Loan Forgiven Meaning

If this happens the borrower will not have to pay back the balance of the loan.

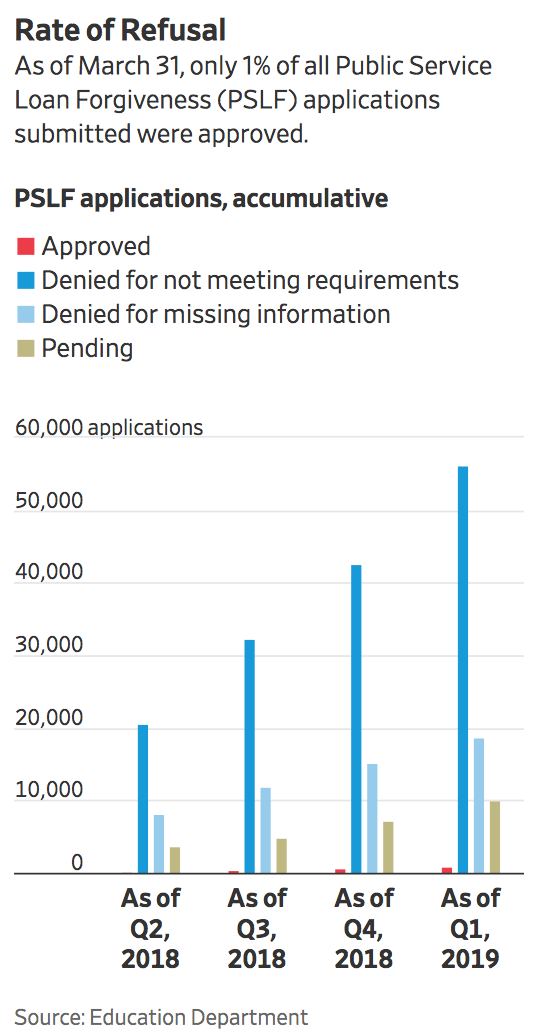

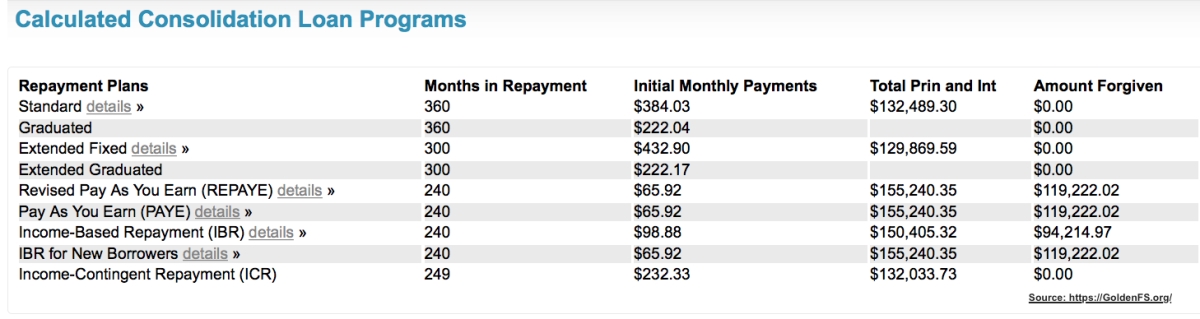

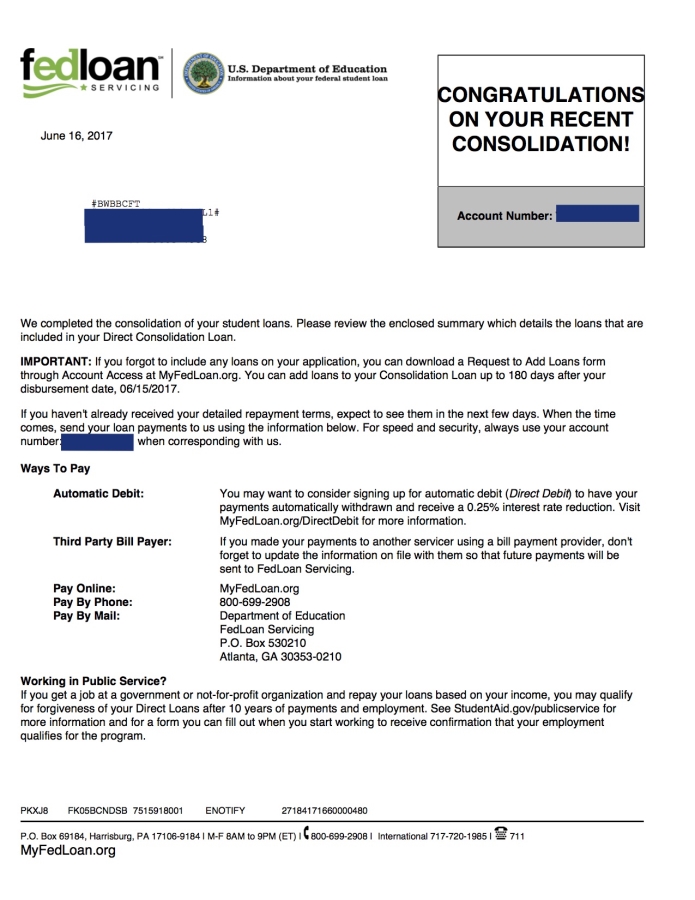

Loan forgiven meaning. A forgivable loan also called a soft second is a form of loan in which its entirety or a portion of it can be forgiven or deferred for a period of time by the lender when certain conditions are met. Public service loan forgiveness after youve worked full time for a nonprofit organization or the government for at least 10 years your remaining federal loan balance can be forgiven. Student loan forgiveness can be earned in two ways. The date of disbursement of ppp funds starts the clock on an eight week window for monitoring expenses covered by ppp funds.

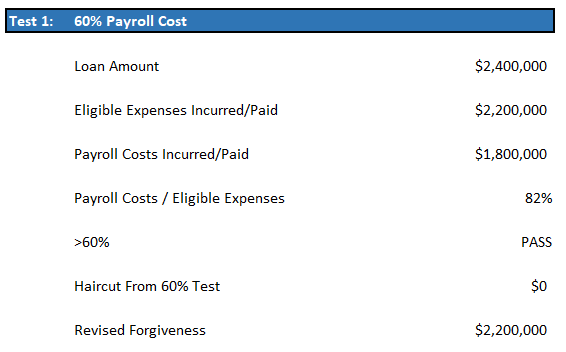

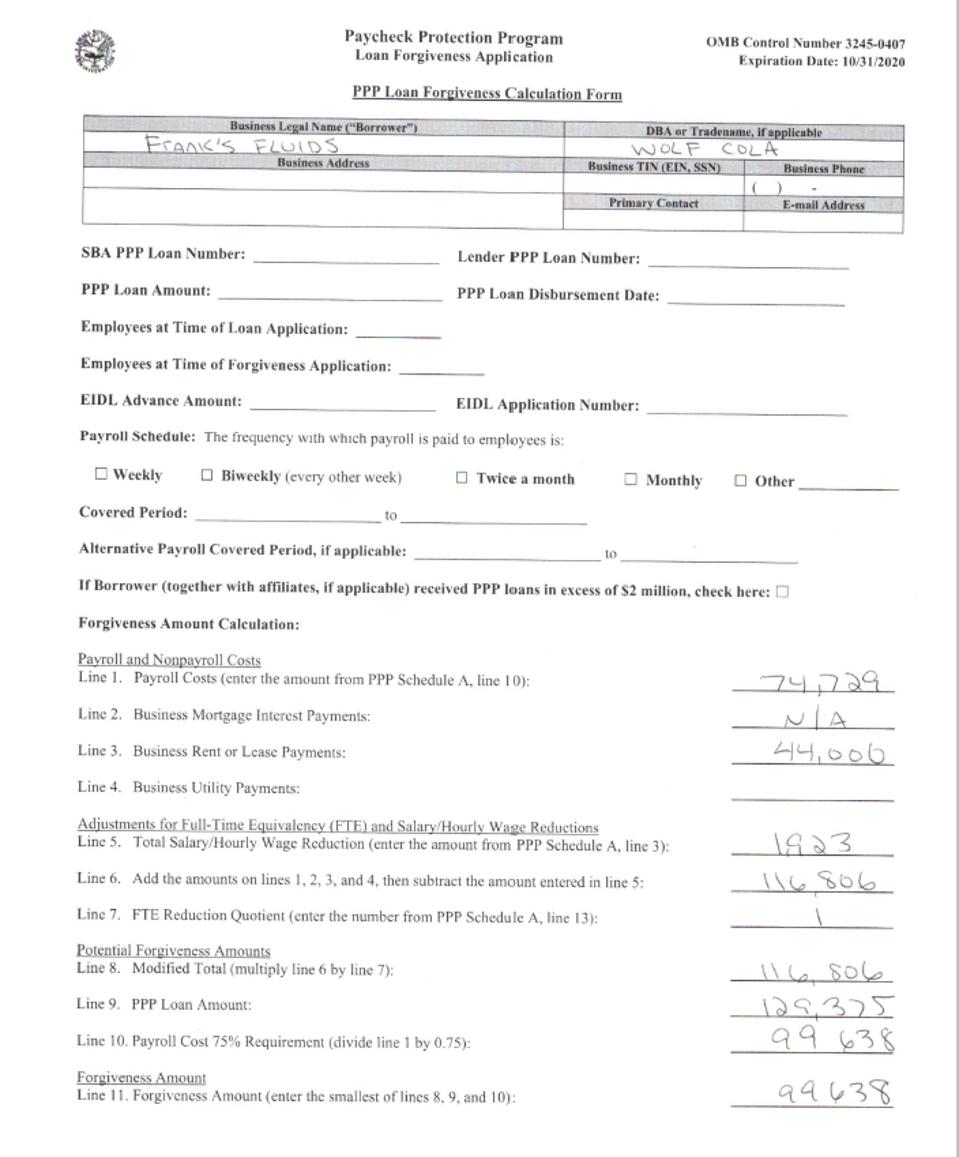

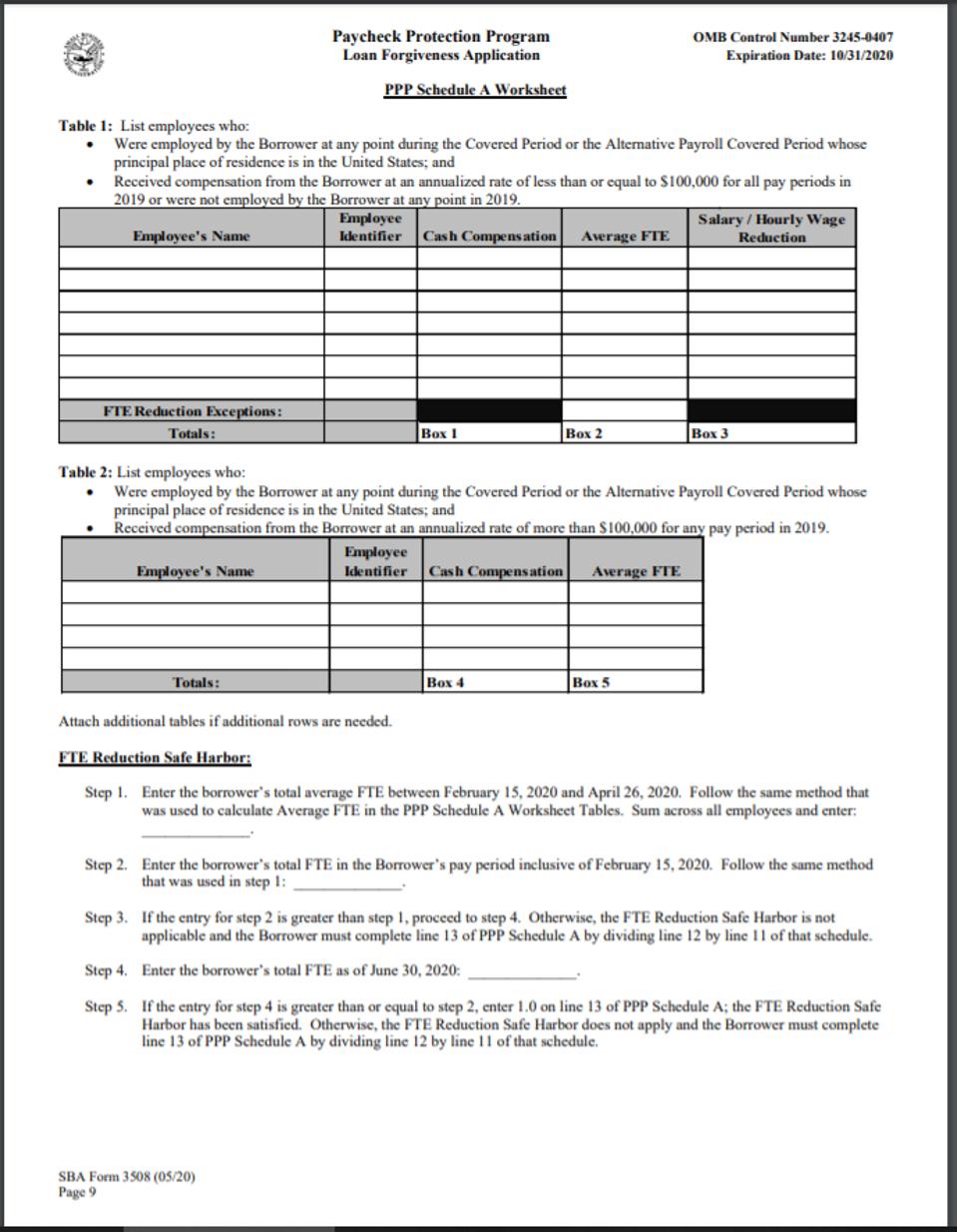

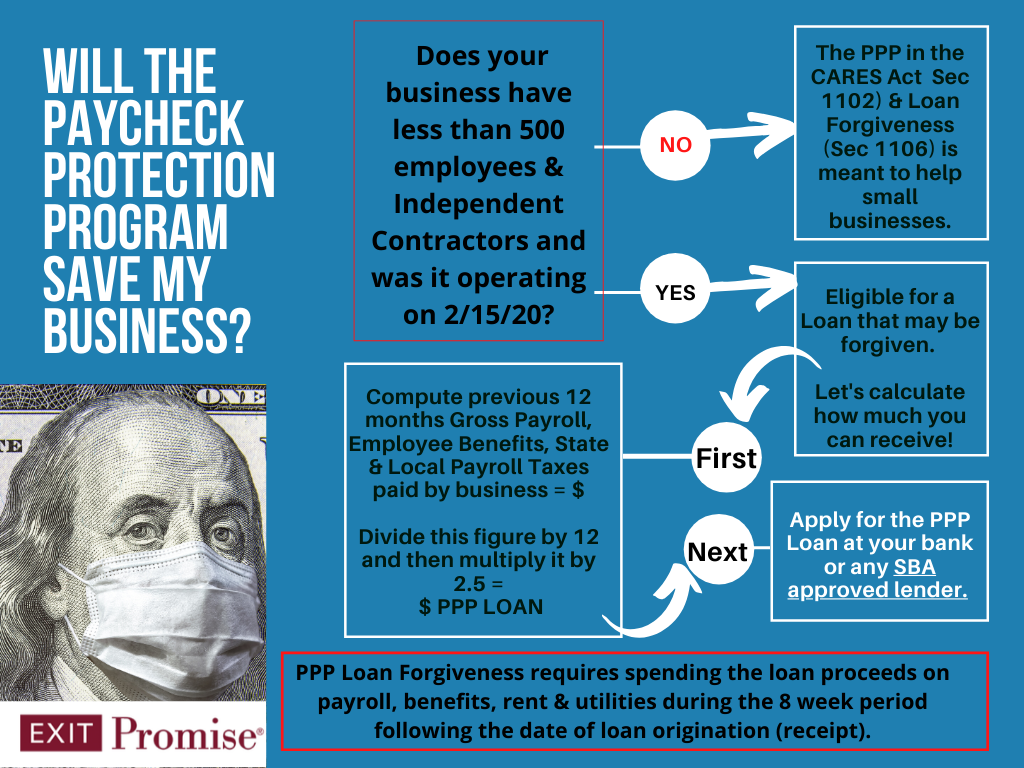

Stimulus 2020 qa 4 steps to get your ppp loan forgiven use your loan only for what its intended but thats only the start. It is more like a grant with conditions rather than a loan as in most cases the loan is forgiven if all the conditions are met. Student loan forgiveness is a circumstance where federal student loans backed by the federal government are partially canceled. If you didnt have any other payroll expenses factoring into your ppp loan amount this means that your entire ppp loan could be forgiven for the 24 week period.

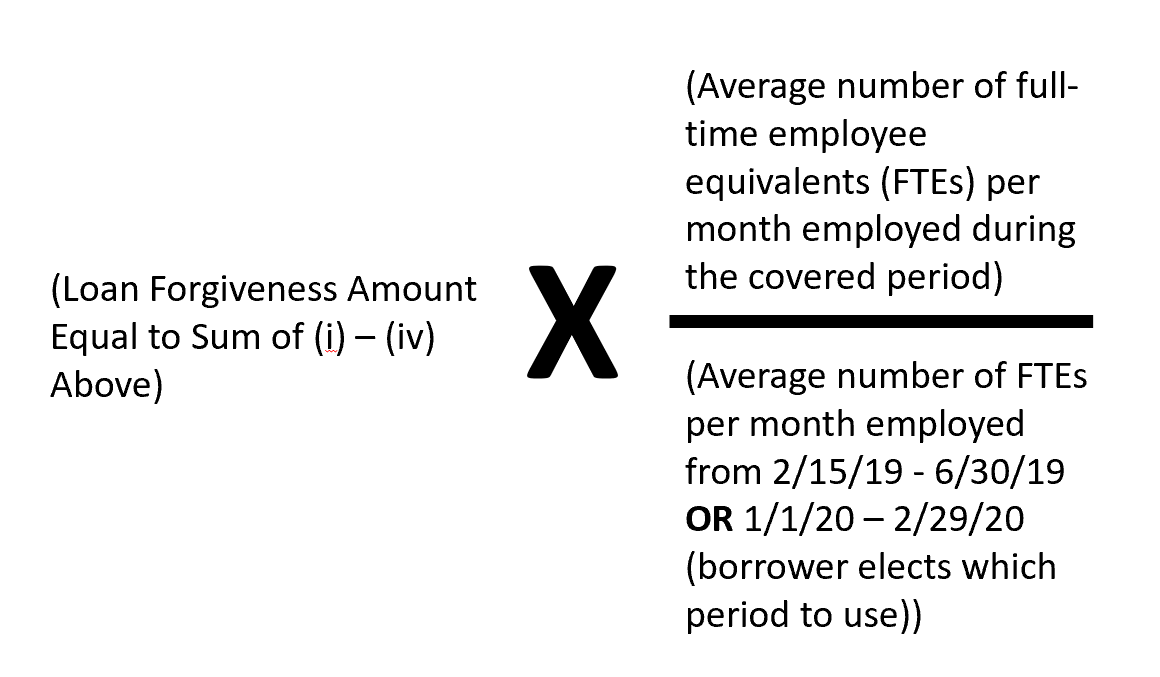

Payroll costs has the same definition for forgiveness purposes as it did for the original ppp loan application. The purpose of the forgiveable loan is so you can maximize loan forgiveness for your particular circumstances. It may seem simple at first but this is before taking into consideration all of the details that are behind ppp loan forgiveness computation that will reduce the loan forgiveness amount. Forgiveness is available for expenses during that period on.

The 2 trillion federal stimulus package includes 350 billion in loans backed by the us. This program can discharge or forgive the loan. So what does loan forgiveness really mean under the act. Section 1105b of the act provides that an eligible recipient shall be eligible for forgiveness of indebtedness on a covered 7a loan in an amount equal to the cost of maintaining payroll continuity during the covered period.

Careers that qualify for this forgiveness are firefighters teachers military personnel nurses and others. However if the conditions are not met the loan has to be repaid. Salaries over 100000 are excluded. By working in public service or by making payments through an income contingent payment plan for a long period of time.

:max_bytes(150000):strip_icc()/elfi_inv-99e18bda6338465a8560177b6520b5a4.png)

:max_bytes(150000):strip_icc()/great-lakes-inv-0f9d61e0ba6b492f916e72458cf903b3.png)

/iStock-469187462.college.grad.money-c61d58b7dd65417492484e1b0e34b522.jpg)