How Many Loans And Credit Cards Should I Have

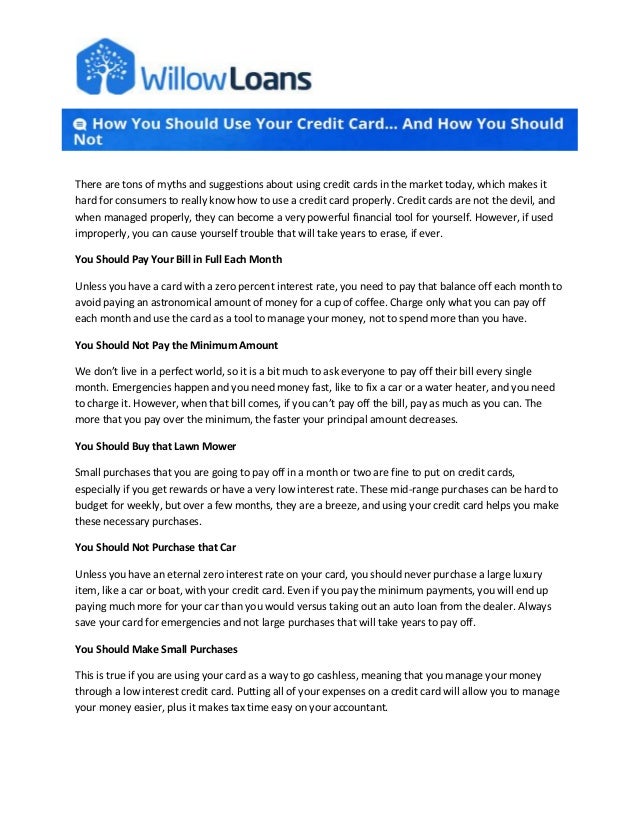

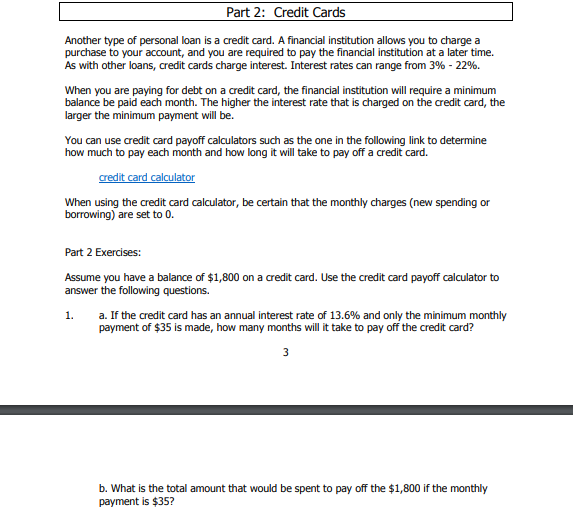

How many credit cards you should have depends on many factors such as your spending habits desire for rewards financial responsibility and willingness to pay annual fees.

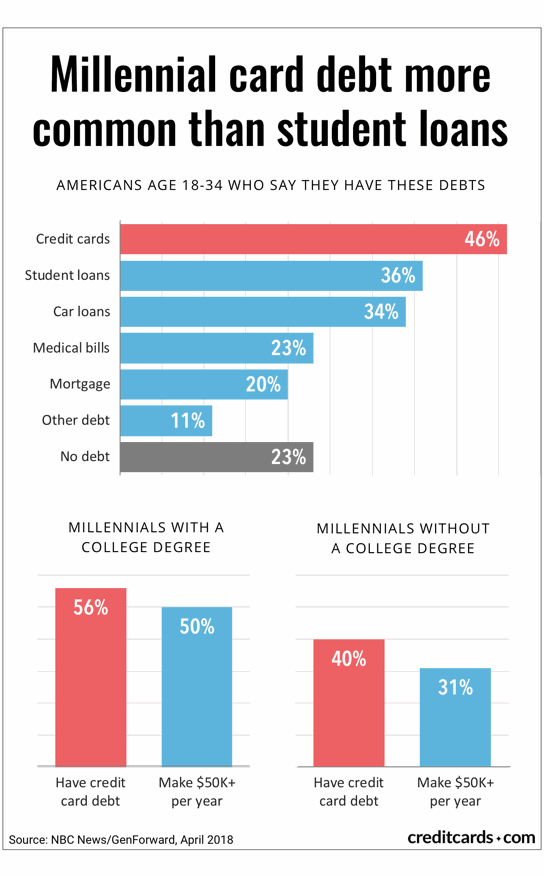

How many loans and credit cards should i have. Having too many credit cards sends a signal to banks and the credit bureau of singapore cbs that you are in desperate need of credit. If you do you may be wondering if you have too many credit cards. There is no magic number of cards you should shoot for to achieve a high credit score. It can help you make large one off purchases and can even help to build your credit score among other benefits.

You should have at least two ideally each from a different network visa mastercard american express discover etc and each offering you a different kind of rewards cash back miles rewards points etchow many credit cards is too many. However be wary of the fact that applying for too many credit cards can make you appear credit hungry to financial institutions which is why applying for more than 4 cards should be avoided. If you find yourself asking how many credit cards you should have we have some answers. Statistics find that the average individual with a fico score exceeding 785 has 7 open credit cards.

Credit builder plus loans have an annual percentage rate apr ranging from 599 apr to 2999 apr are made by either exempt or state licensed subsidiaries of moneylion inc and require a loan payment in addition to the membership payment. If it isnt used sensibly however it can have a detrimental impact on your ability to borrow money in the future and worse you can get into a significant amount of debt if it isnt managed responsibly. Instead lets take a look at the credit cards of consumers with excellent scores. The bank of america travel rewards credit card and the capital one ventureone rewards credit card cards are examples of these types of cards.

Many people may wonder if there is a right number of cards to have. Both cards are single rate earning cards that. Theres no one size fits all when it comes to the number of credit cards you should have in your wallet.

/denied-credit-card-application-960247-v1-0aa7e53830ea4a508ab8366f8d5bde26.png)

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

:max_bytes(150000):strip_icc()/how-to-get-a-credit-card-with-no-credit-history-960228_final-a41f121e97334815b26f1d506ec3bd1a.png)