Loan Receivable In Balance Sheet

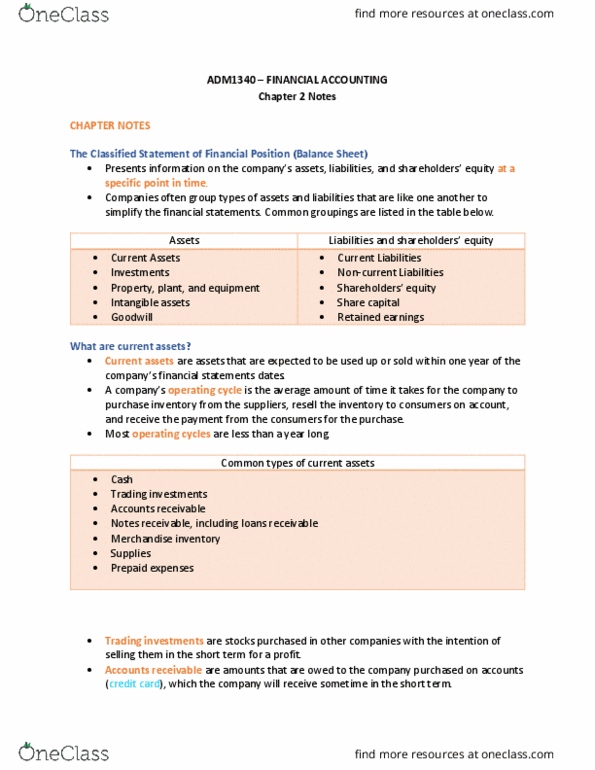

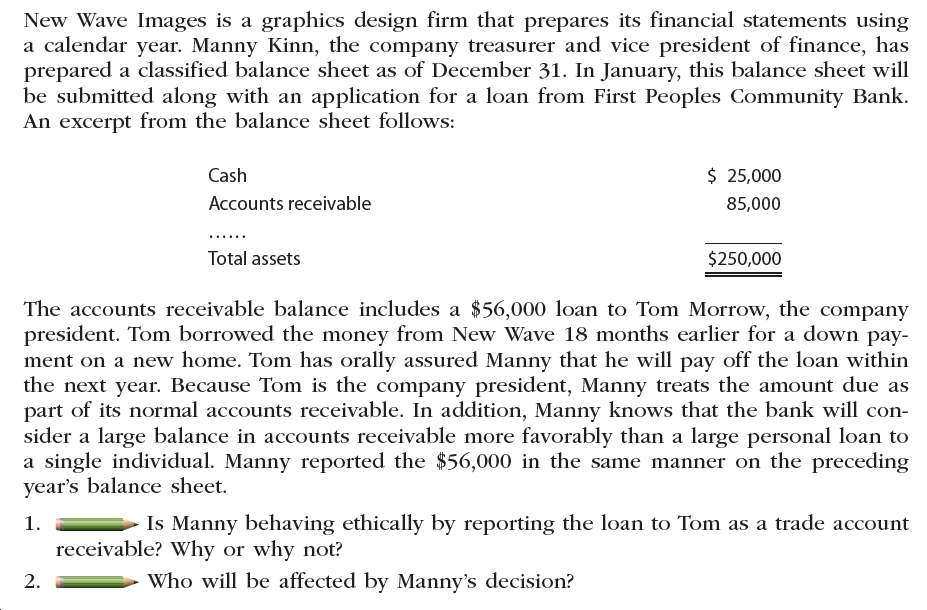

Receivables are recorded by a.

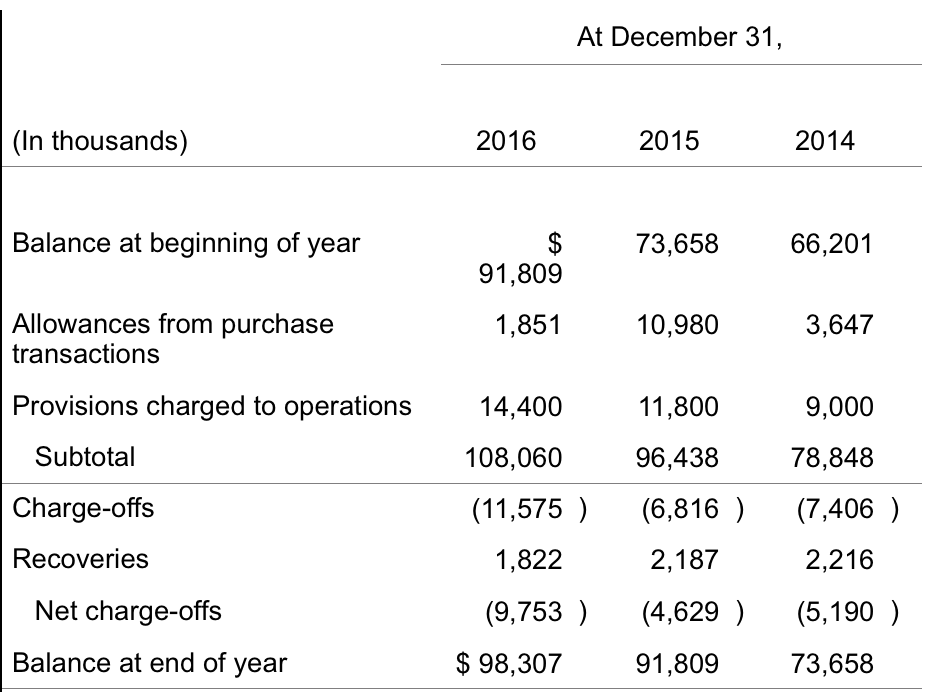

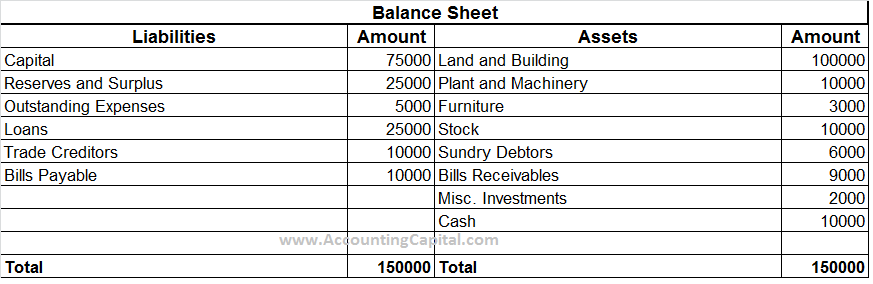

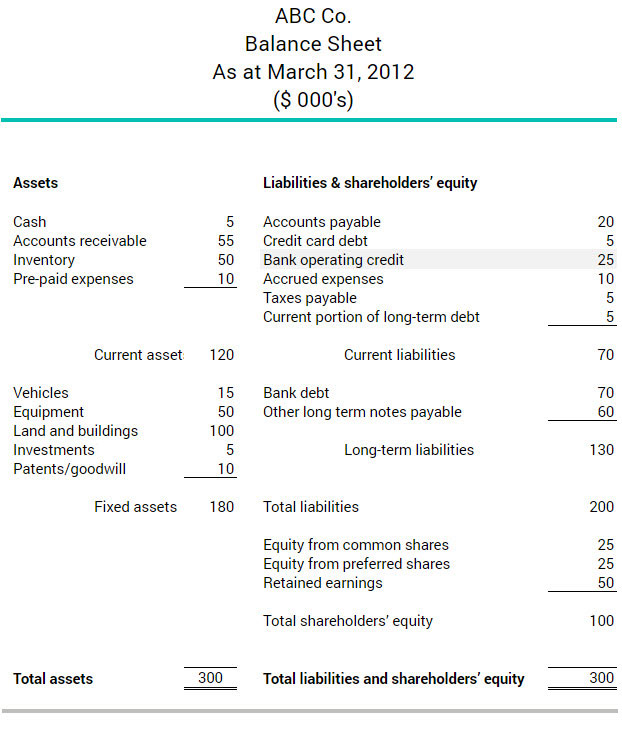

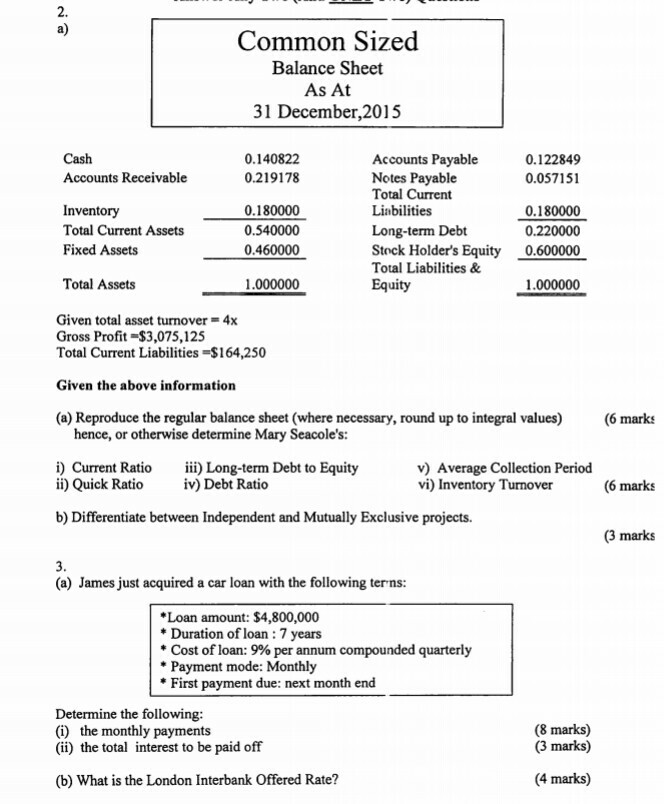

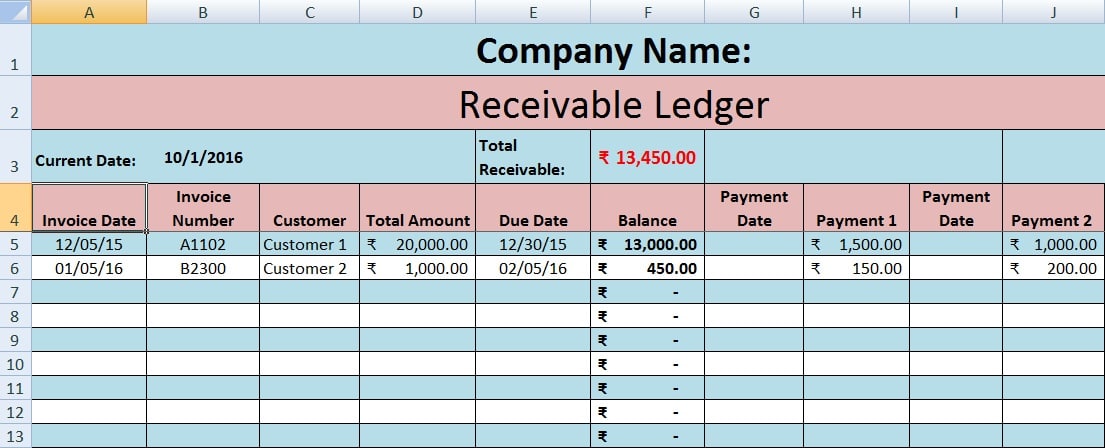

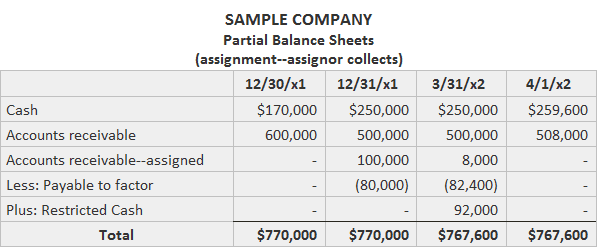

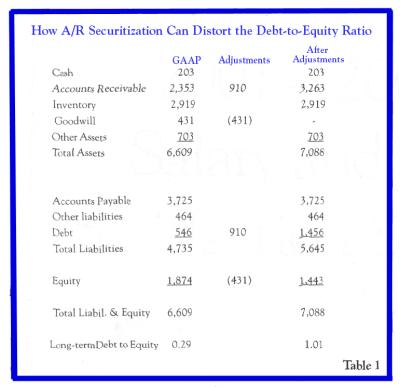

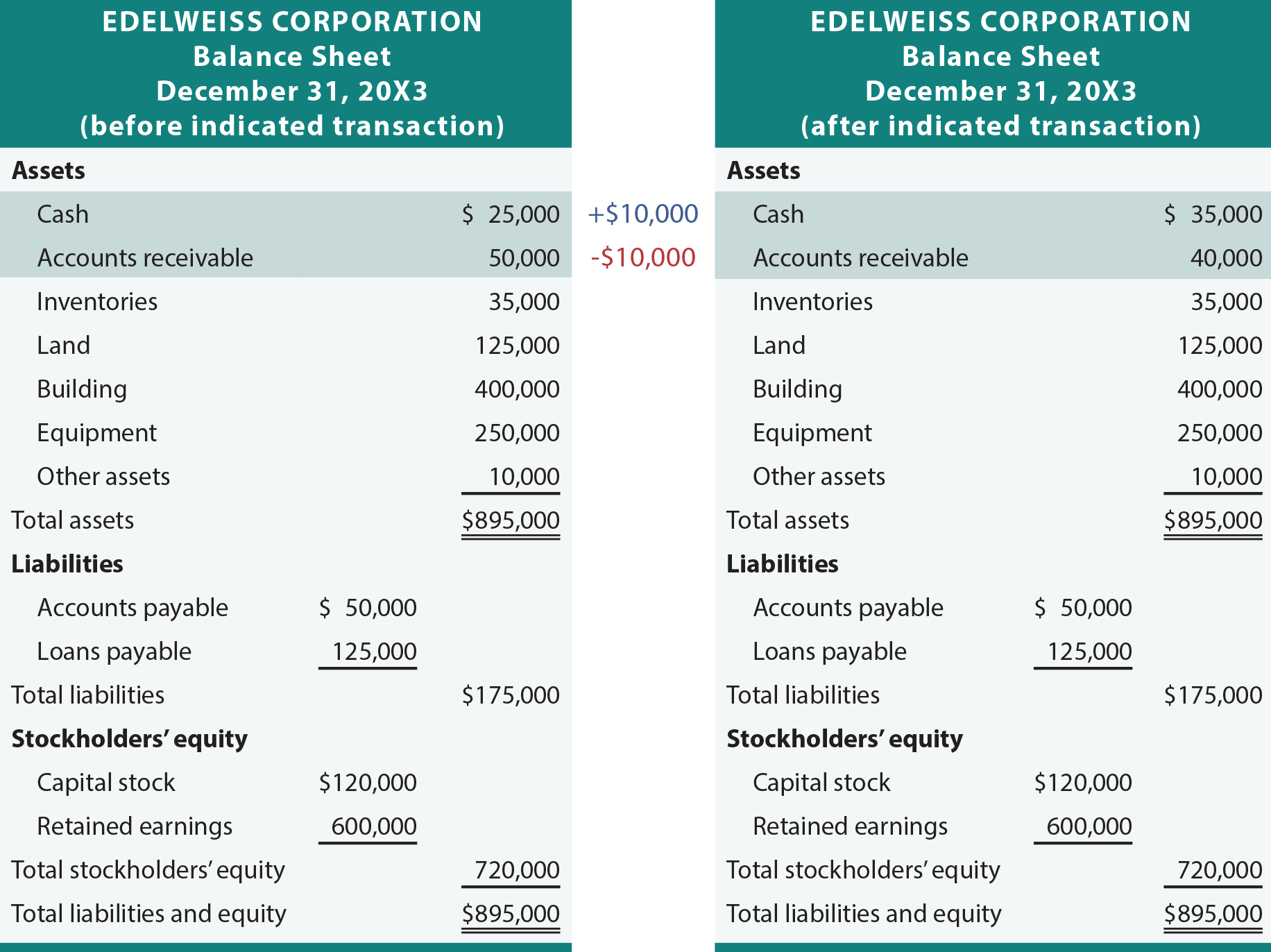

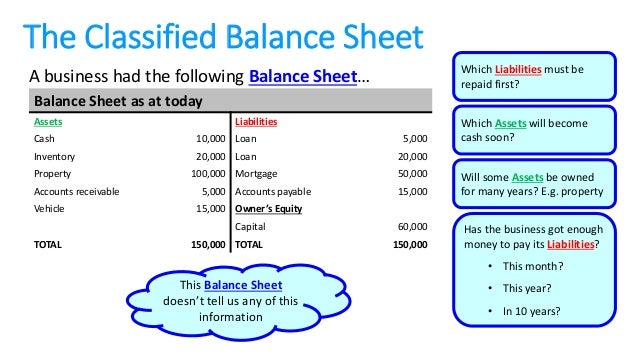

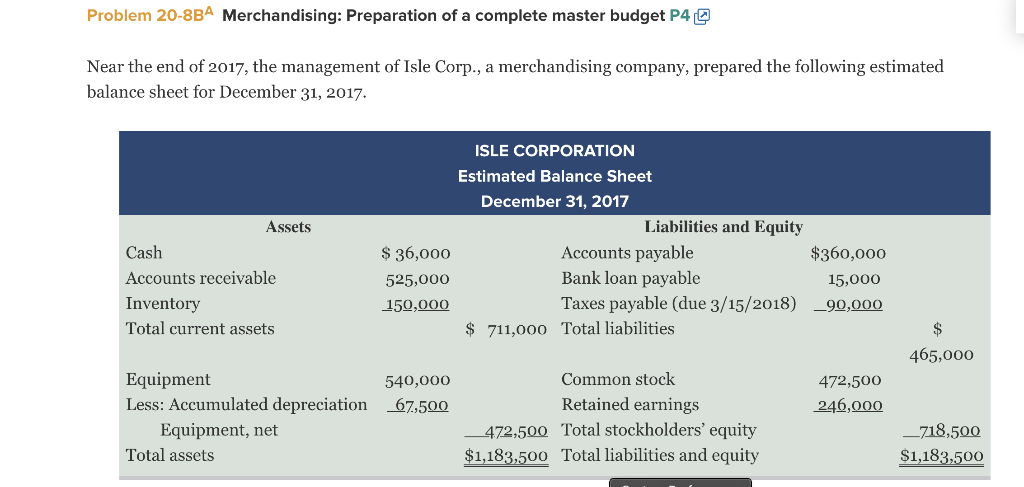

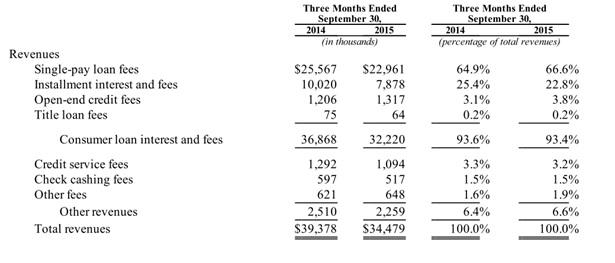

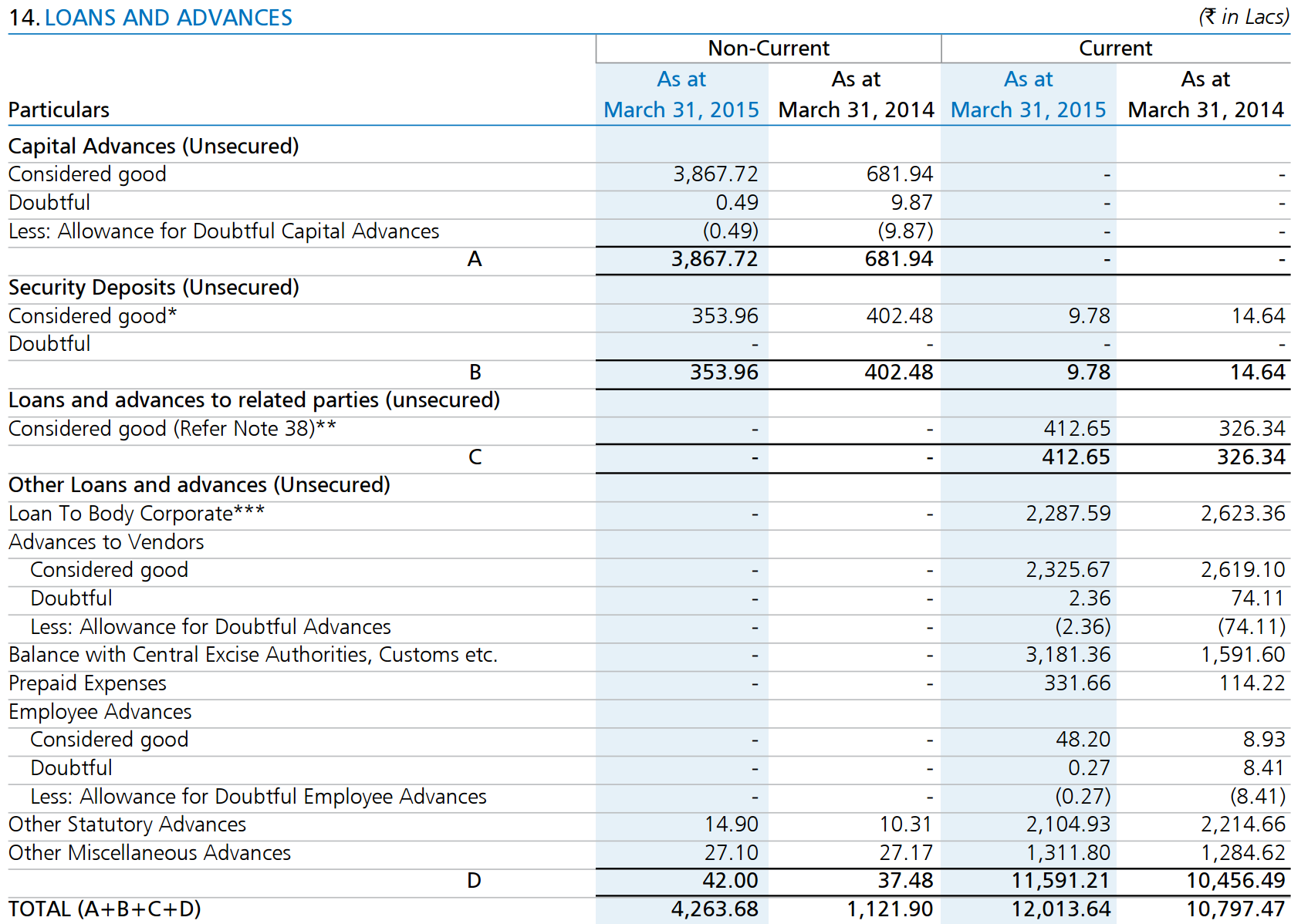

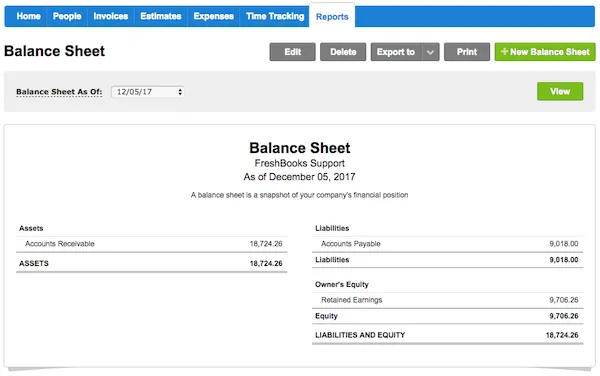

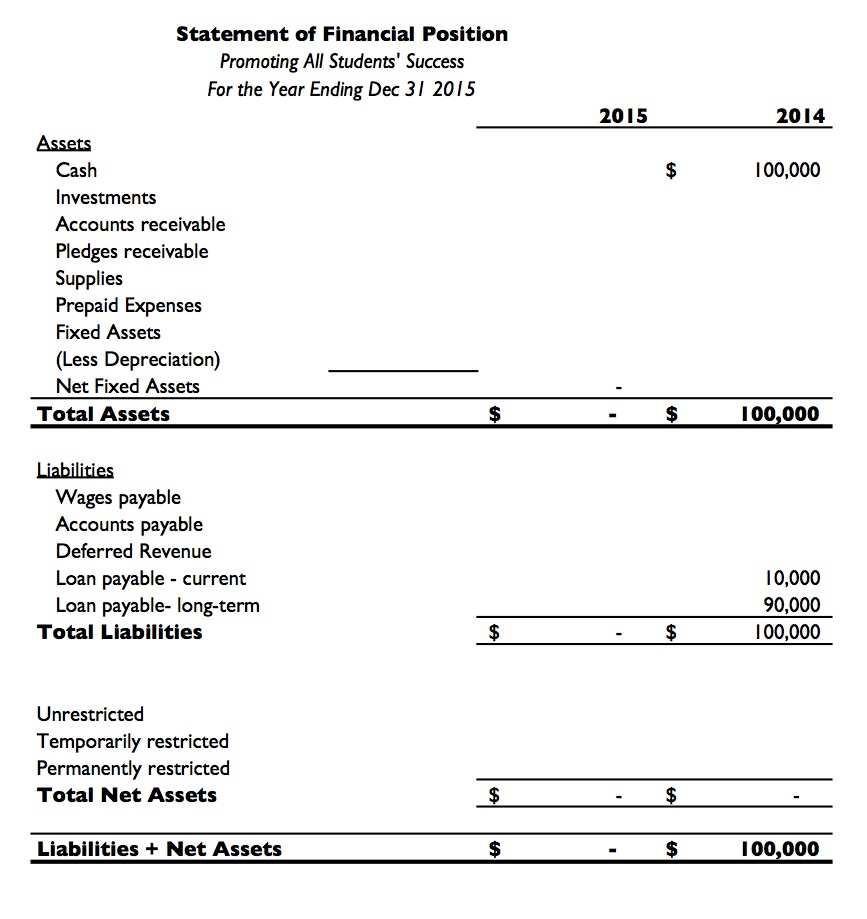

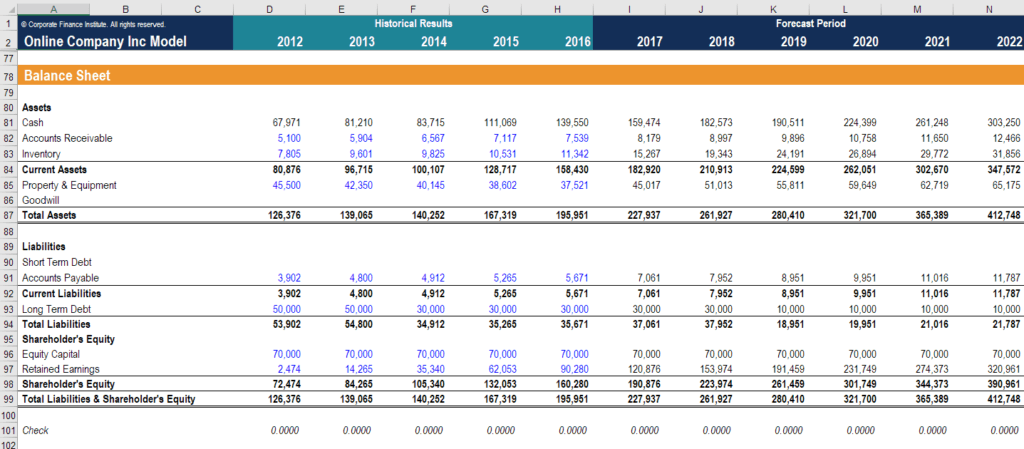

Loan receivable in balance sheet. Loans receivable is an accounting term that refers to the manner in which lenders classify the outstanding money owed them by debtors. Receivables is an asset designation applicable to all debts unsettled transactions or other monetary obligations owed to a company by its debtors or customers. As the money is earned either by shipping promised products using the percentage of completion method or simply as time passes it gets transferred from unearned. This increases your cash balance on your balance sheet and how much you have available to spend.

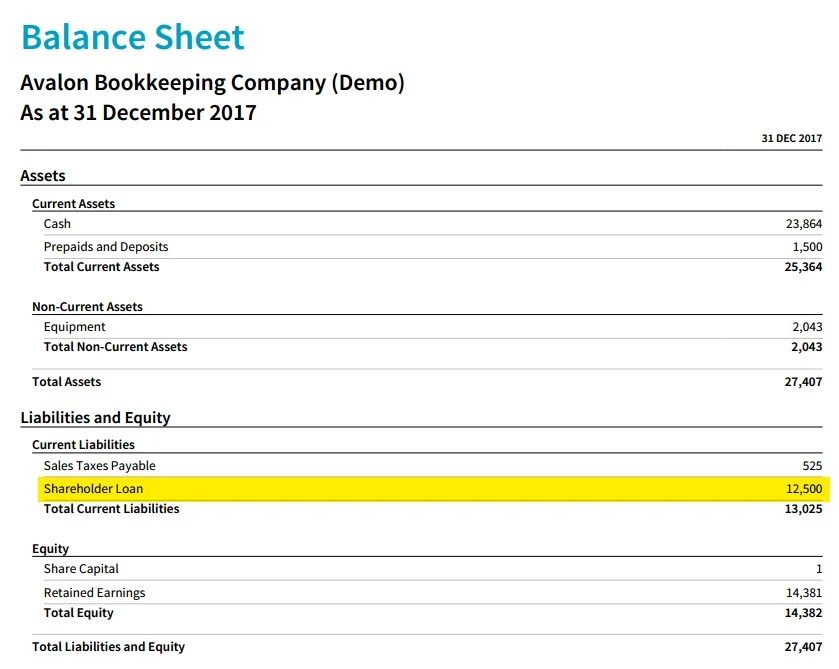

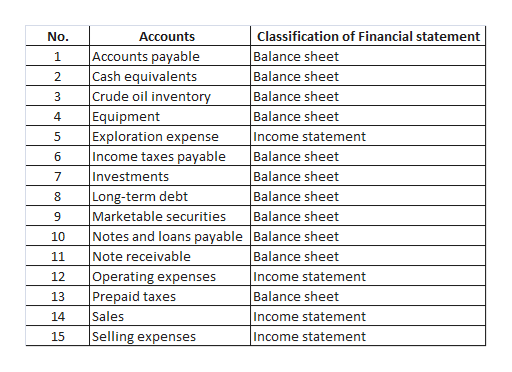

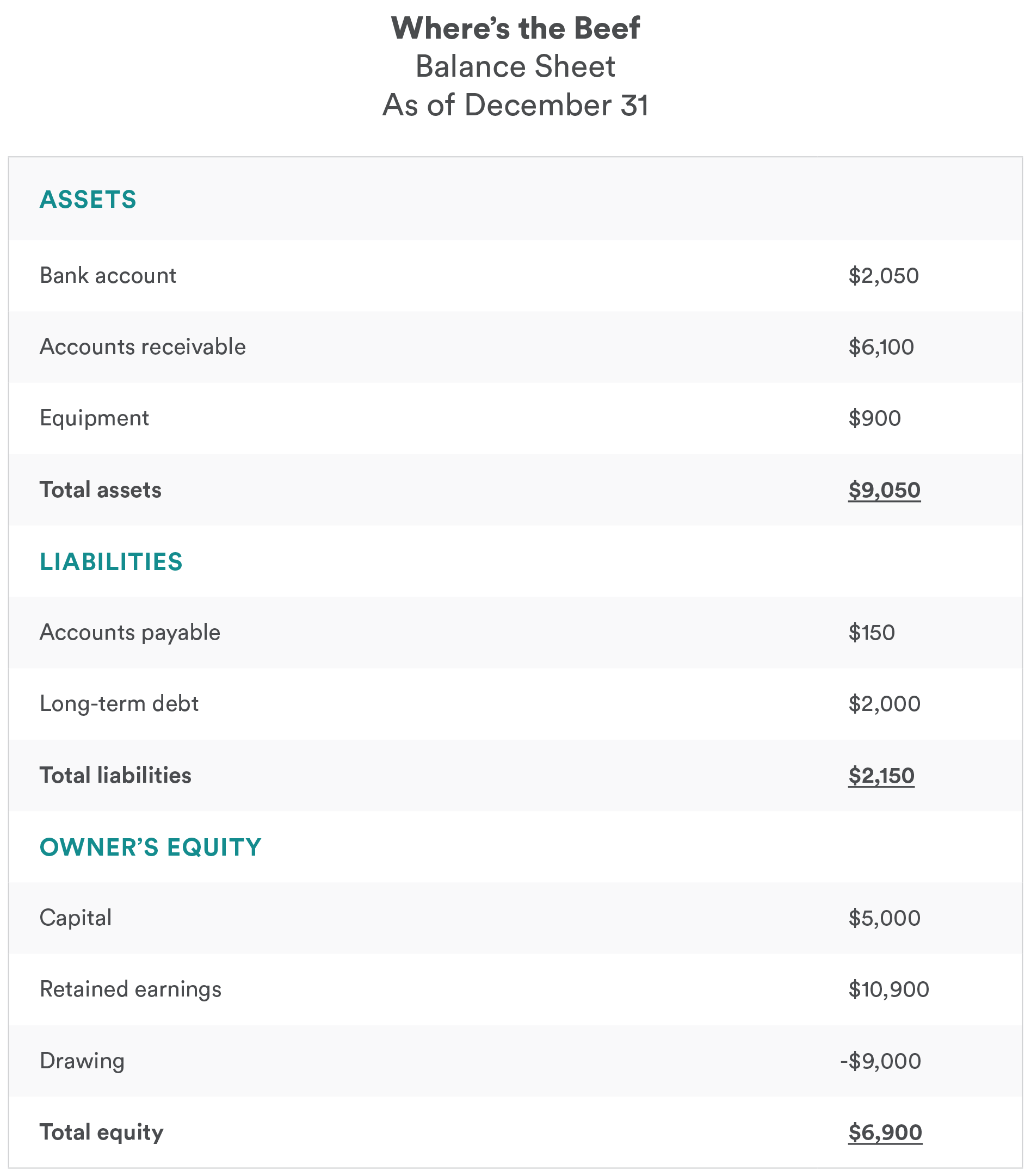

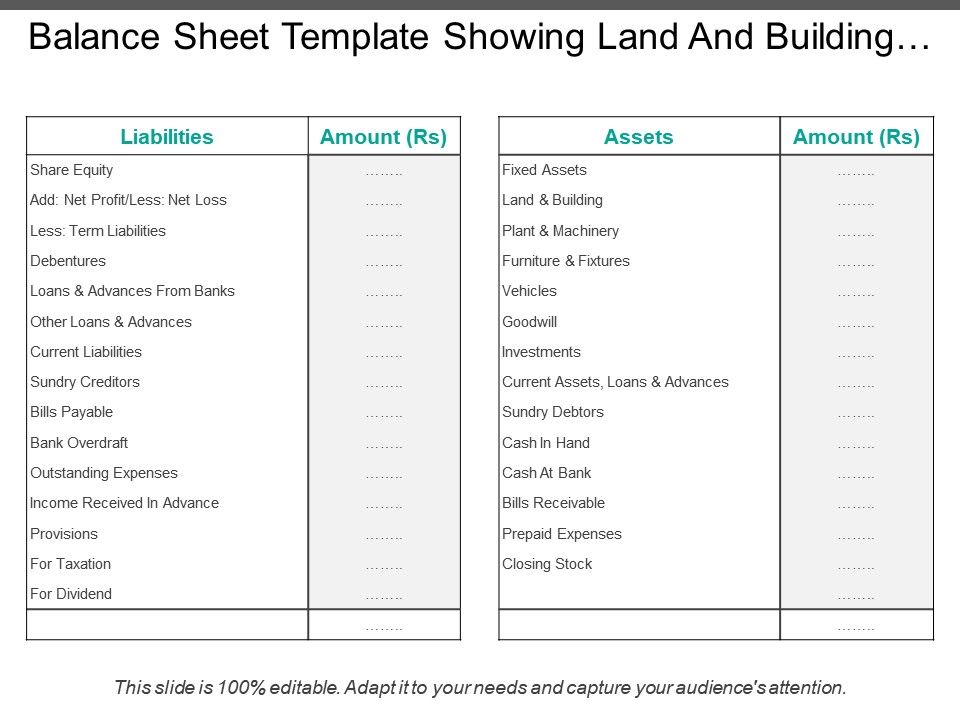

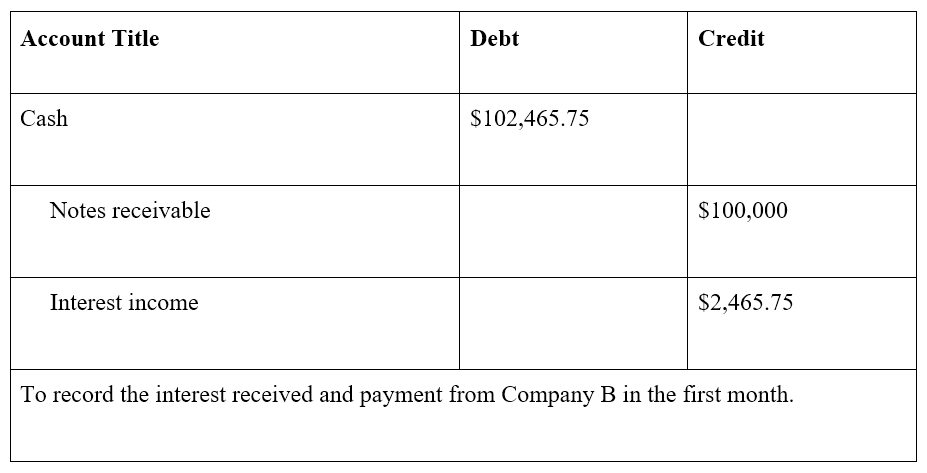

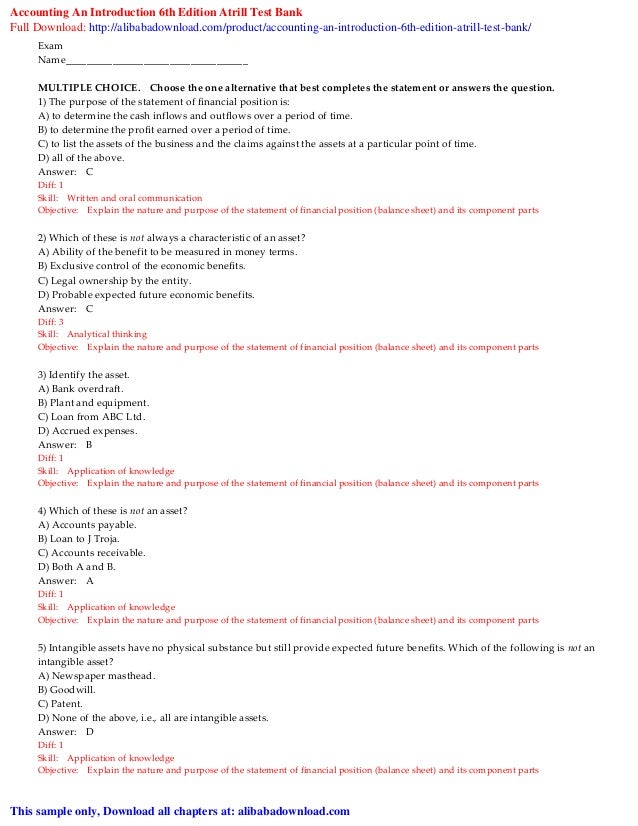

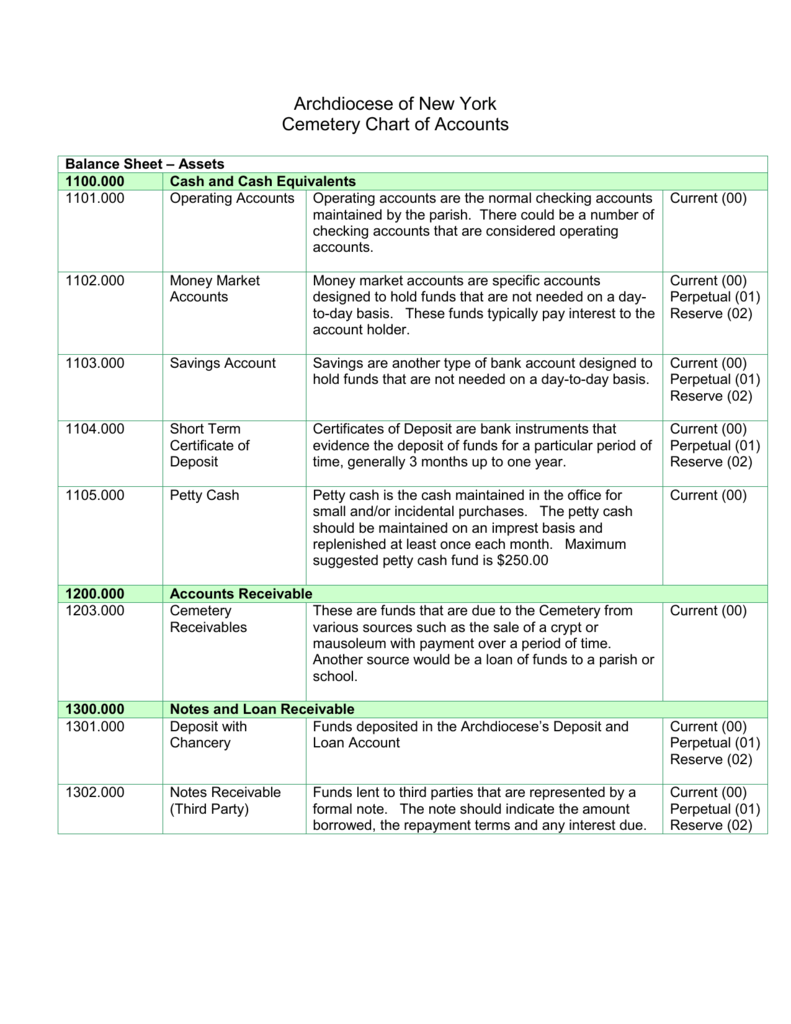

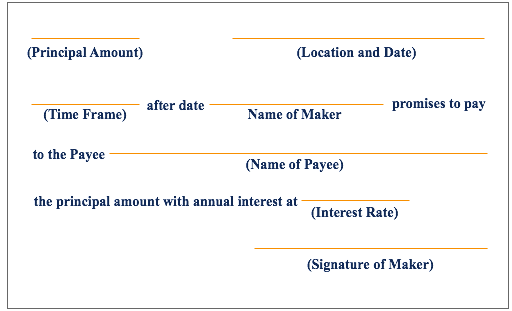

Notes receivable are written promissory notes that give the holder or bearer the right to receive the amount outlined in an agreement. The interest receivable account is usually classified as a current asset on the balance sheet unless there is no expectation to receive payment from the borrower within one year. Accounts payable is a liability since its money owed to creditors and is listed under current liabilities on the balance sheet. The balance in the accounts receivable account is comprised of all unpaid receivables.

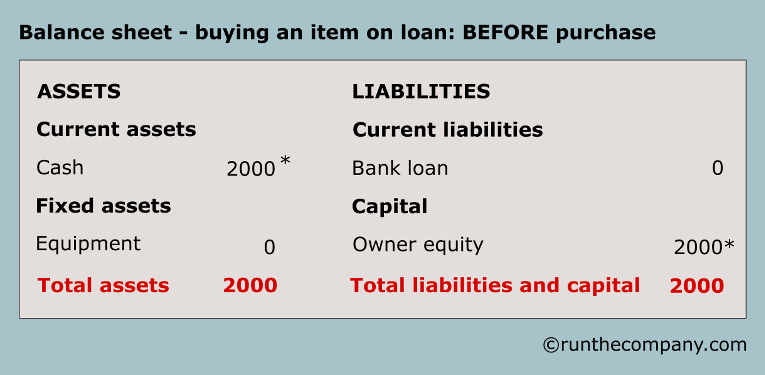

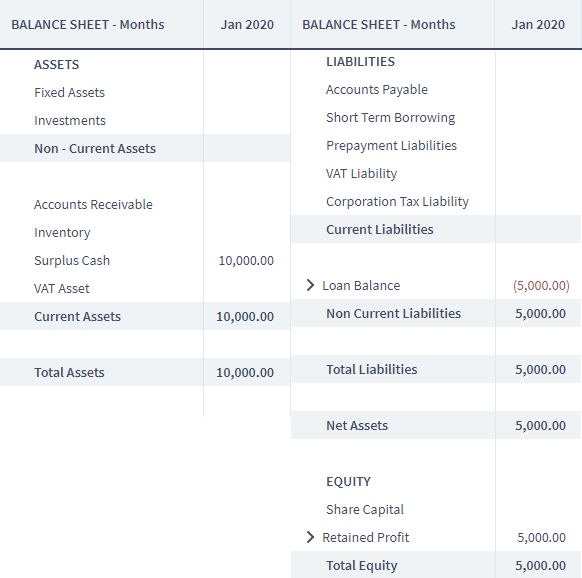

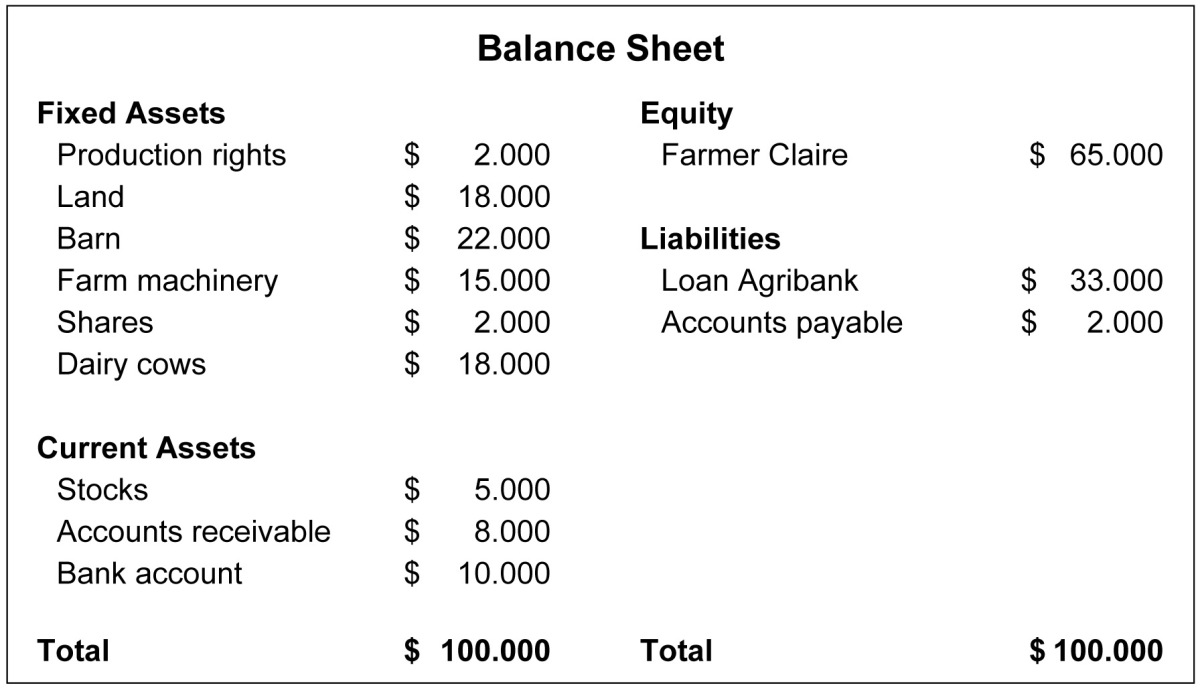

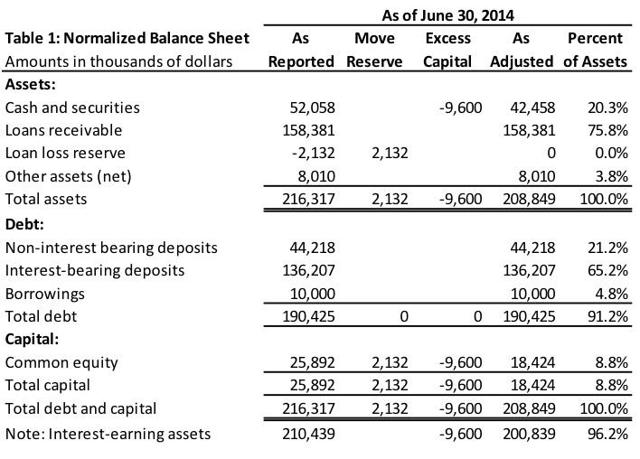

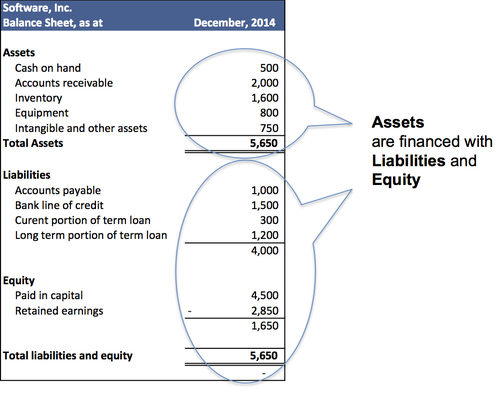

Invested funds or loan. A loan receivable is the amount of money owed from a debtor to a creditor typically a bank or credit union. If the company is in the business of lending money loans receivable likely will be a significant figure. If the note receivable is due within a year then it is treated as a current asset on the balance sheet.

A separate note receivable account should be created and named due from shareholder to separate this type of receivable from other receivables from the ordinary course of business. A loan receivable meaning money someone borrowed from you and must repay is the opposite of a loan payable. Thats money you borrowed and must repay to someone else. Promissory notes are a written promise to pay cash to another party on or before a specified future date.

The lender could be anyone form banks financial institutions and private investors to individuals. This sum is referred to as loans receivable. Loans receivables are entered in the accounting ledgers of the lenders as money that is yet to be repaid by the. If the loan is to be paid back in less than one year the receivable should be part of current assets on the balance sheet.

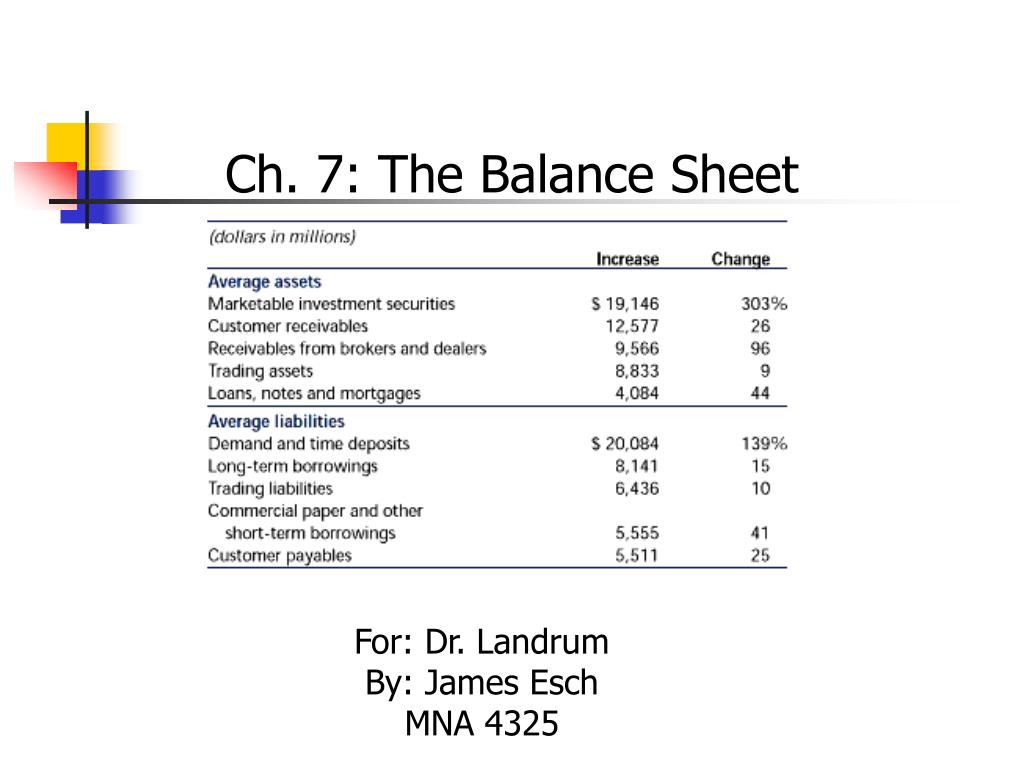

Loans receivable are assets. A companys balance sheet displays the sum of all funds that have been lent out but have not yet been collected. The part due in the next 12 months is a current liability or asset. As such sometimes a debit account is referred to as a cash account.

Loans payable are liabilities.

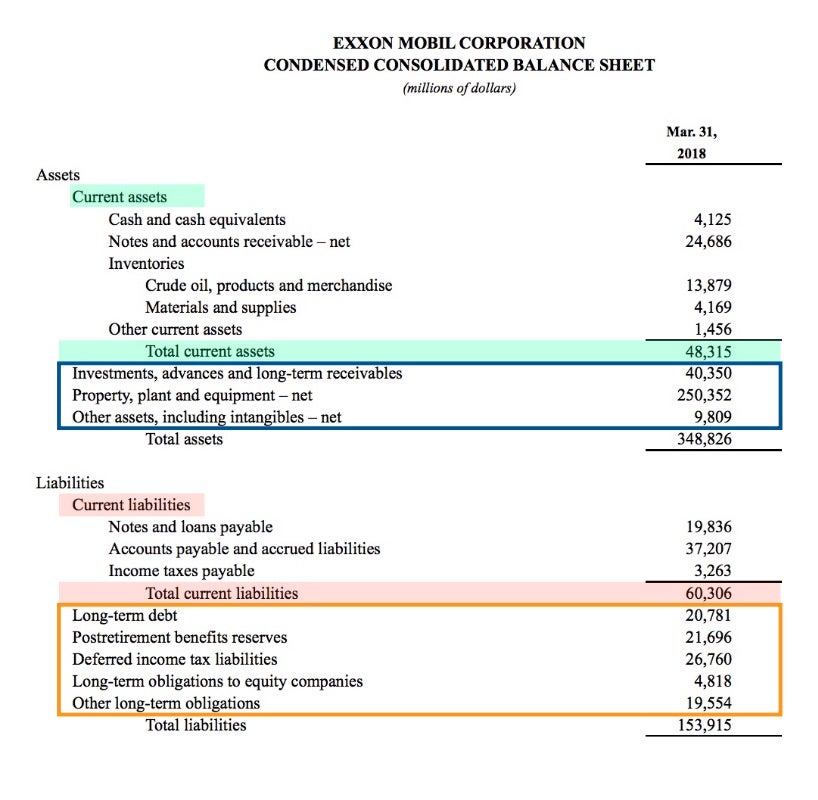

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

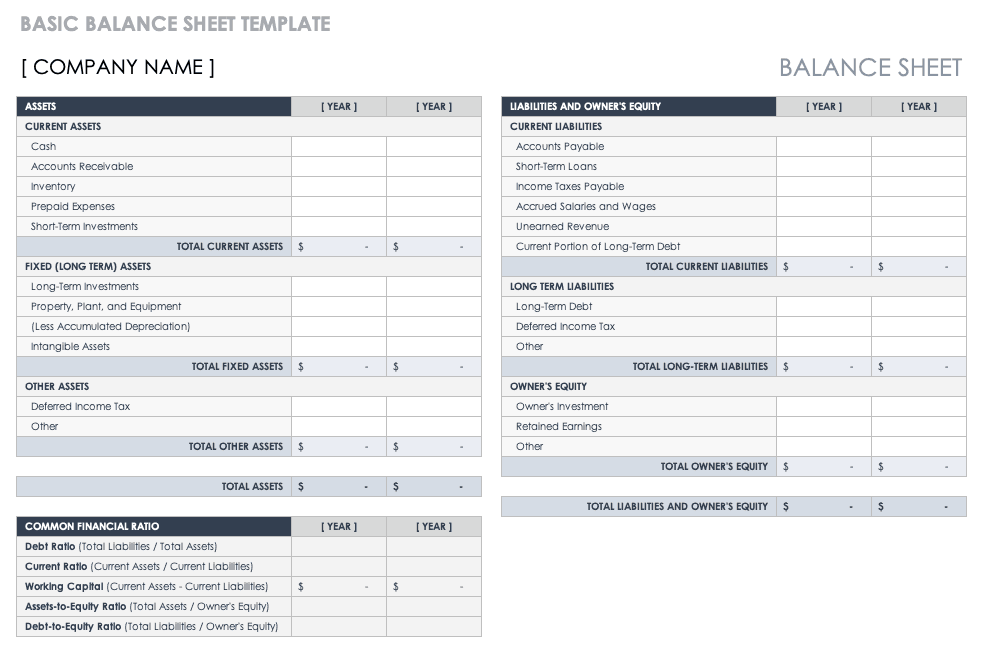

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)