Ifrs 9 Loans At Fair Value

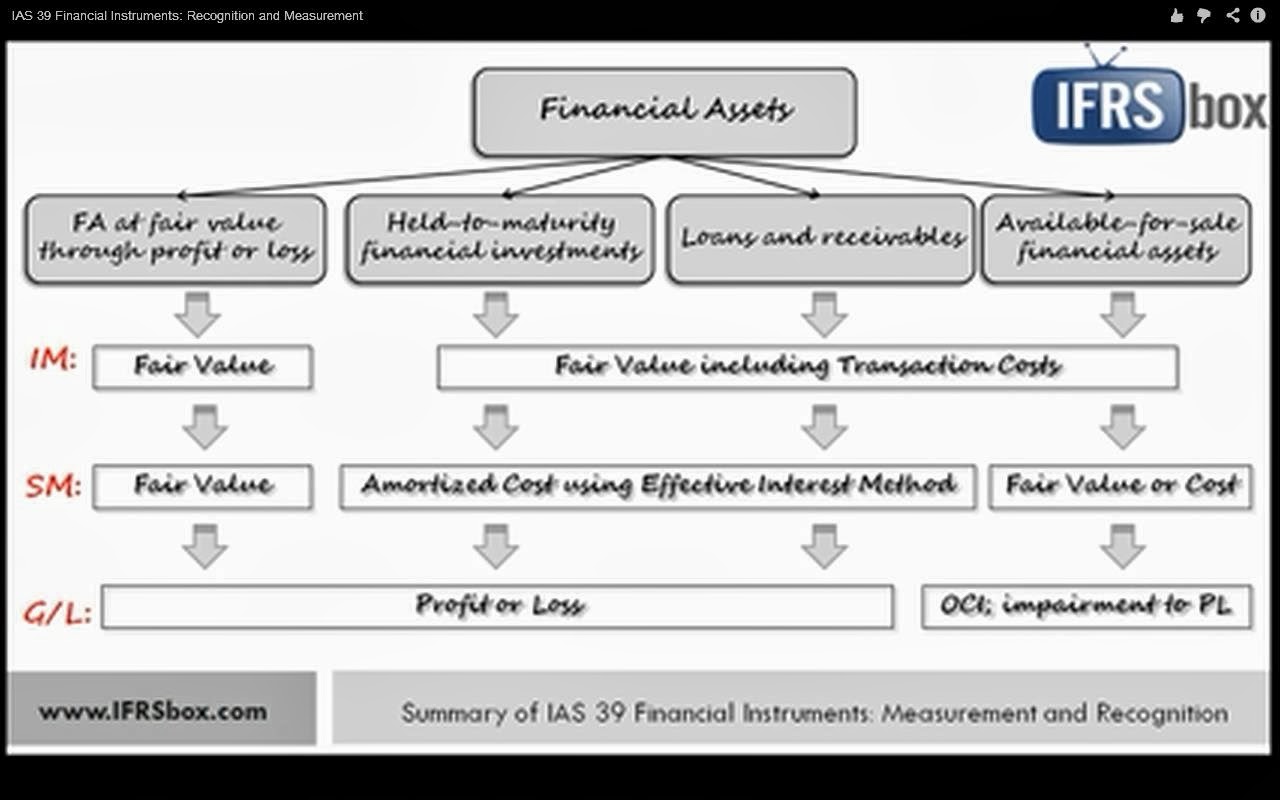

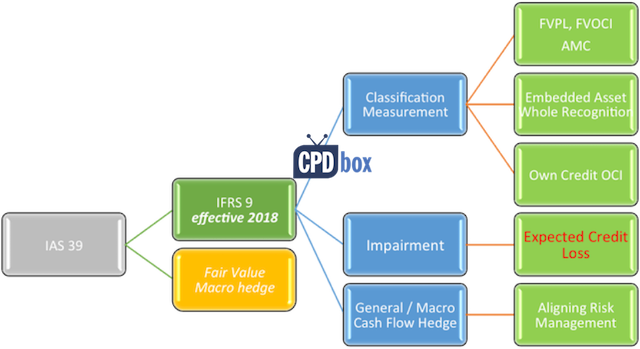

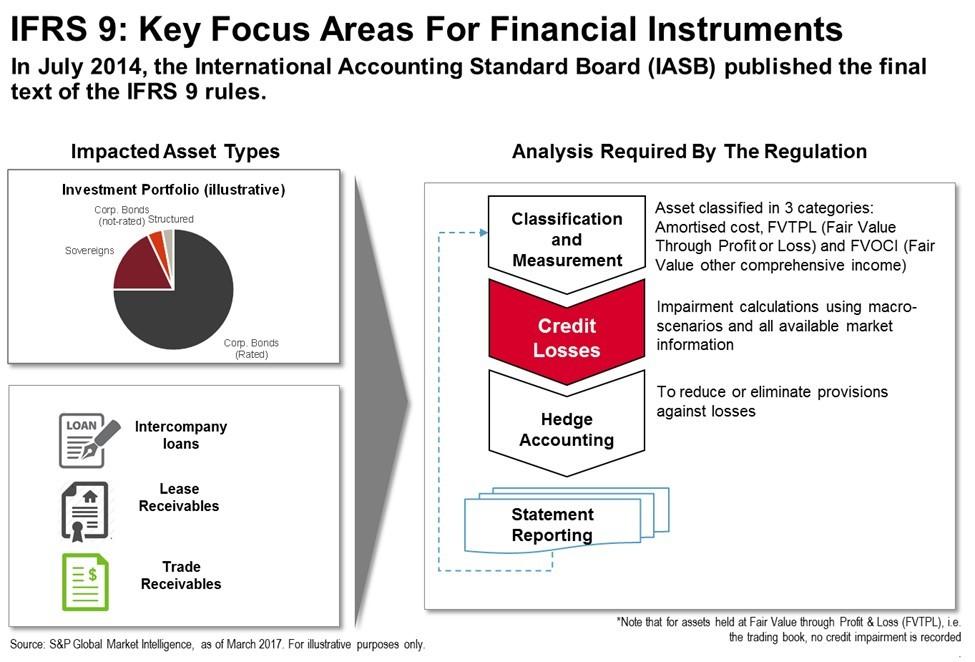

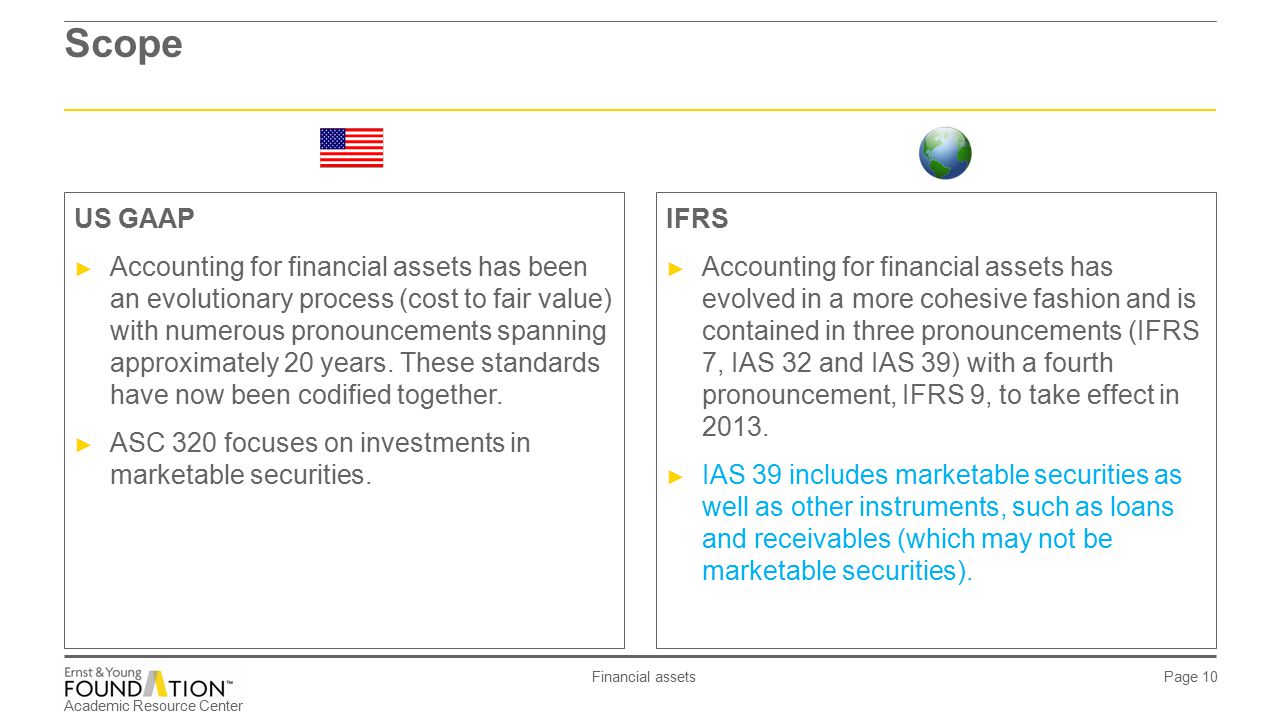

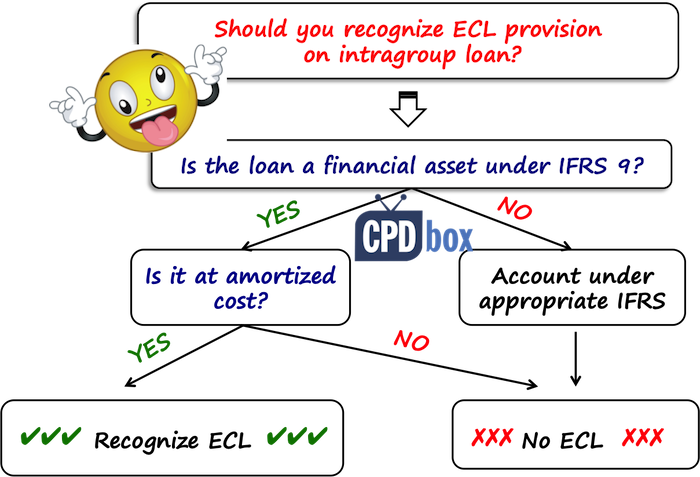

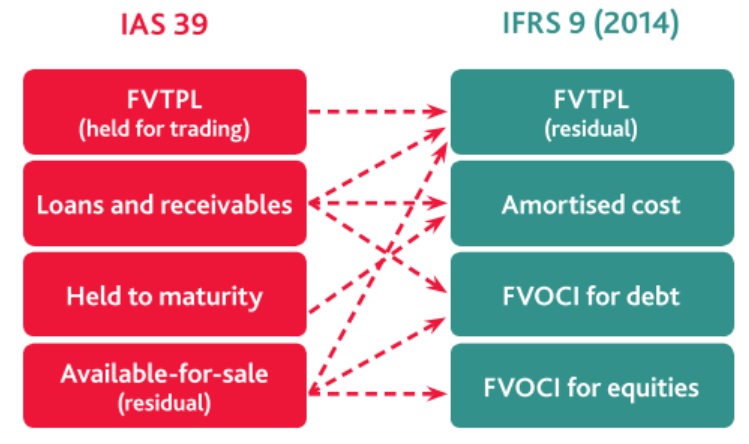

Although accounting treatment of intercompany loans or financial liabilities under ifrs 9 financial instruments is almost same as discussed in our obsolete accounting standard ie.

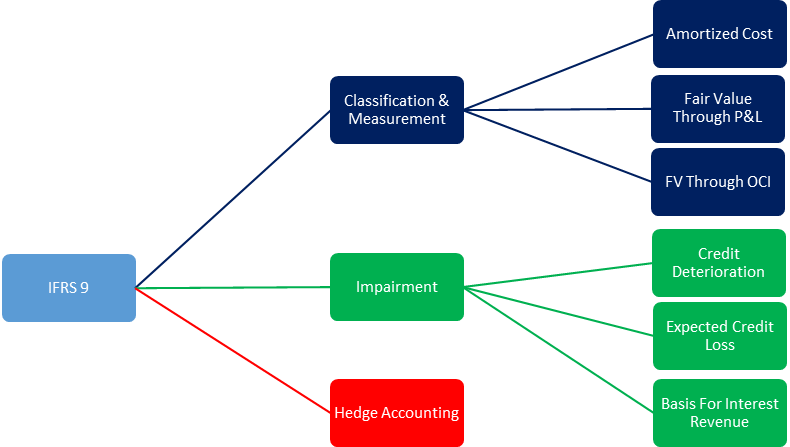

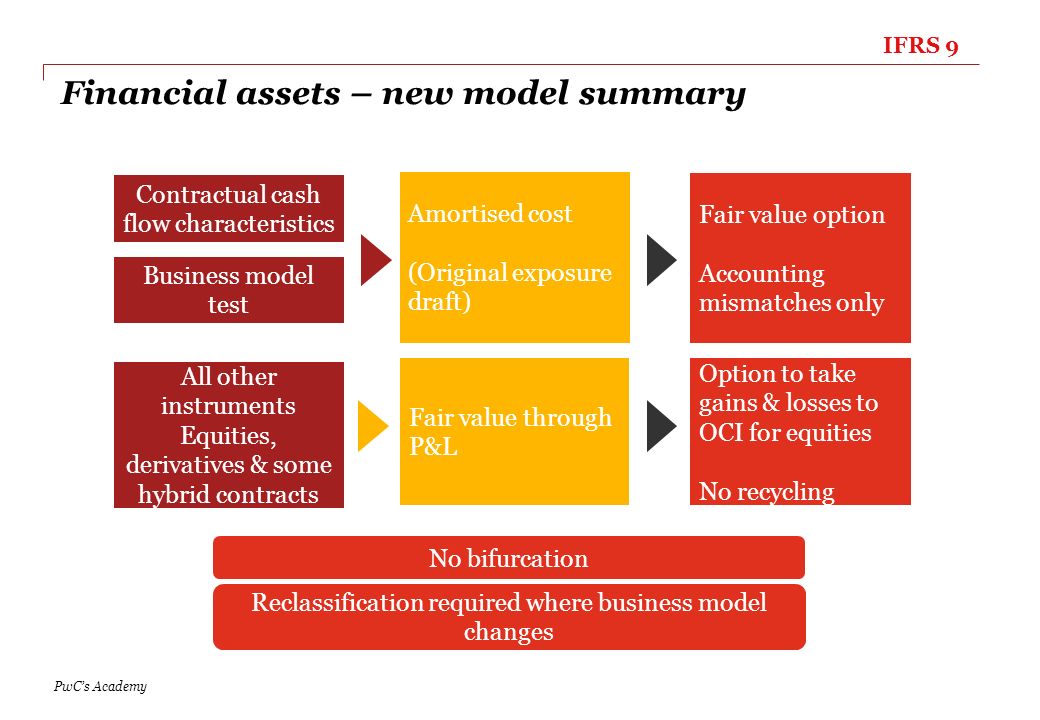

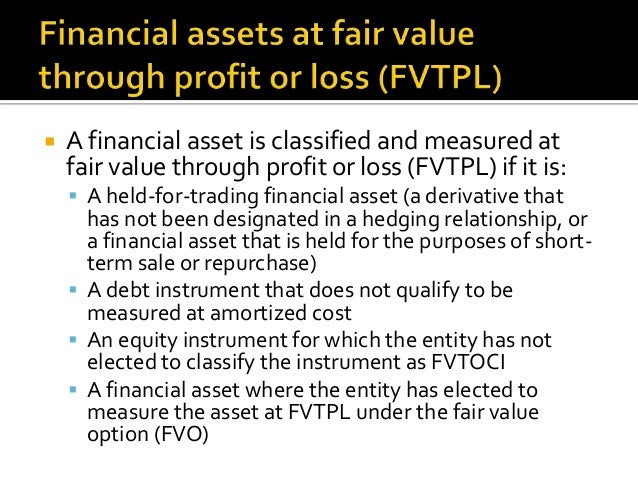

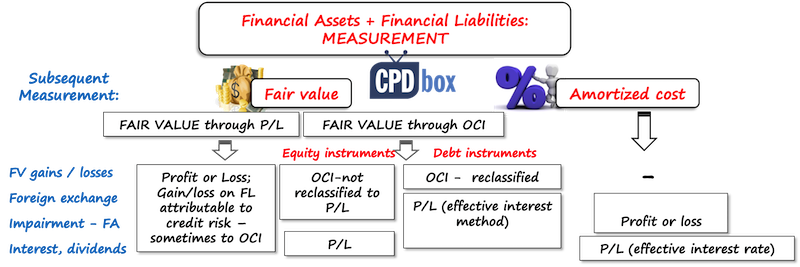

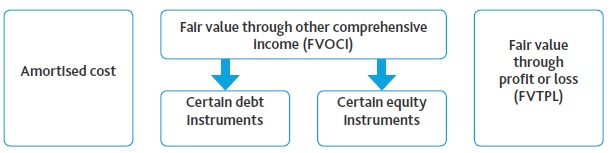

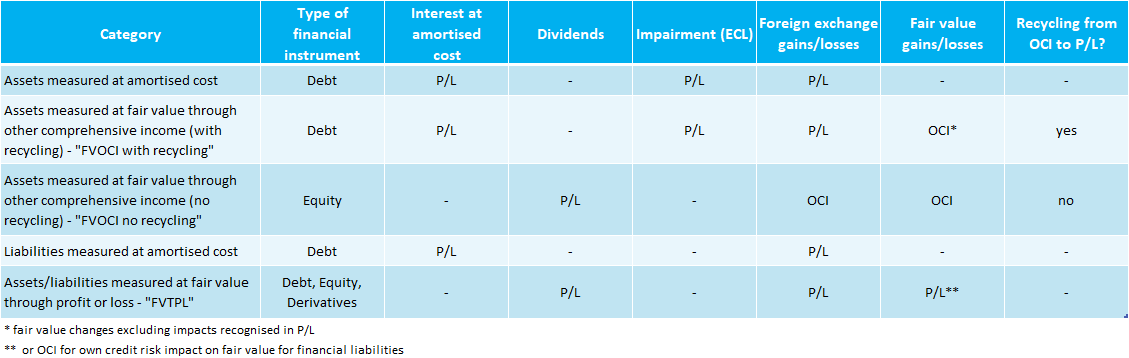

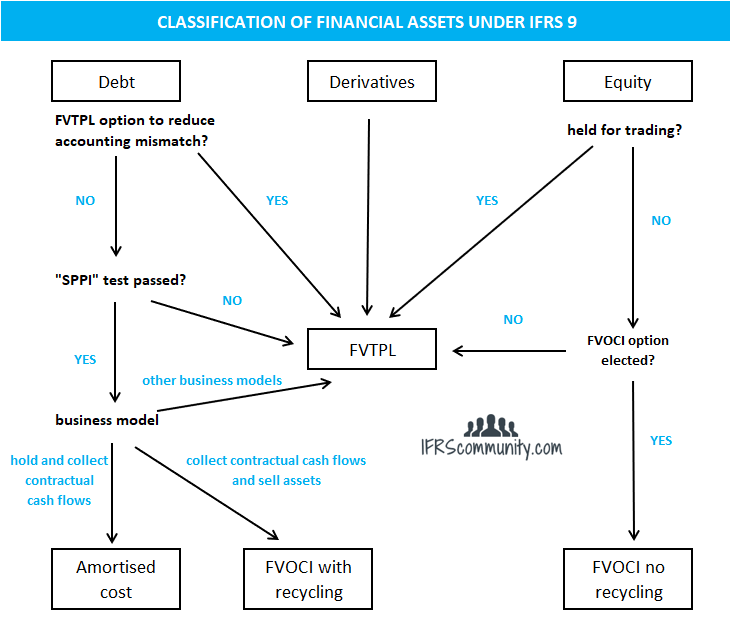

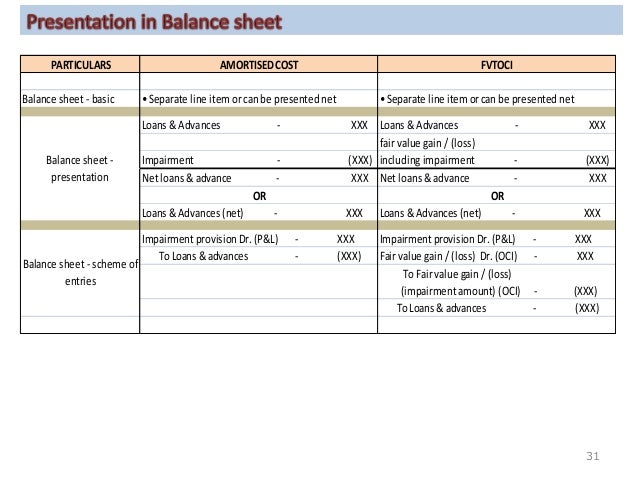

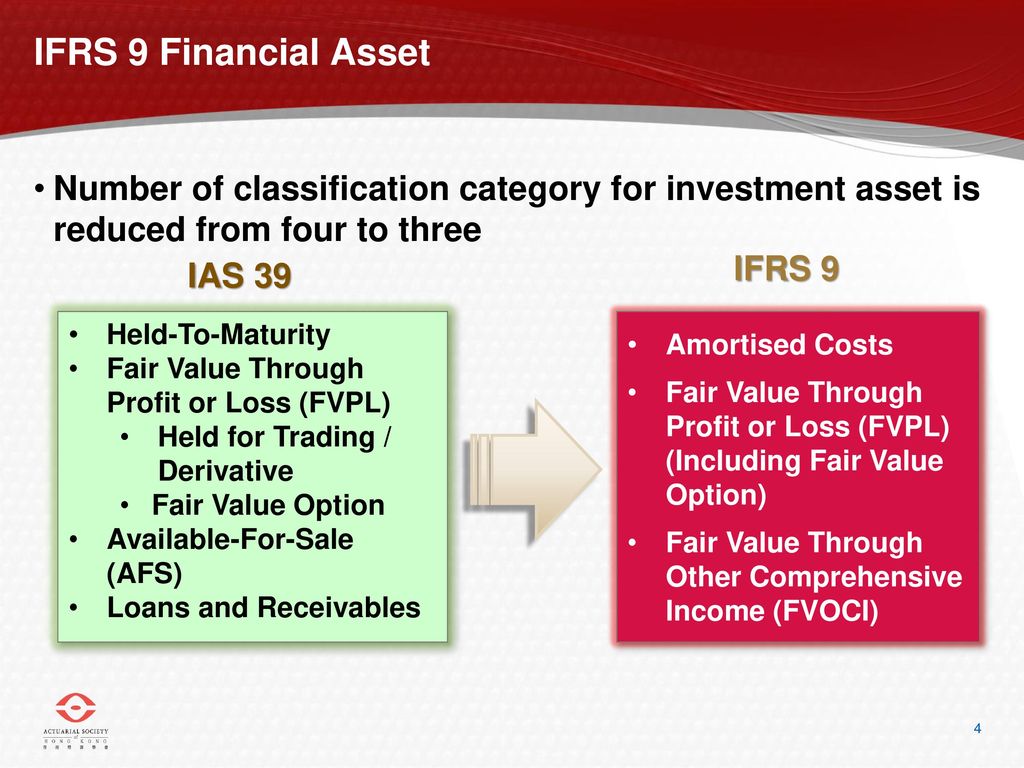

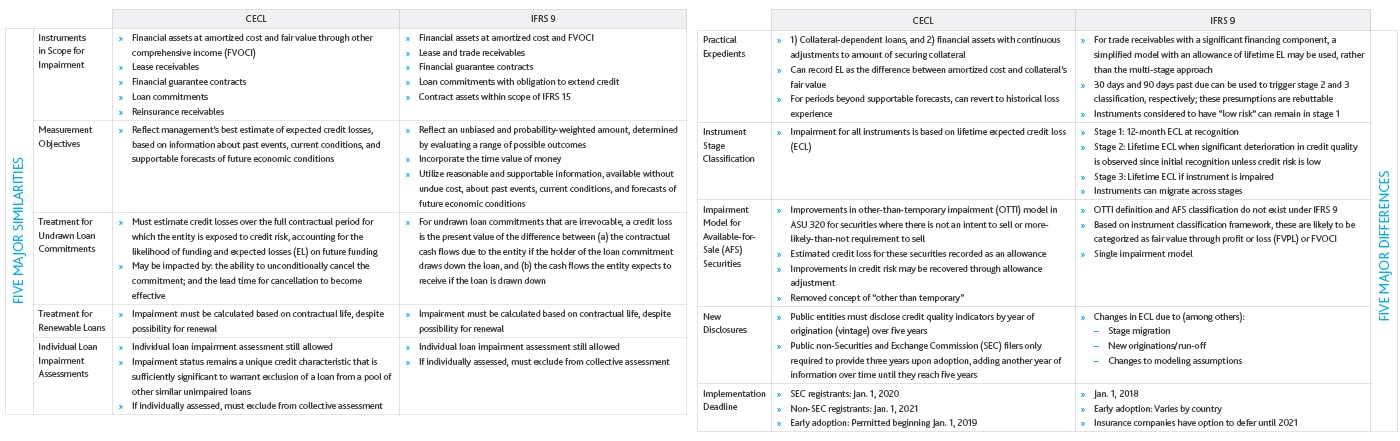

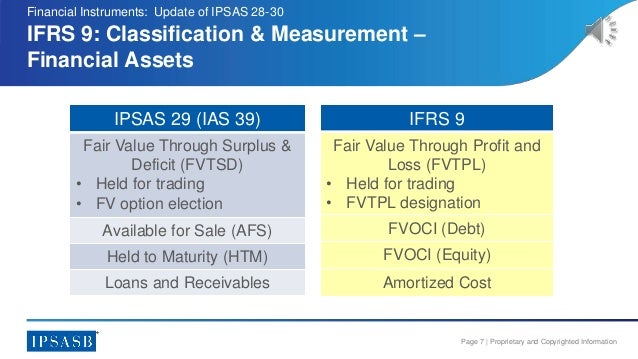

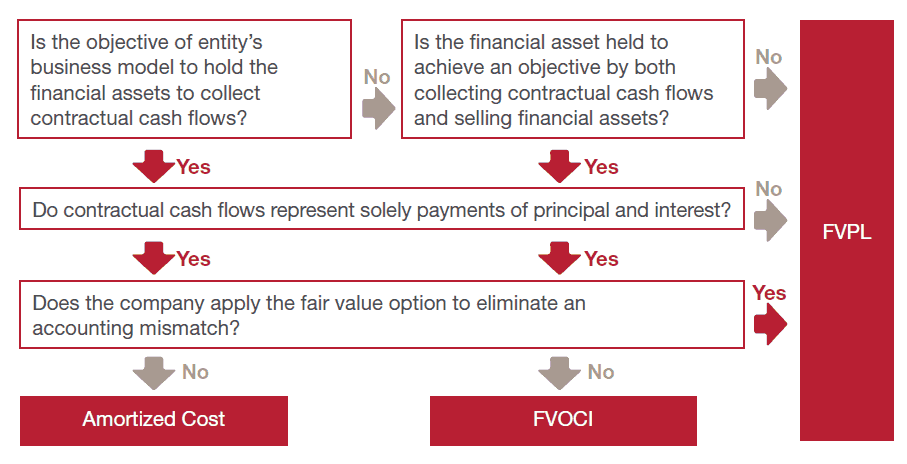

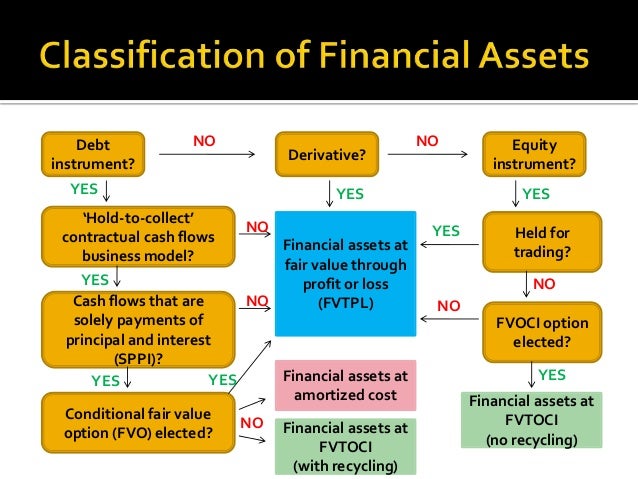

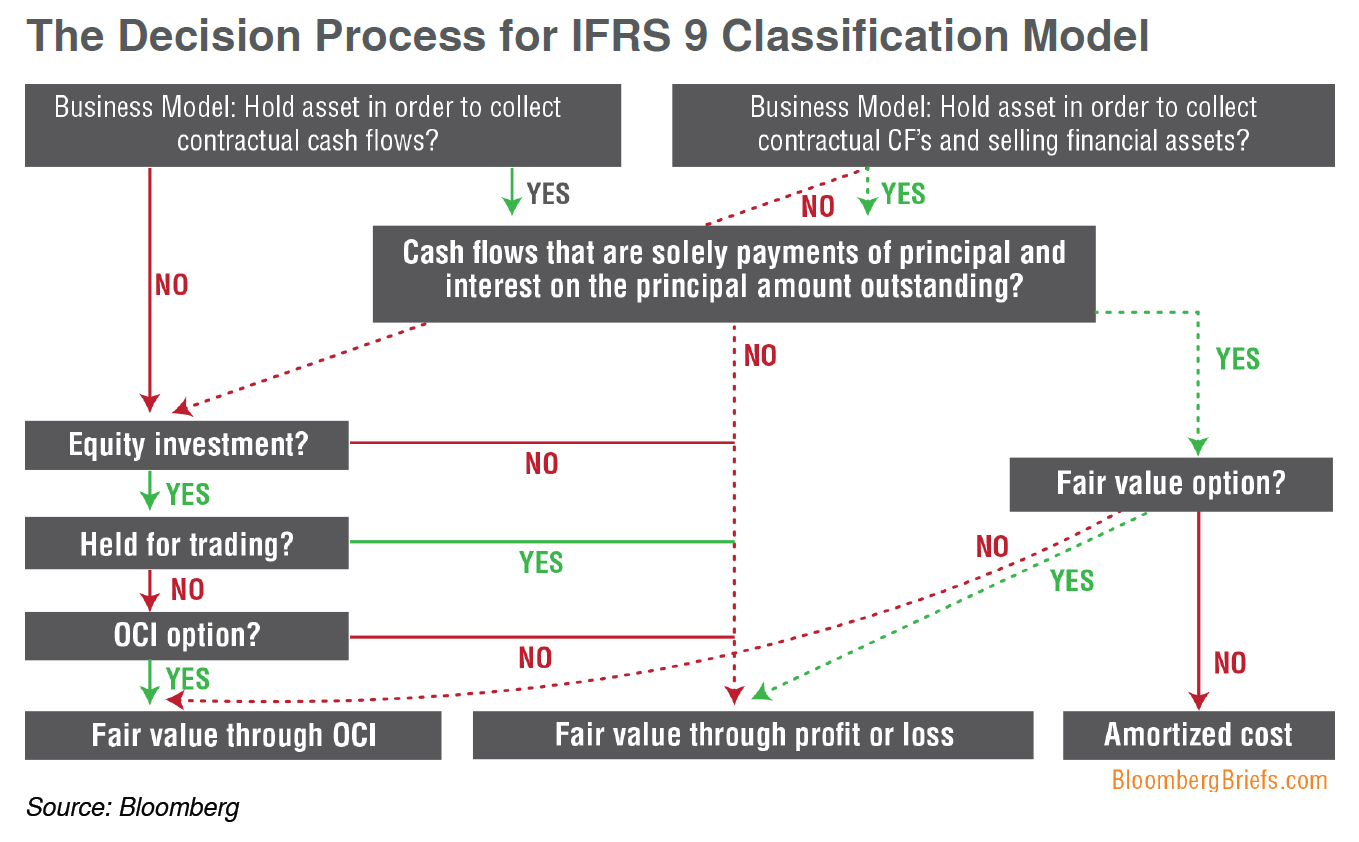

Ifrs 9 loans at fair value. That is additional burden and completely different accounting because you have to set the fair value of such a loan at each reporting date which. Within the scope of ifrs 9 that arenot held for trading. Fvoci without recycling of fair value changes to profit and loss. The standard defines fair value on the basis of an exit price notion and uses a fair value hierarchy which results in a market based rather than entity specific measurement.

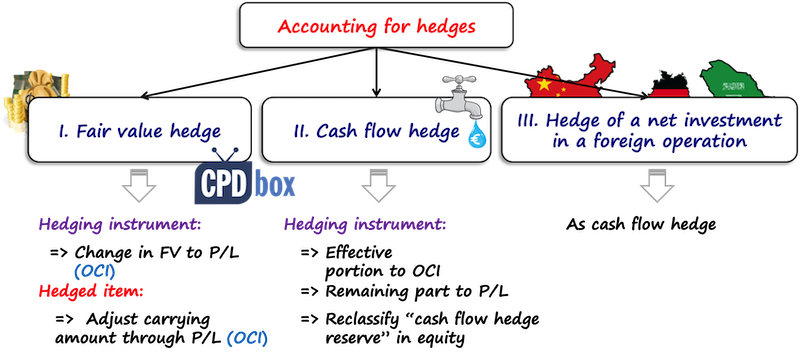

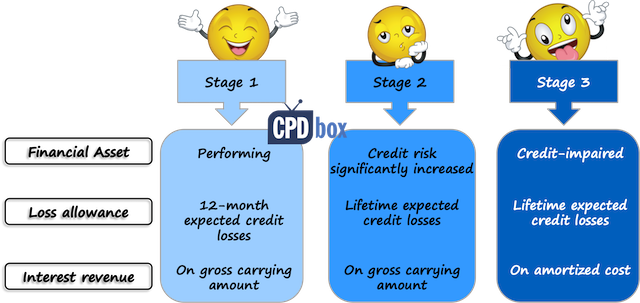

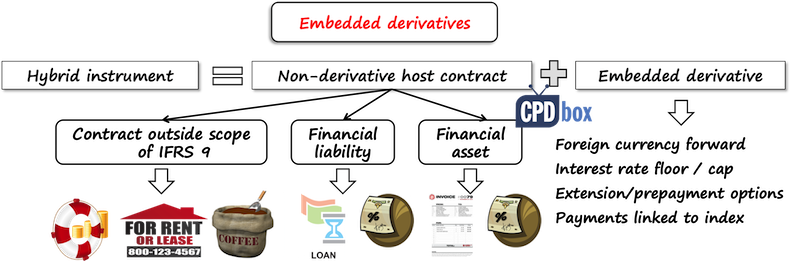

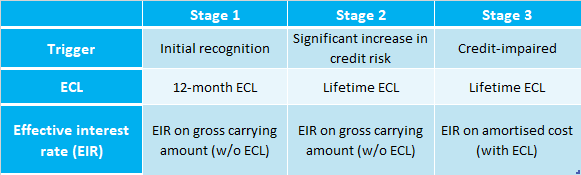

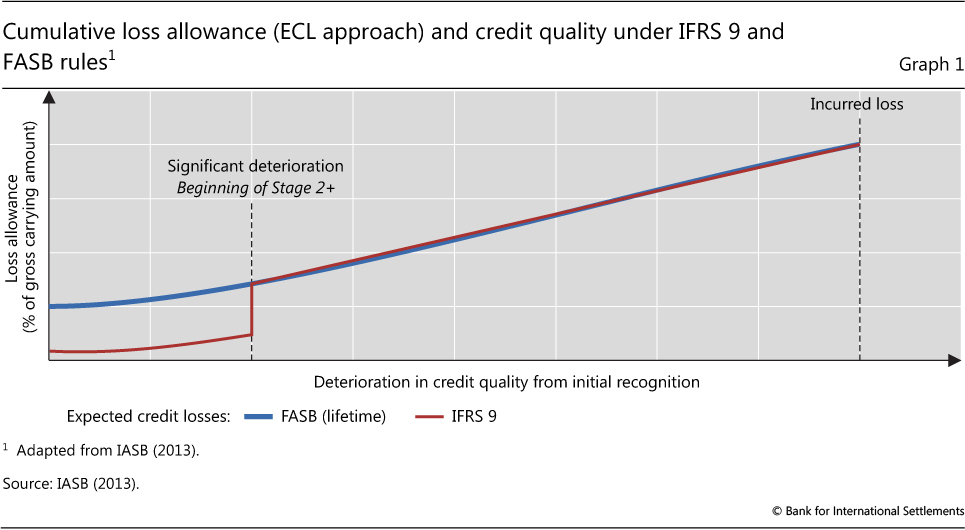

Such loans can be measured as the present value of all future cash receipts discounted using the prevailing market rates of interest for a similar instrument similar as to currency term type of interest rate. On 19 november 2013 the iasb issued ifrs 9 financial instruments hedge accounting and amendments to ifrs 9 ifrs 7 and ias 39 amending ifrs 9 to include the new general hedge accounting model allow early adoption of the treatment of fair value changes due to own credit on liabilities designated at fair value through profit or loss and. On the other hand ifrs 9 establishes a new approach for loans and receivables including trade receivablesan expected loss model that focuses on the. The difference between the fair value of the loan and the loan amount will be taken into profit or loss.

Ias 39 financial instruments. Although ifrs 9 requires all equity instruments to be measured at fair value it acknowledges that in limited circumstances cost may be an appropriate estimate of fair value for unquoted equity instruments. In such a case no amortized cost but you have to classify the loan at fair value through profit or loss. Cost as an estimate of fair value.

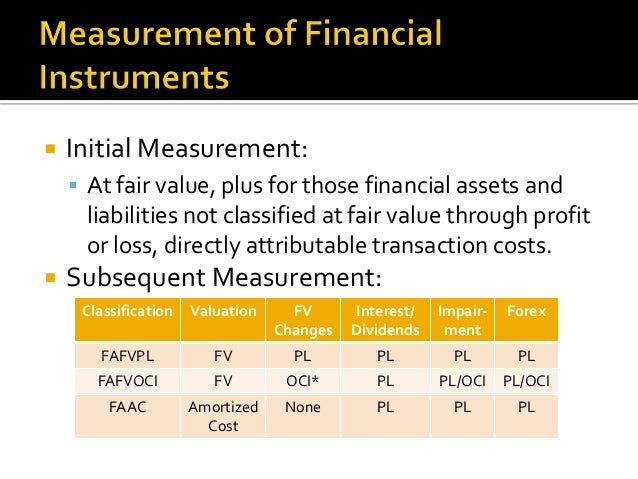

Subsequent measurement fair value with all gains and losses recognised in other comprehensive income changes in fair value are not subsequently recycled to profit and loss dividends are recognised in profit or loss. Debt instruments category classification criteria. Ifrs 9 paragraph b511 provides guidance on determining the fair value of a long term loan or receivable that carries no interest. This requirement is consistent with ias 39.

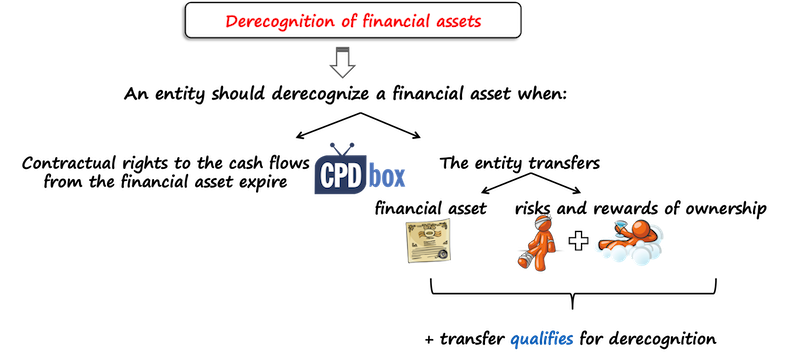

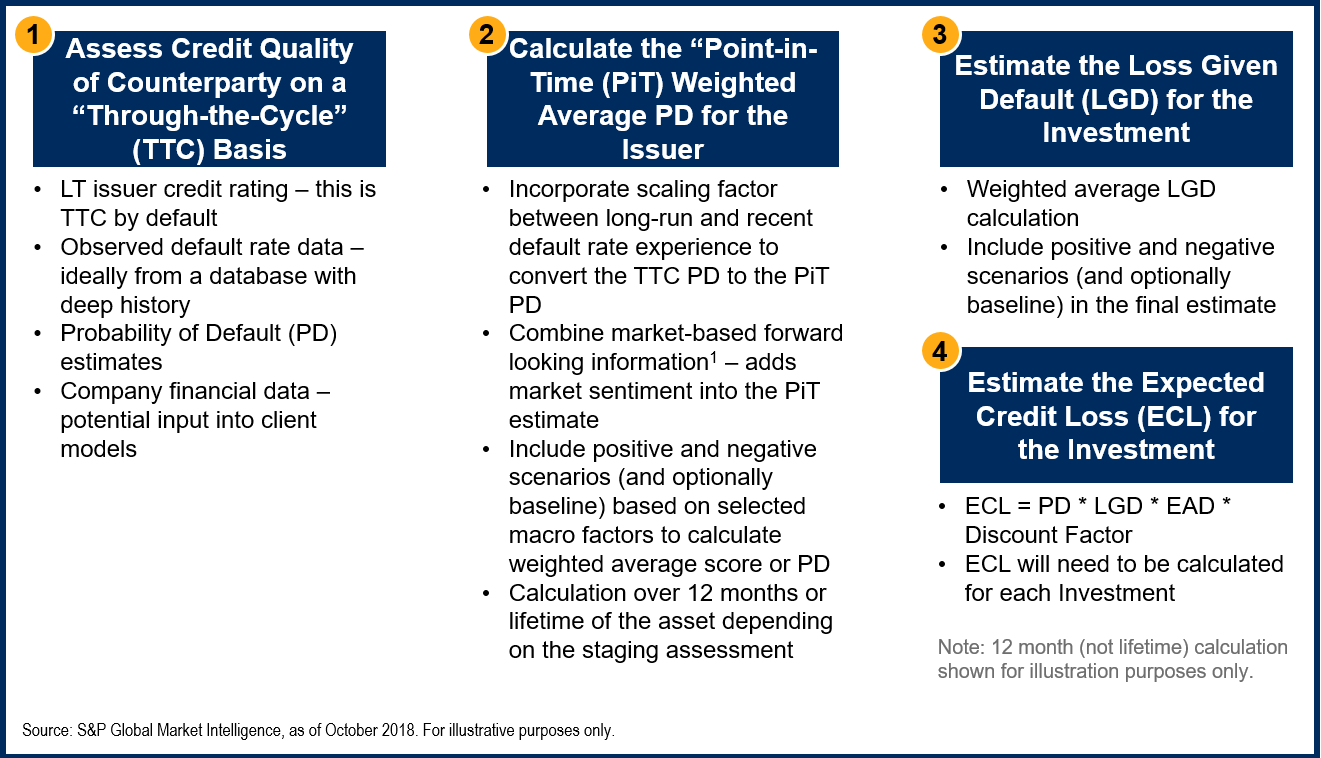

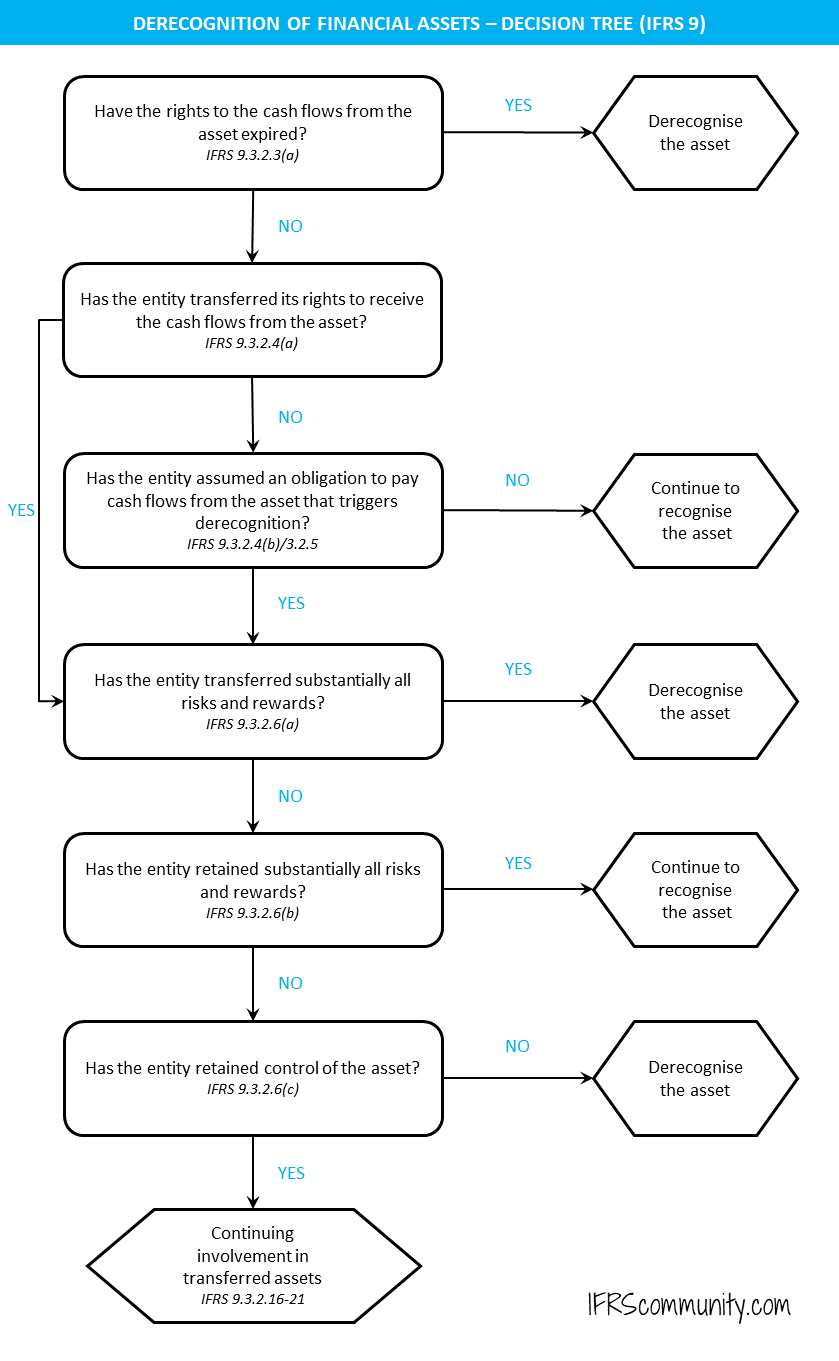

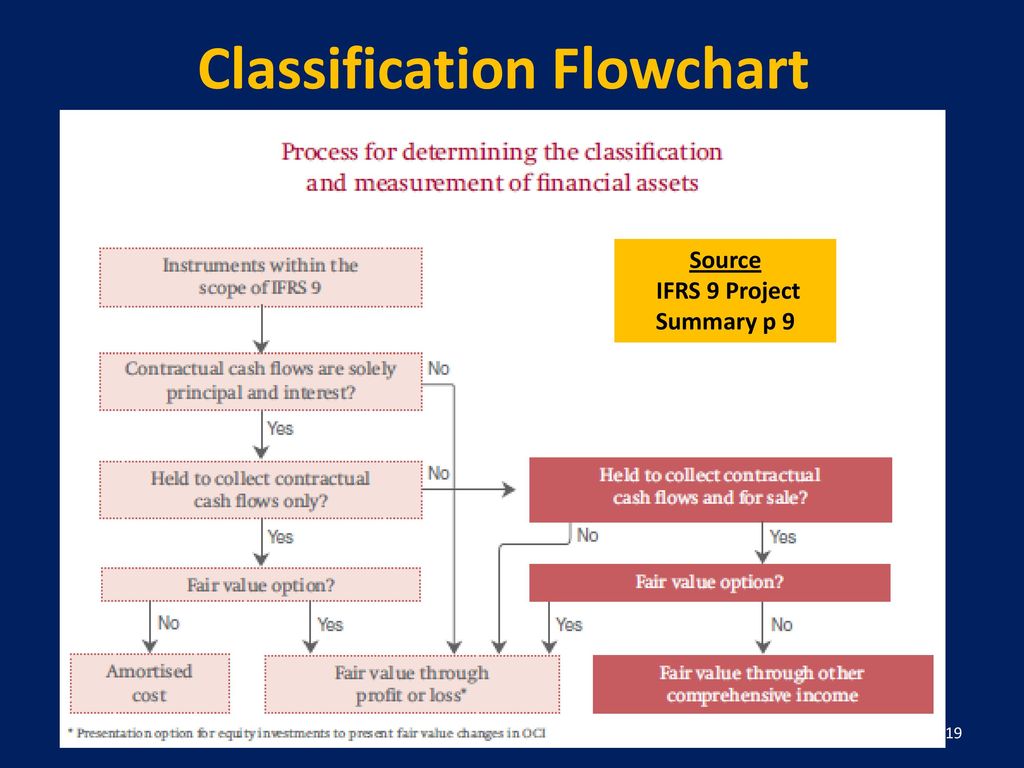

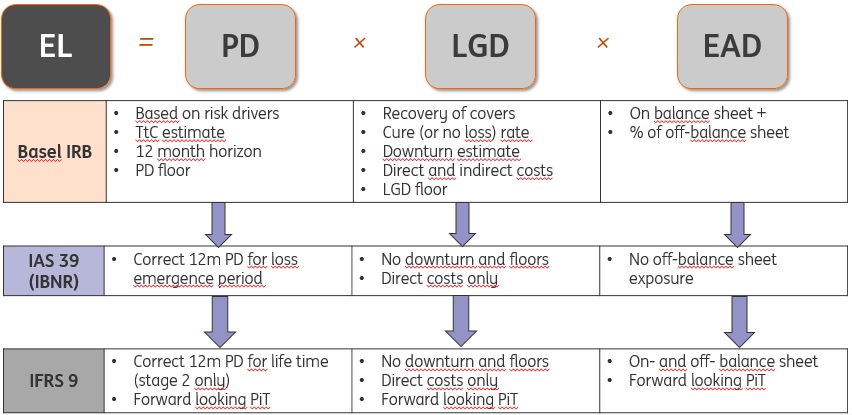

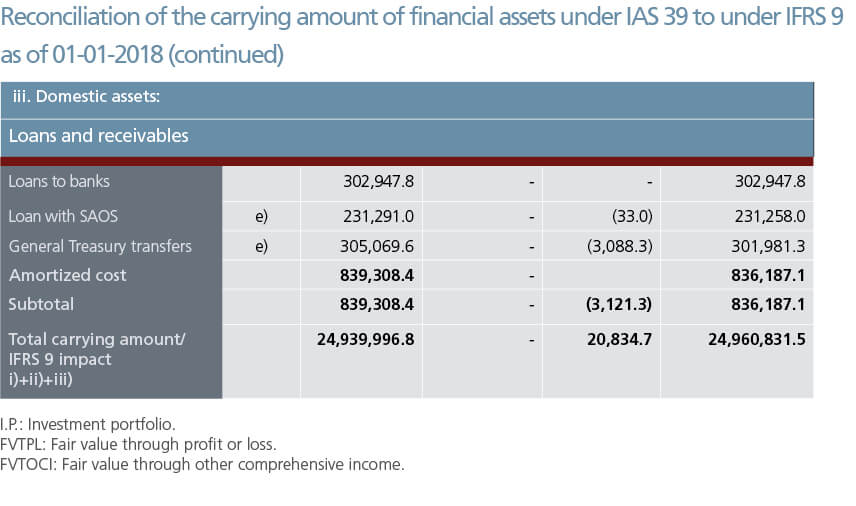

Financial assets that are debt instruments measured at fair value through other comprehensive income loan commitments that are not measured at fair value through profit or loss under ifrs 9 financial guarantee contracts that are not measured at fair. Accounts receivable loans debt securities bank balances and deposits etc. Under ifrs 9 all financial instruments are initially measured at fair value plus or minus in the case of a financial asset or financial liability not at fair value through profit or loss transaction costs. Under ifrs 9 you can classify the loan at amortized cost only if it passes 2 tests.

Loans and receivables including short term trade receivables.

.jpg)