Explain Loans With Example

Short term loans and revolving credit.

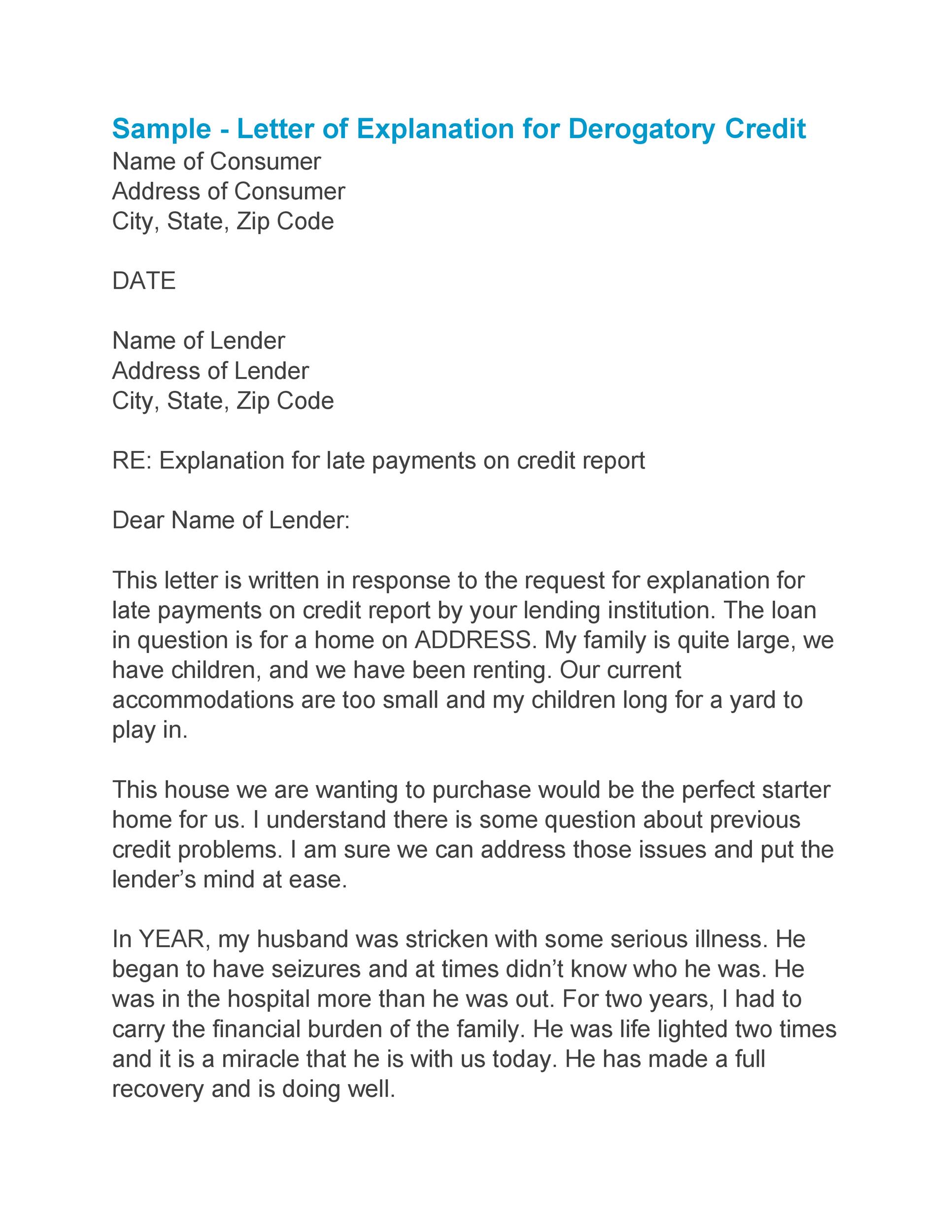

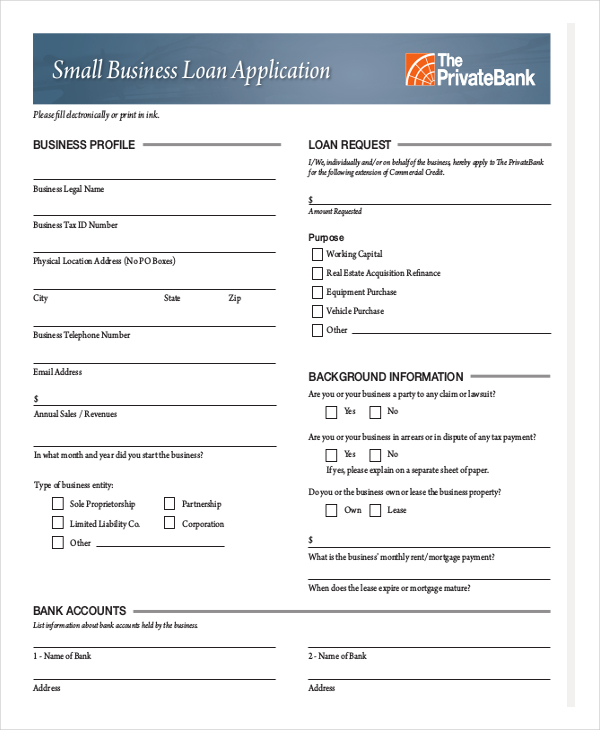

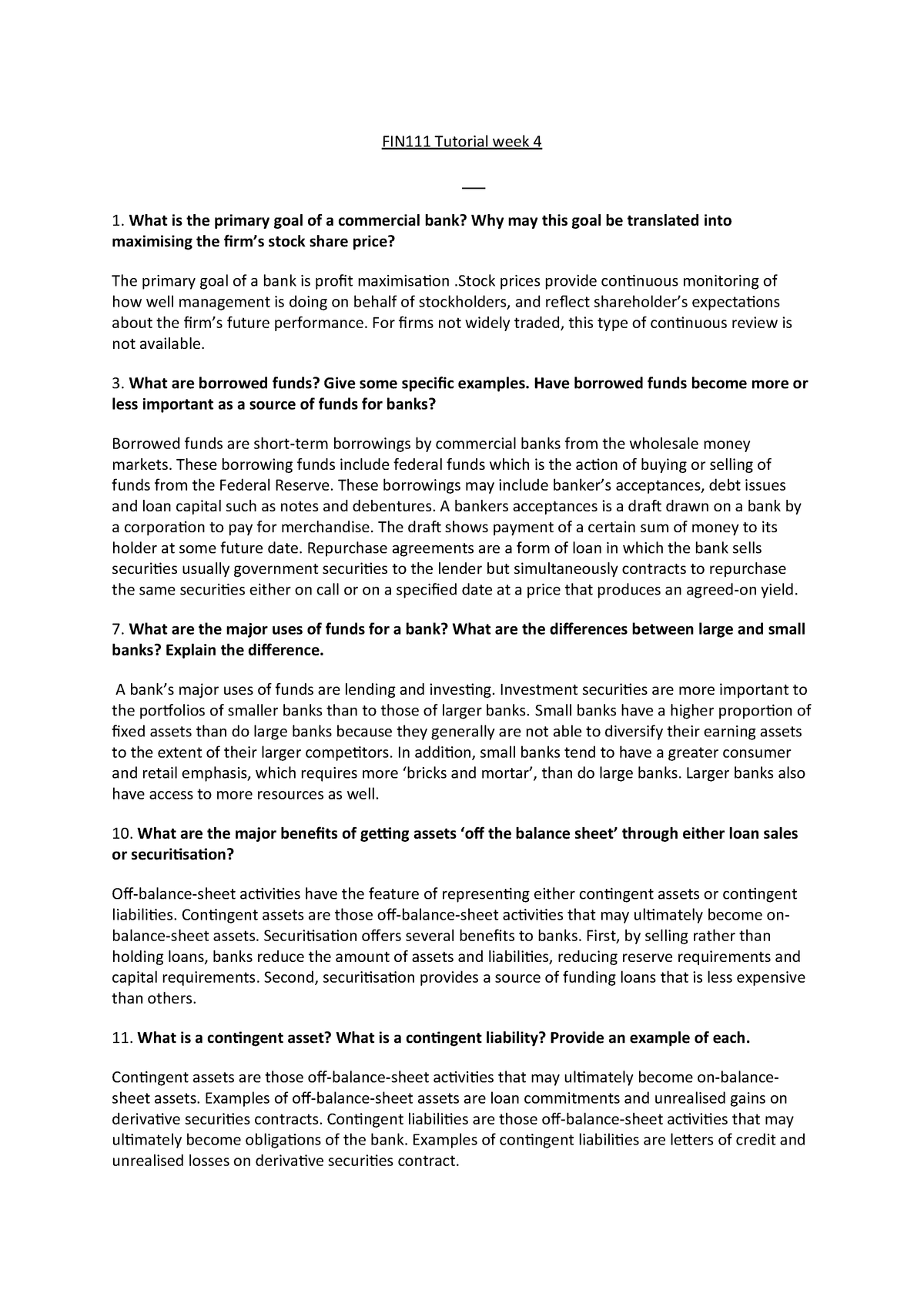

Explain loans with example. These loans may be more difficult to get and have higher interest rates. Example of a company oriented term loan. Questions are typically answered within 1 hour q. A small business administration loan officially known as a 7a guaranteed loan encourages long term financing.

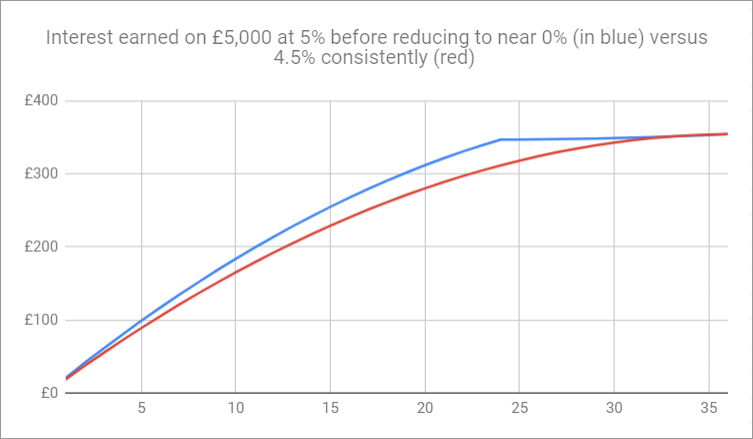

When olayan america corporation wanted to purchase the sony building in 2016 it took out a bridge loan from ing capital. For example if a person borrows 5000 on an installment or term. Is presently enjoying relatively high growth because of a surge in the demand for its ne. However you would still have to pay back the whole 20000.

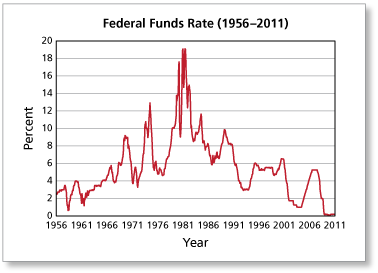

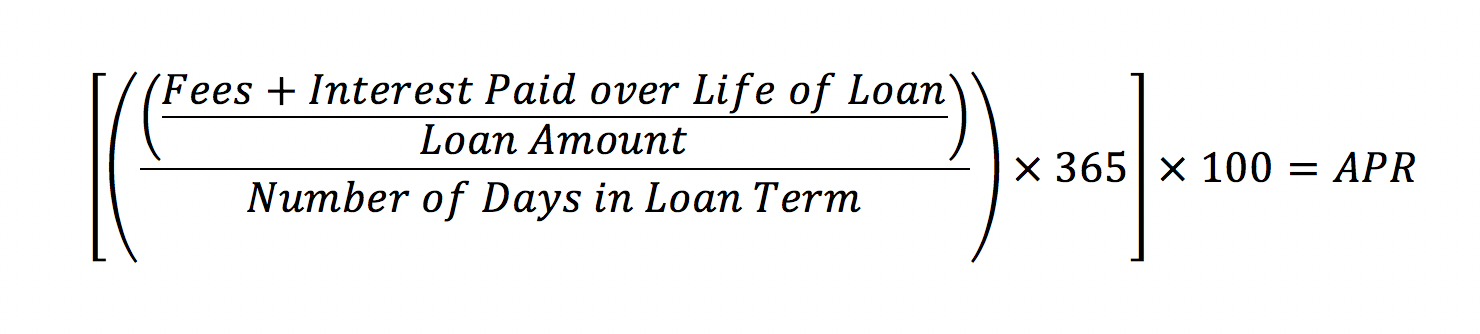

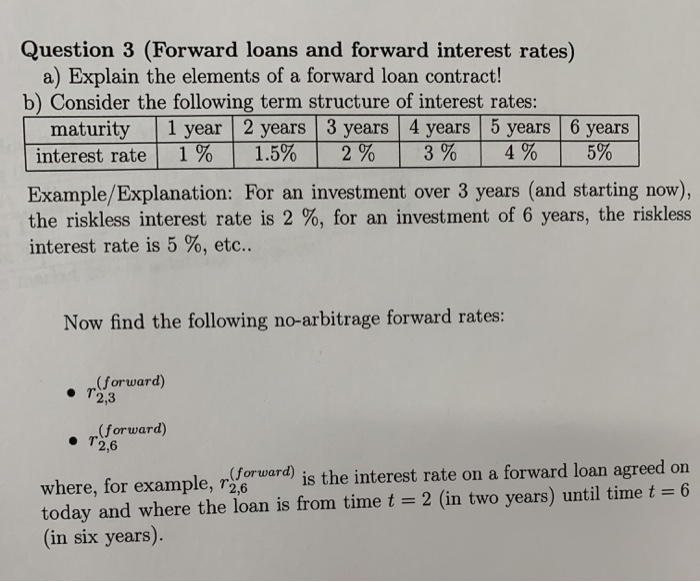

For example a 51 hybrid mortgage or 51 arm offers a borrower a fixed interest rate for 5 years before switching to an adjustable rate with the rate adjusting once per year for the remainder of the home loans term. The interest and charges came to 2000you would receive 18000 from the lender. If your home gains value because housing prices rise your ltv will decrease although you might need an appraisal to prove it. Auto loans are often five year or shorter amortized loans that you pay down with a fixed monthly paymentlonger loans are available but youll spend more on interest and risk being upside down on your loan meaning your loan exceeds your cars resale value if you stretch things out too long to get a lower payment.

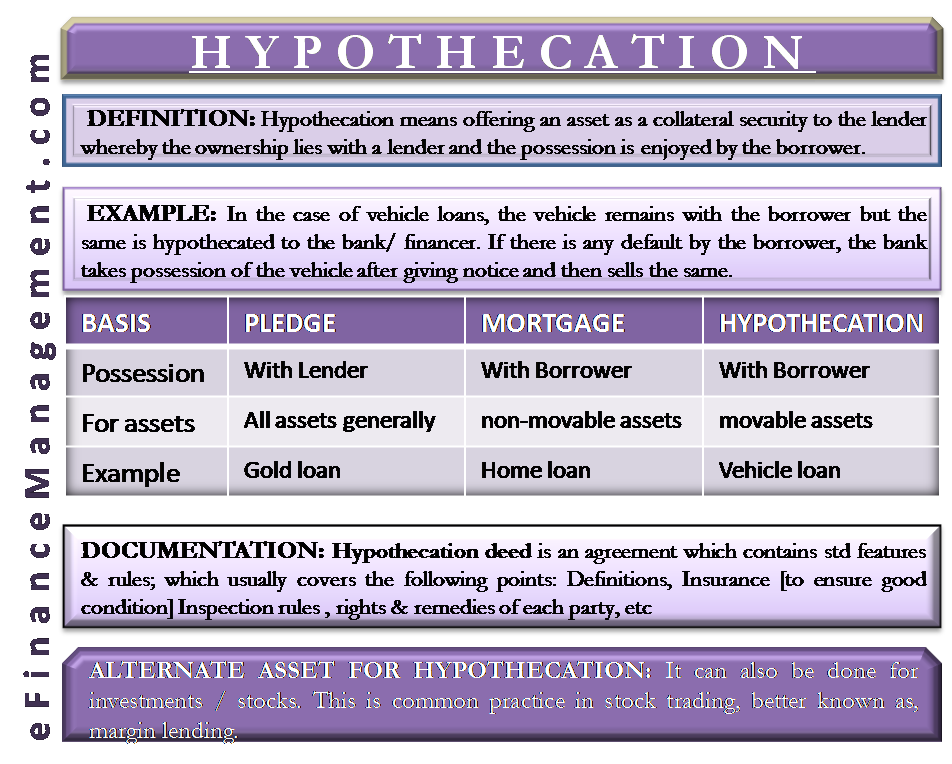

Unsecured loans rely solely on your credit history and your income to qualify you for the loan. Example of a bridge loan. Home loans are traditionally 15 year or 30 year fixed rate mortgages. For example when you borrow against your house with a home equity loan youre using your homes value and effectively increasing your ltv ratio when you get a loan.

Solutions are written by subject experts who are available 247. Loans with higher interest rates have higher monthly paymentsor take longer to pay offthan loans with lower interest rates. A title loan is another example of a secured loan. Interest rates on discount loans tend to be higher than those on other types of loans.

Example of a discount loan. Subprime borrowers generally have low credit ratings or are people who are perceived of as likely to default on a loan. Expected rate of return risk free rate. The short term loan was approved very quickly.

Imagine you wanted to borrow 20000 and pay back twelve months later. If you default on an unsecured loan the lender has to exhaust.

/what-is-an-interest-only-mortgage-1798407v2-1d8bab55729948ce930d672c239609d7.png)

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

/calculate-Interestrate_393165-76ce02cdd3b0498280004aa12a7596f8.png)

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)

/close-up-young-woman-with-calculator-counting-making-notes-624490712-5ae94f5a0e23d9003918019c.jpg)

:strip_icc()/loan-principal-questions-and-answers-52ba5408c43b44fc940ac8b4c1446f24.png)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

:max_bytes(150000):strip_icc()/what-is-interest-315436-Final-da800acbec464ec5ad6fc7e5f60a1475.png)

/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)