Home Equity Loans Low Credit Score

However cash out loan programs like the fha loan will allow you to borrow up to 85 of your homes value with a credit score as low as 580 which gives you added options if your scores are below the 620 threshold that most home equity lenders require as the minimum.

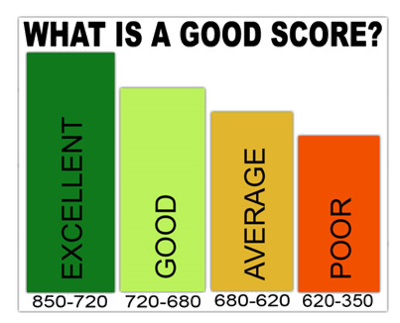

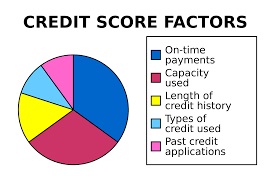

Home equity loans low credit score. Lenders look at a variety of factors when deciding if you qualify for a home equity loan. The credit score required for a heloc is typically the same as that of a home equity loan. A credit score is one of the most important metrics that a lender uses to analyse an individuals creditworthiness. The eligible credit score for a home equity line of credit is usually at least 620 though a score closer to 700 is ideal.

However maintaining a good credit score is not easy for many as it requires discipline money management skills and most importantly adequate cash flow to repay debts on time. Home equity loans are a way for property owners to turn the unencumbered value of their homes into cash. Take a few moments and compare poor credit home equity loans. Unlike a home equity loan which is a second loan on the home a cash out refinance moves your entire loan balance to a new lender.

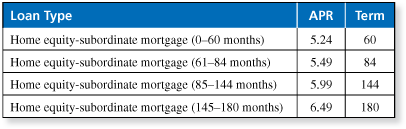

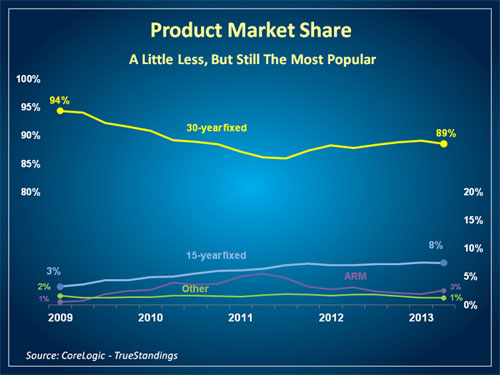

A score of 750 or above is considered good and helpful in getting loans approved easily. We will connect you to the leading home equity brokers who provide sub prime loans in your local region. A cash out refinance may also be easier to get with a low fico score than a home equity loan because the lender retains first lien rights on your property. For instance a borrower with a credit score between 620 and 639 would pay an average interest rate of 1078 percent for a 15 year fixed home equity loan of 50000.

Jpmorgan chase co for example said that except for one type of loan for low and moderate income households the bank now requires a minimum fico score of 700 and a minimum down payment of 20. Hem is your best source with home equity loans for people with bad credit problems. And if you have bad credit a home equity loan is more likely to be approved by a lender. If your credit score is below 700 qualifying for a home equity loan may require you to shine in other areas such as your debt to income ratio dti or the amount of equity you have.

In general fair credit scores are a minimum for this type of financing.

/business-with-customer-after-contract-signature-of-buying-house-957745706-85fbb1739bcc4a27b1e5d1e80dd9c1c9.jpg)

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

/shutterstock_499759978.home.equity.cropped-5bfc30ec46e0fb005145d2a0.jpg)

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

/GettyImages-494330523-5a43dc60eb4d520037842ffc.jpg)