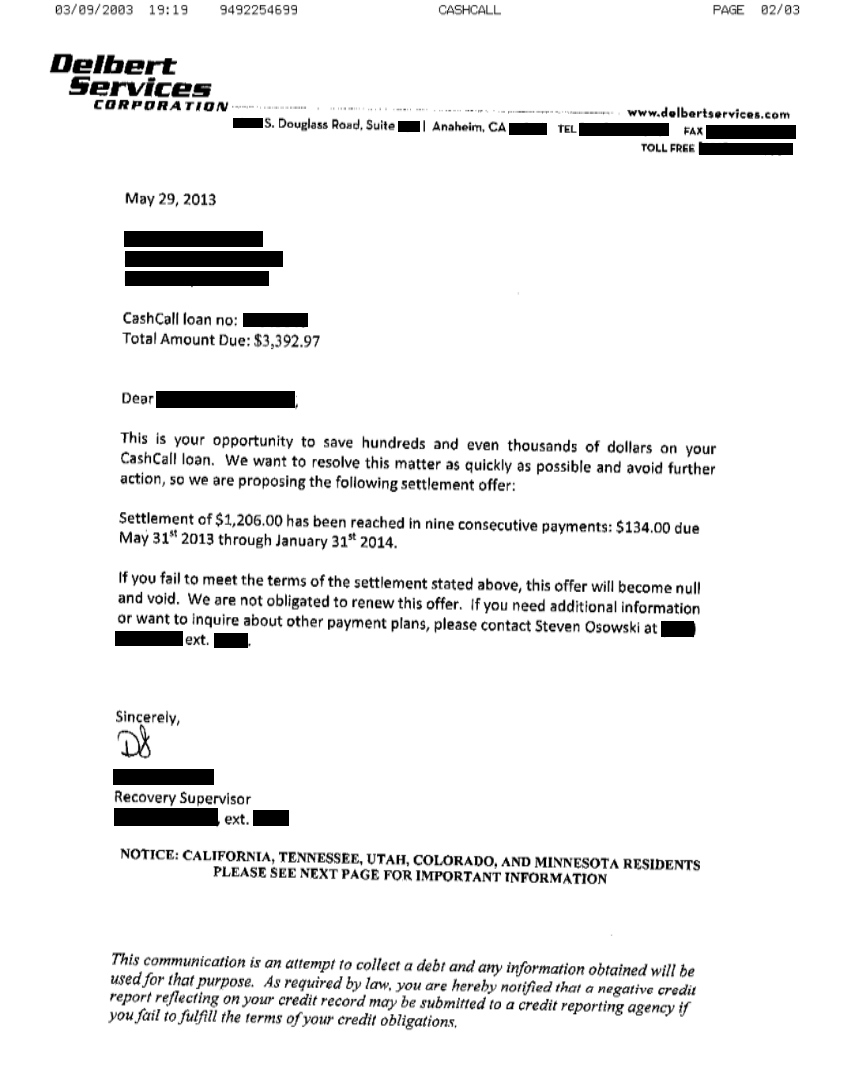

Request a free debt consultation to find out how the freedom debt relief program could help you significantly reduce what you owe and get your finances back on track now. Consumers pick payday advancements to cover little unexpected costs while staying clear of pricey bounced check fees as well as late settlement charges. Debt settlement works best for individuals with more than 7500 in unsecured debt or debt that is not linked to any assets such as property.