Loan In Jersey

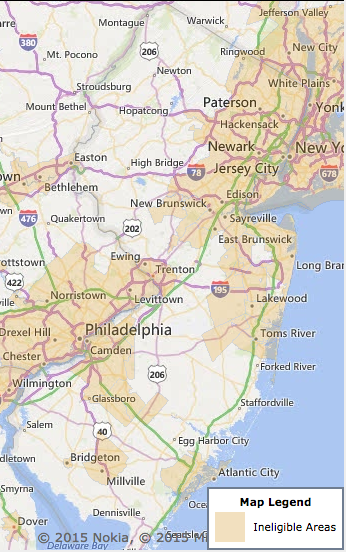

Few new jersey based banks were among the largest lenders to the garden state businesses through the us.

Loan in jersey. Cherry godfrey was founded in march 1993 by husband and wife. 2 million to 5 million 844. But the overall application process is very similar. More than 160 companies were approved for the highest loan amount of 5 10 million.

1 million to 2. Below is a breakdown of the amounts approved in new jersey. From personal loans to business and asset finance smart money makes it easy to find the right loan for you. Join hundreds who have achieved their financial goals.

We have a dedicated financial services area at broad street post office so why not pop in and chat to tania our friendly loans person. If you would like to find out if you are eligible for an fha loan we can help match you with a lender. David and selena cherry nee godfrey. The 25 of companies that received loans for less than 150000 were not named in the data but companies receiving larger loans were.

Whether your business is a hotel restaurant auto repair medical practice veterinary or pharmacy your mission is to exceed your customer expectations. To have an fha lender contact you request a free consultation. 5 million to 10 million. The sba said 75 of the companies receiving loans fell into those categories.

Jersey post works with our trusted partners to deliver a range of personal loans that offer you an affordable way to buy what you want and spread the cost over fixed monthly instalments. Based on the data released for new jersey. Below are some of the basic requirements to get an fha loan in new jersey. Small business administrations 7a program.

Loans to new jersey businesses ran the gamut and included higher education institutions private schools manufacturers car washes real estate agent companies and non profits. A new jersey jumbo loan is essentially an oversized mortgage product that exceeds the limits mentioned above. Loans over 150000 account for about 925000 jobs. Since there is a larger amount being borrowed the qualification requirements can be a bit more strict when compared to a smaller loan amount.

The business began as a finance broker placing channel island customers with other financial institutions.

/arc-anglerfish-arc2-prod-jerseyeveningpost-mna.s3.amazonaws.com/public/QUF3E6VGCZACBDWAGP5SWQIM7M.jpg)

/arc-anglerfish-arc2-prod-jerseyeveningpost-mna.s3.amazonaws.com/public/FXGEYSKEFFCY7LUPZAU3PG6FAM.jpg)