Kiva Loans Criticism

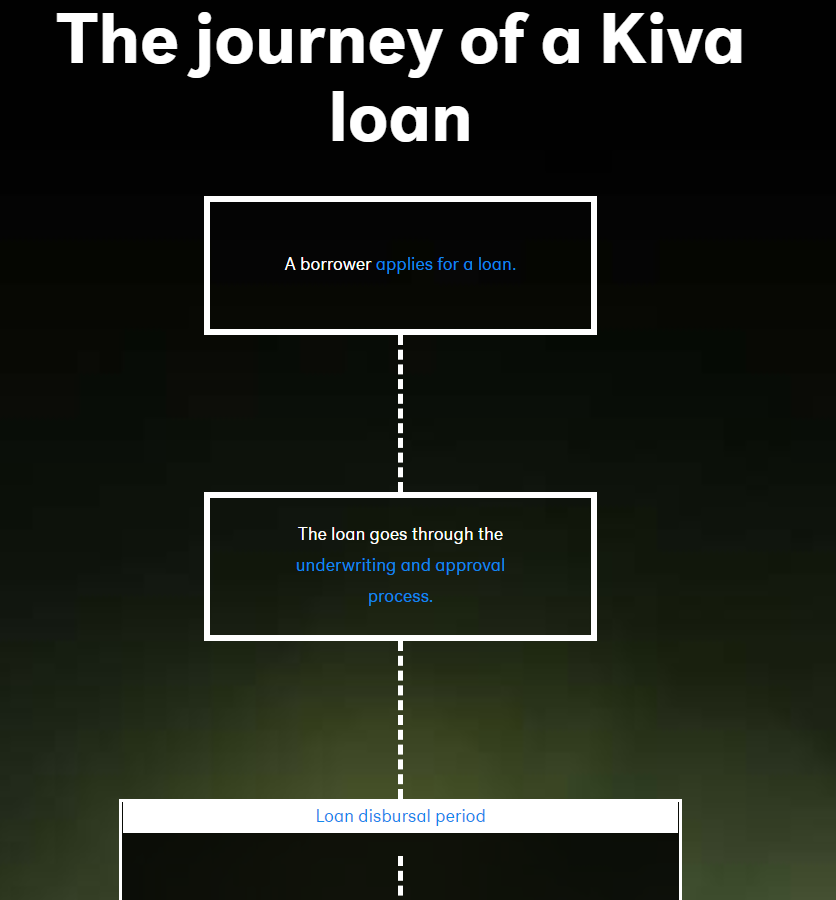

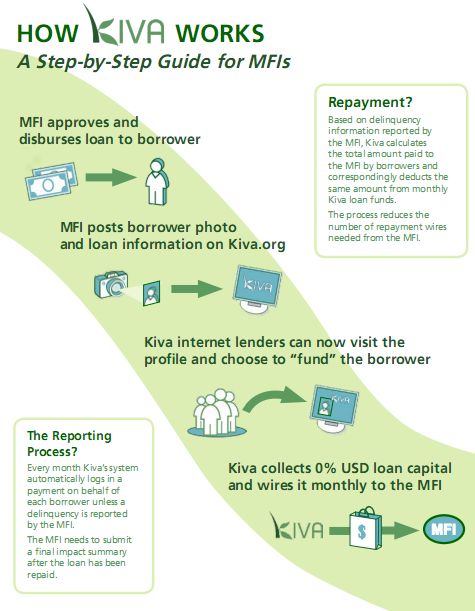

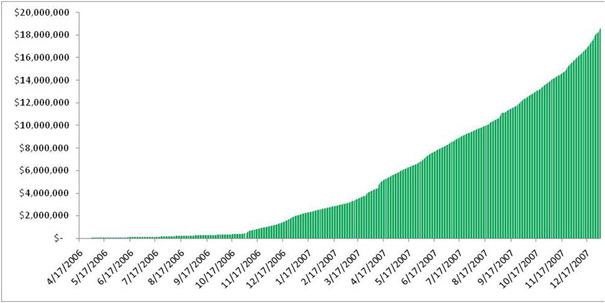

In addition there was 115 million in cash from kiva lenders scheduled to be sent to the field within the month for efficiency and cost savings kiva transmits funds once a month to the field.

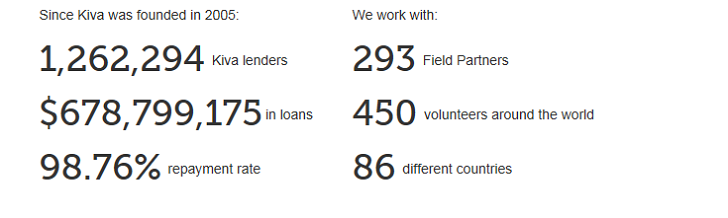

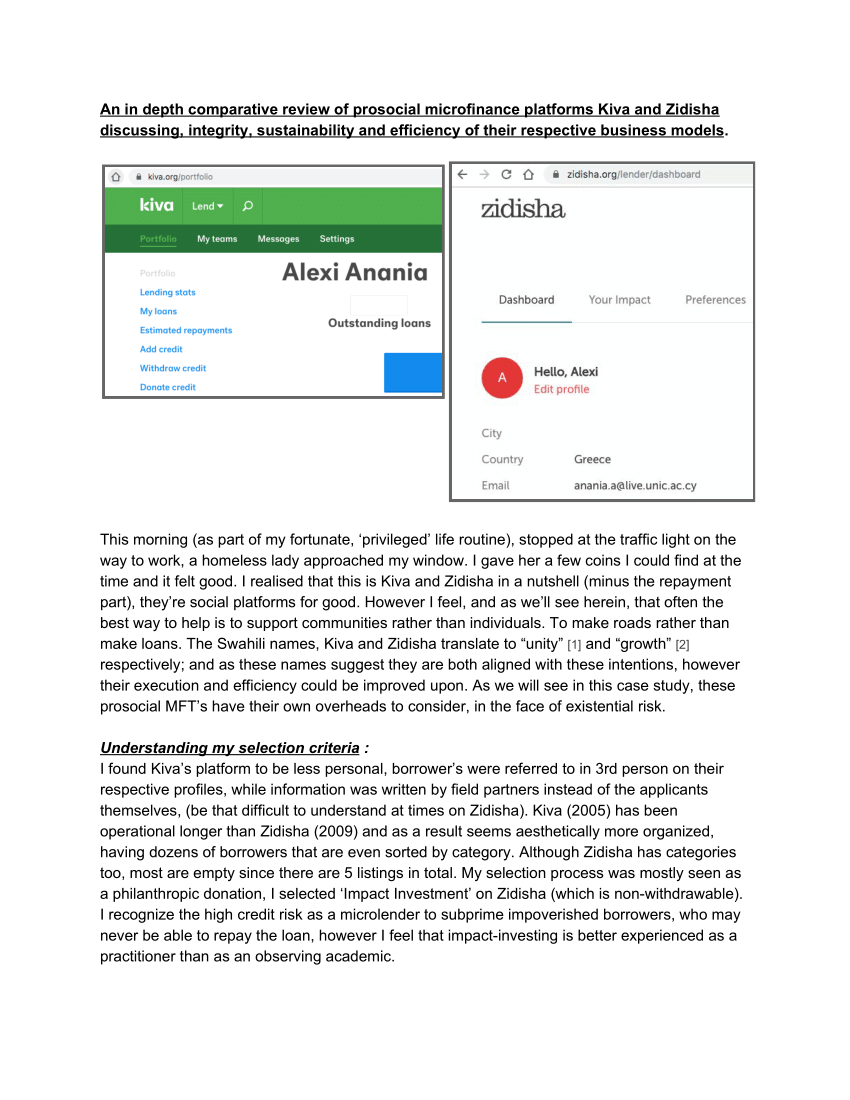

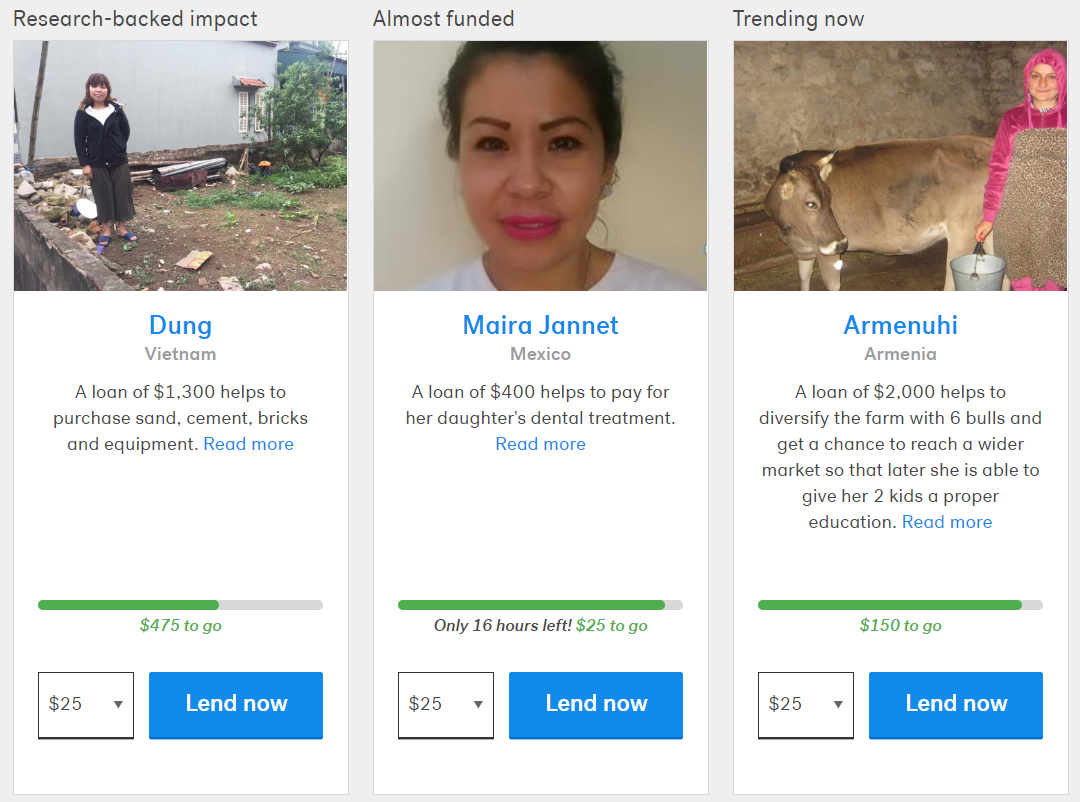

Kiva loans criticism. At the end of 2012 kiva had 353 million in loans outstanding loans that were already in the field not in any of our bank accounts. Kiva posts pictures and stories of people needing loans. It was founded in 2005 in san francisco and has since funded around 950 million 770 million in loans. I was a bit troubled by the criticism of kiva and wanted to check out what alternatives were out there.

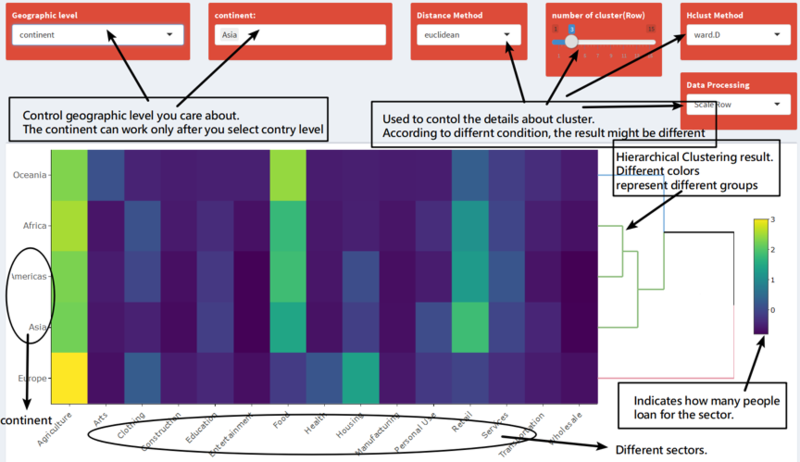

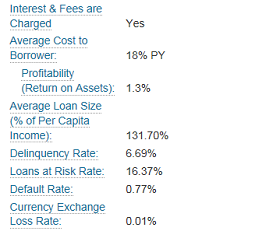

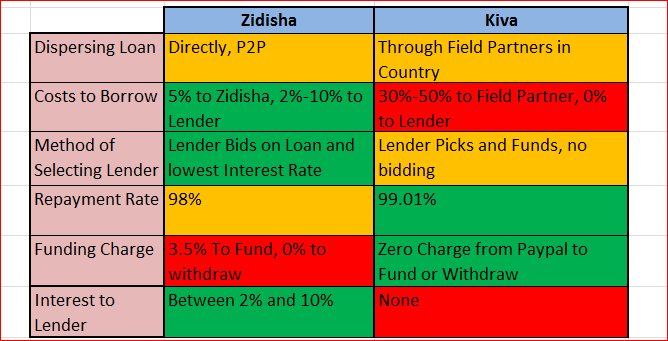

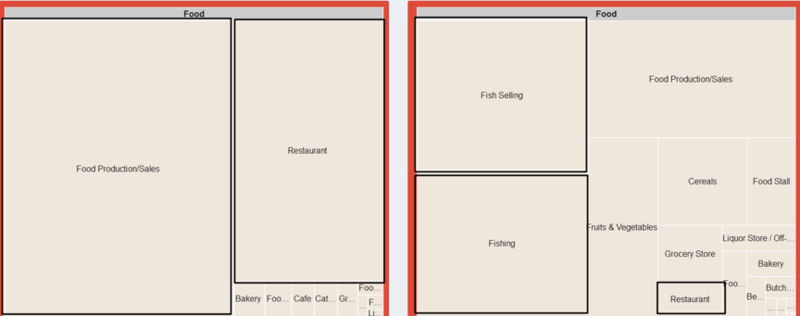

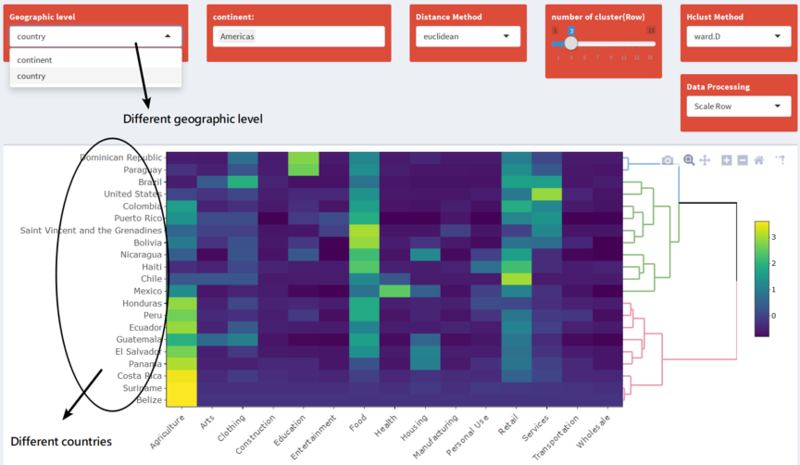

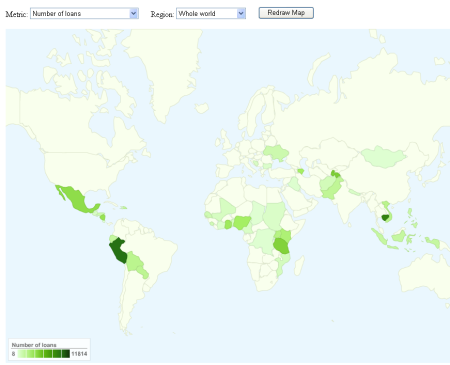

As noted above the parent company has received some criticism about its field partners loan intermediaries responsible for the distribution and collection of loans. I came to the conclusion that my major gripes with kiva stem from its dependency on mfis microfinancing institutions as local middlemen. Kiva a nonprofit organization promoted itself as a link between small individual lenders and small individual borrowers like maryjane cruz in the philippines who recently sought a 625 loan to. Kivas mission is to expand financial access to help underserved communities thrive since 2005 kiva has crowd funded more than 16 million loans totaling over 133 billion with a repayment.

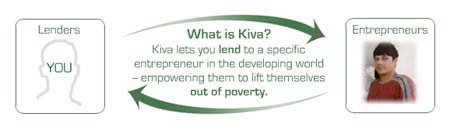

Kiva is the path breaking fast growing person to person microlending site. Make a loan to an entrepreneur across the globe for as little as 25. Does not have intermediaries this program does not carry the same problems as kivas international services. Support women entrepreneurs students and refugees around the world with as little as 25 on kiva.

You lend in multiples of 25 but unlike most p2p lending sites you receive 0 interest. But the programming is pivotal to poverty reduction when it comes in the form of agricultural workshops financial skills workshops. Kiva is a non profit organisation which provides micro finance loans to entrepreneurs in the developing world. We would like to show you a description here but the site wont allow us.

You give your money to kiva. Kiva is the worlds first online lending platform connecting online lenders to entrepreneurs across the globe. I would have agreed if either roodman or the nyt were making the valid criticism that the interest charged by mfis on kiva funded loans a detail that kiva does not clearly state is used to fund their programs.