Loans And Receivables Classification

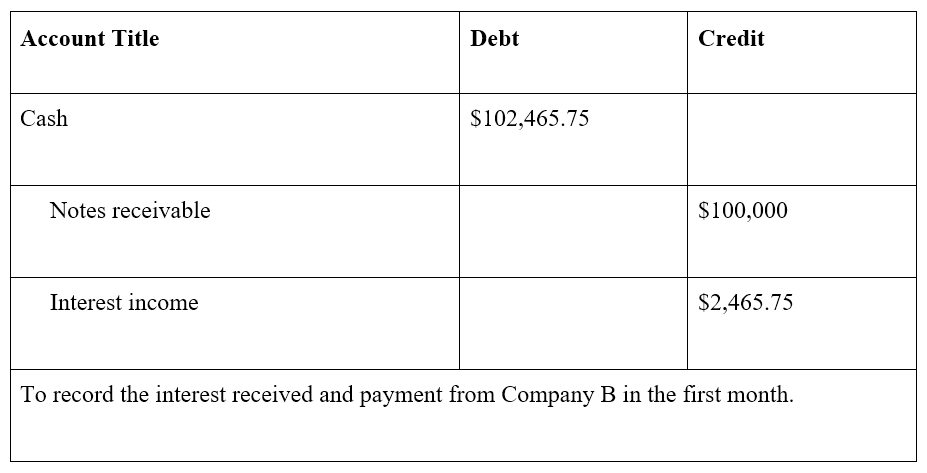

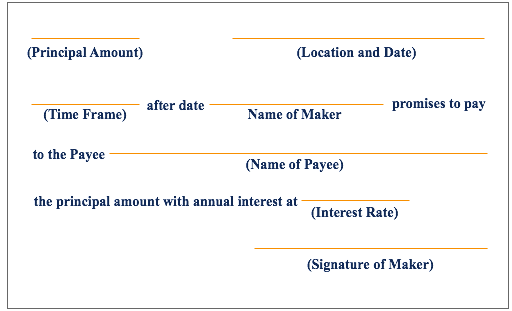

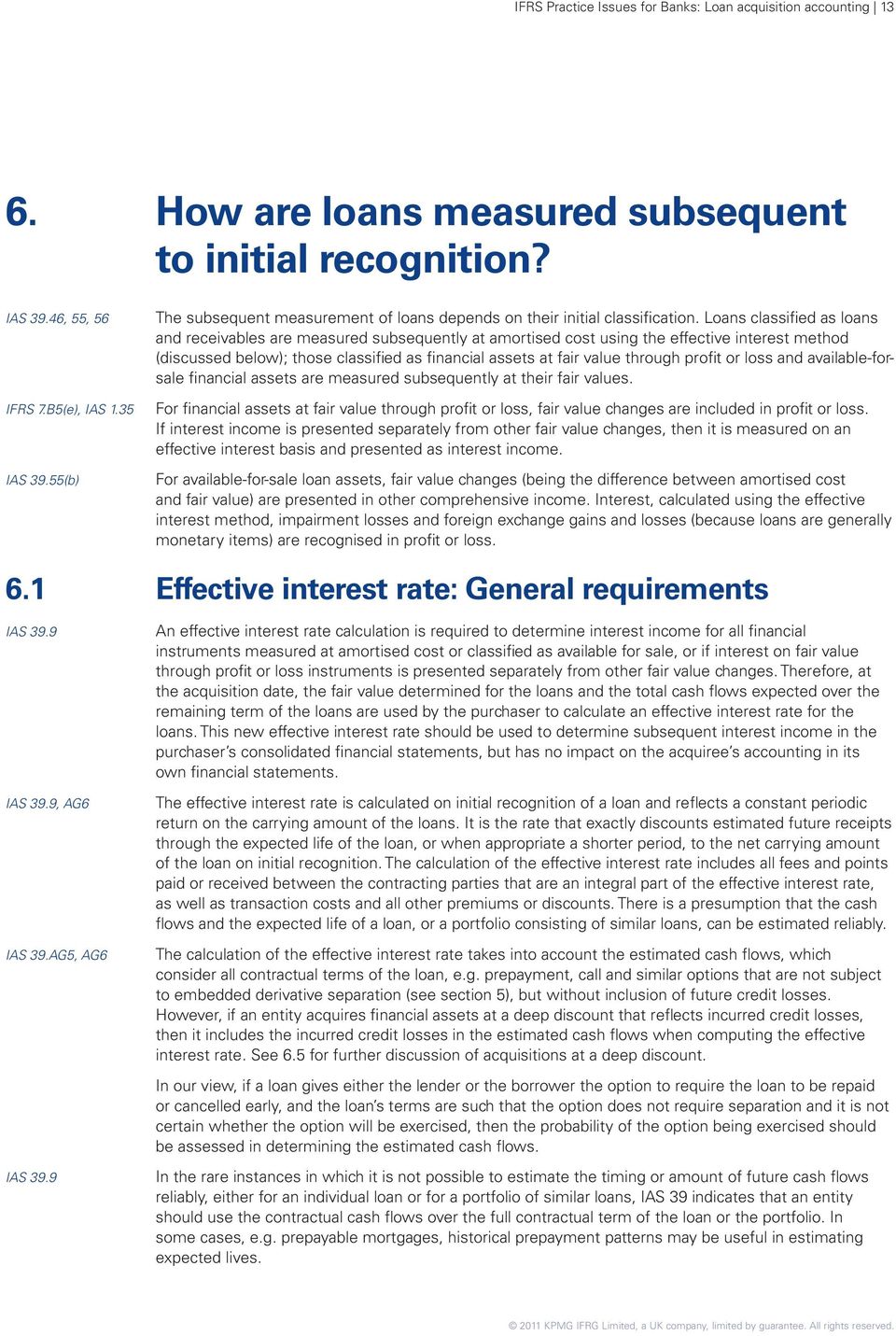

Interest expense is calculated on the outstanding amount of the loan for that period.

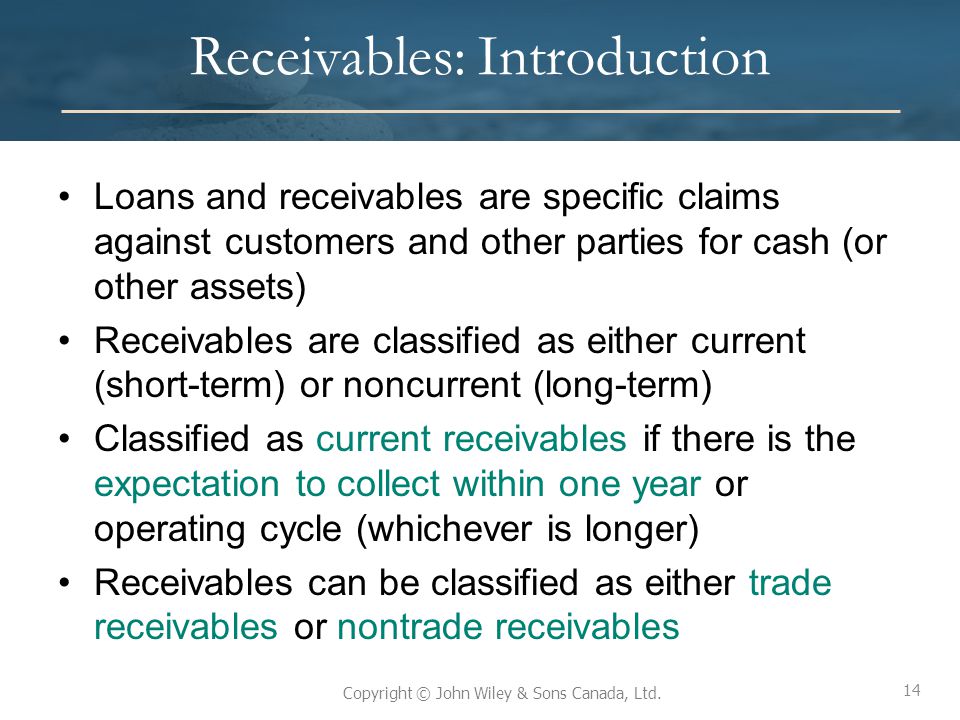

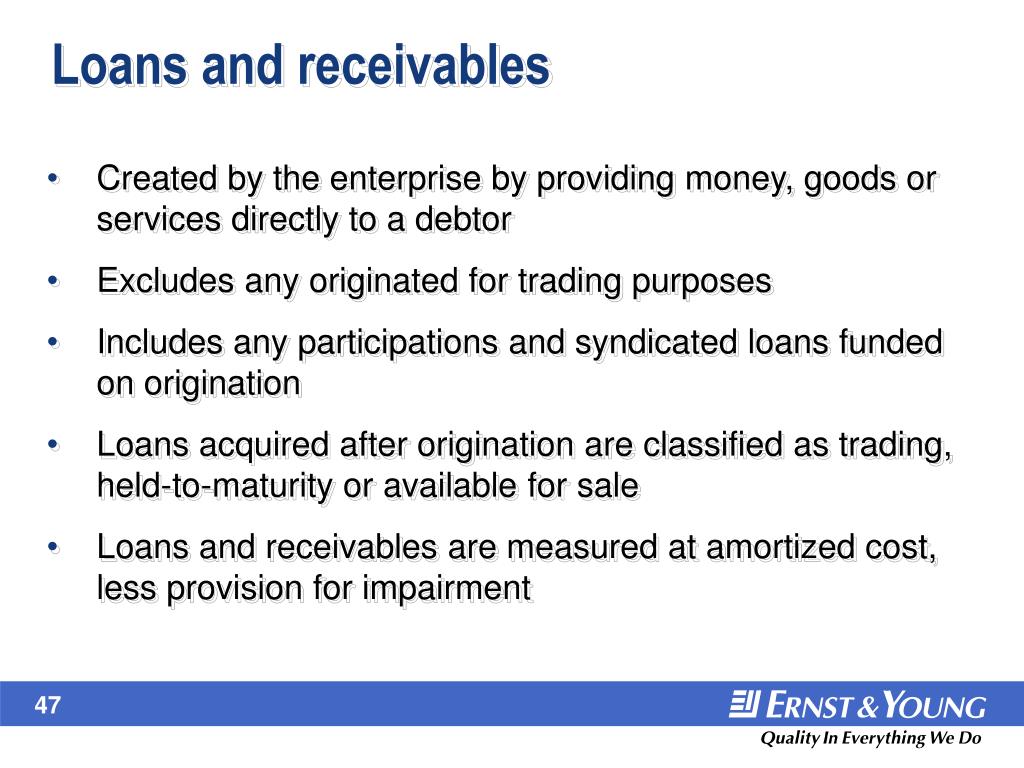

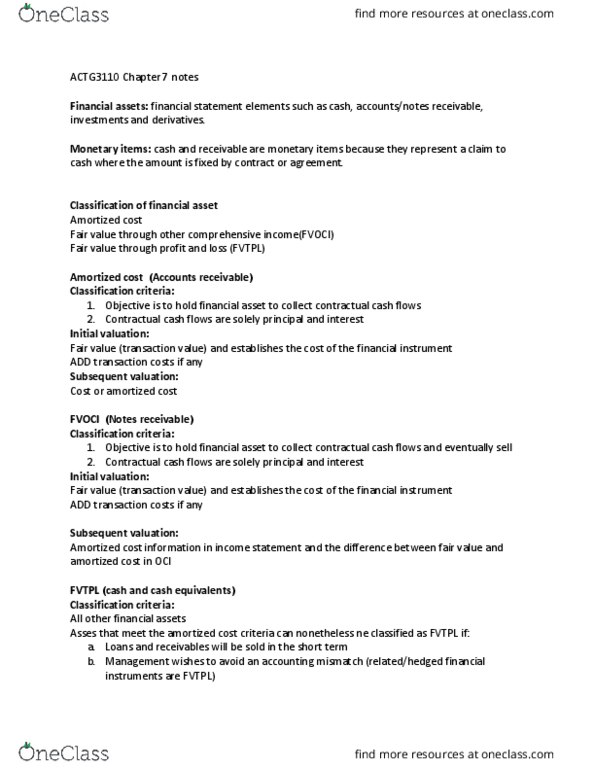

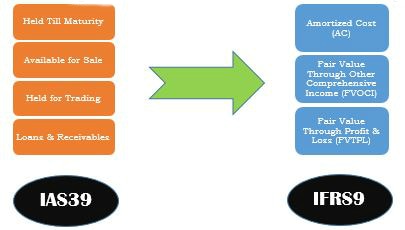

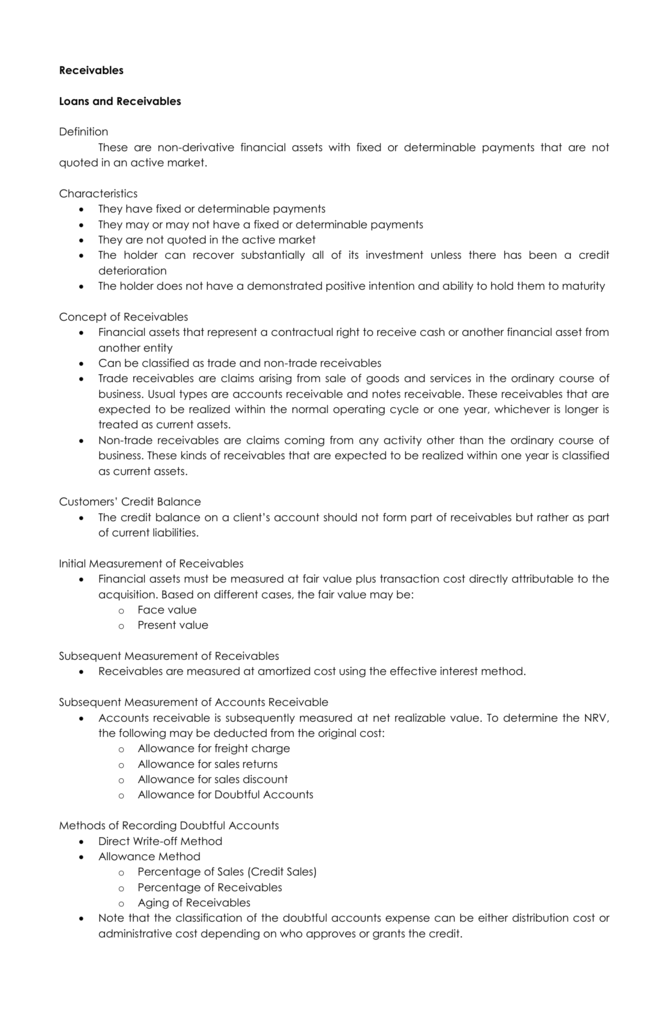

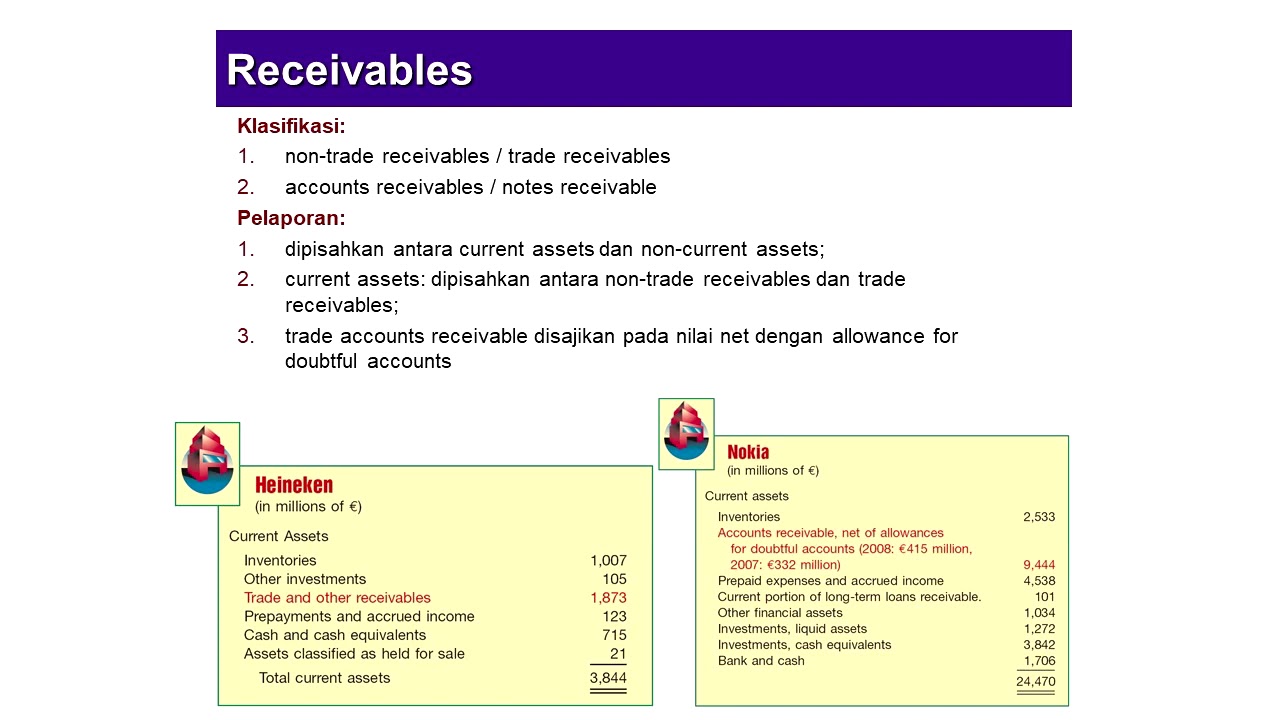

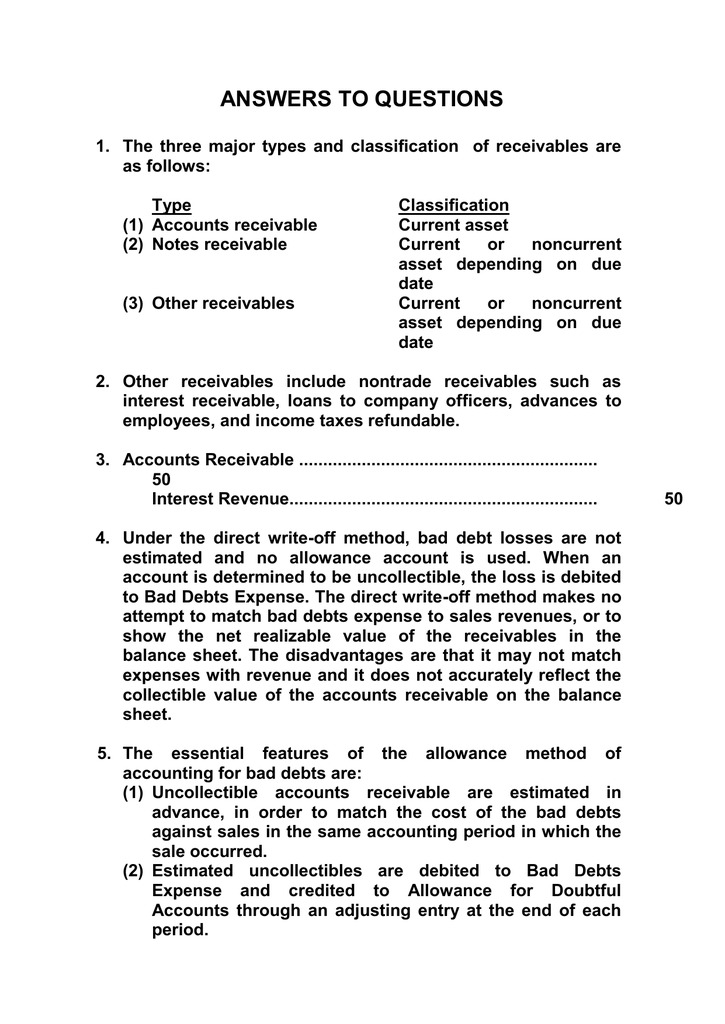

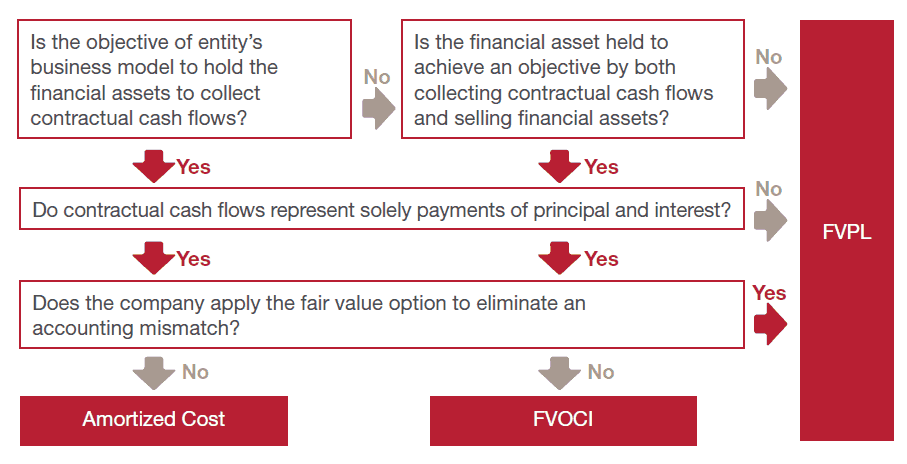

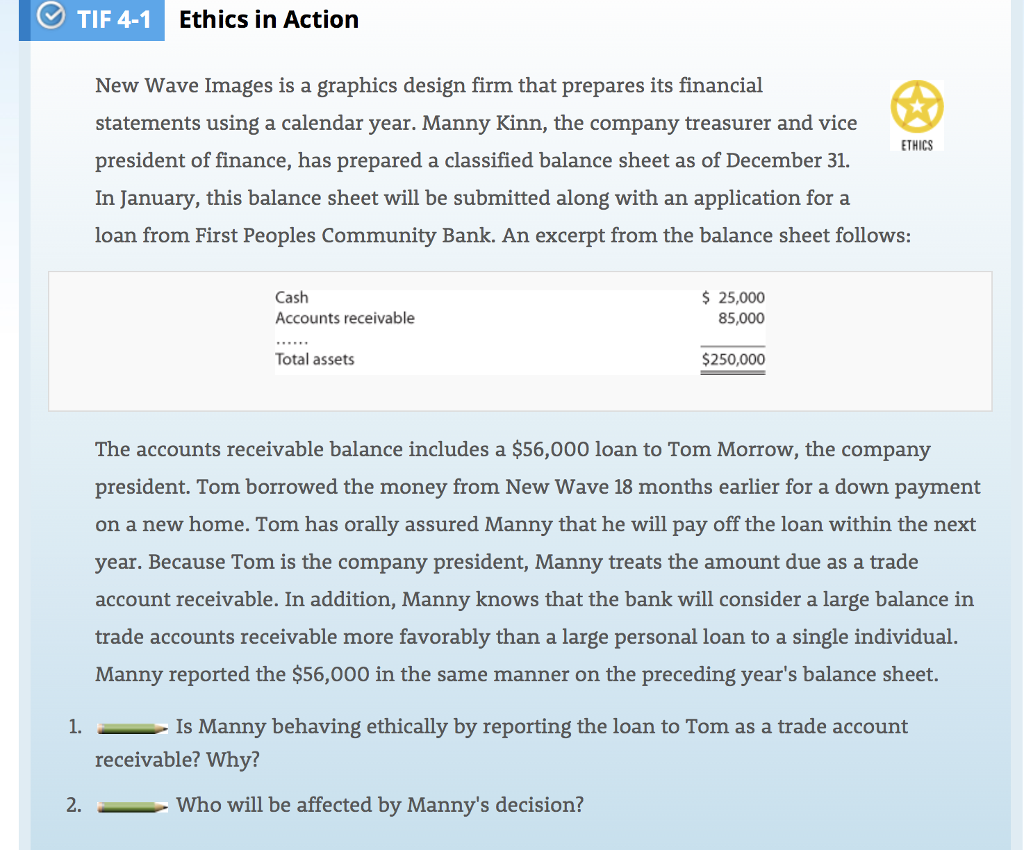

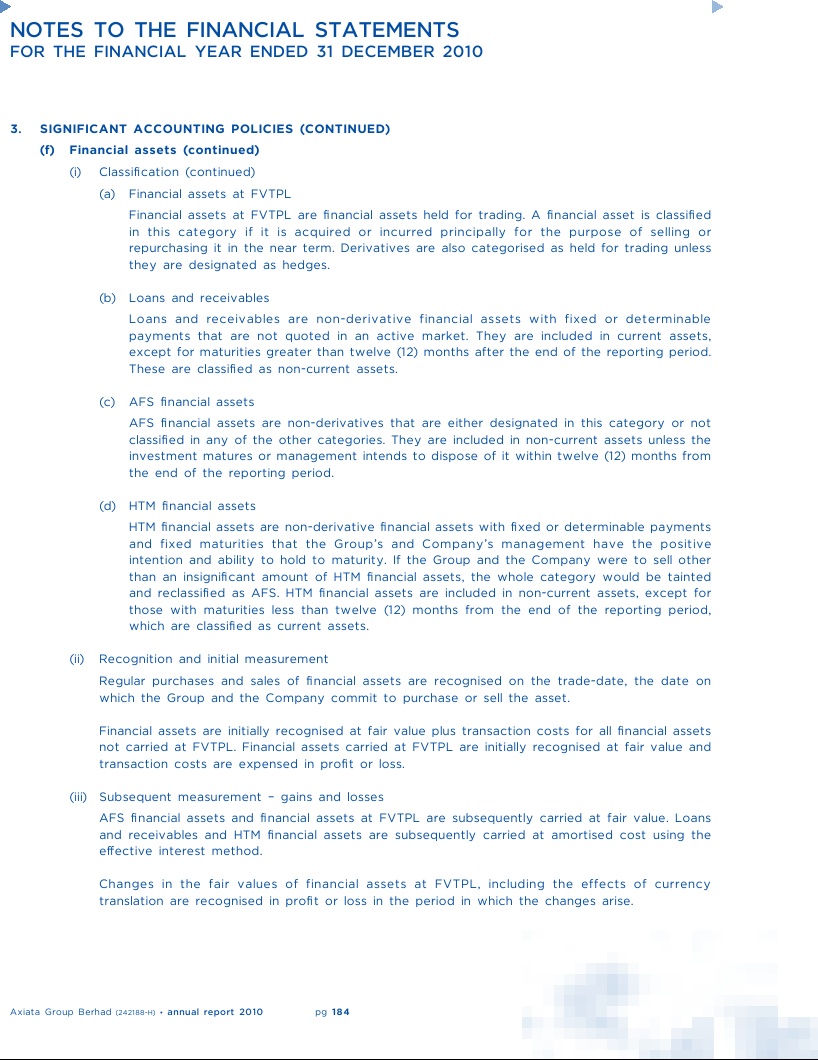

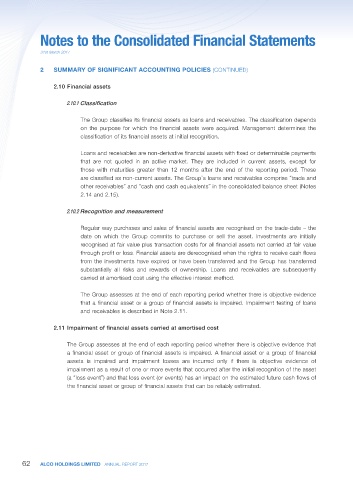

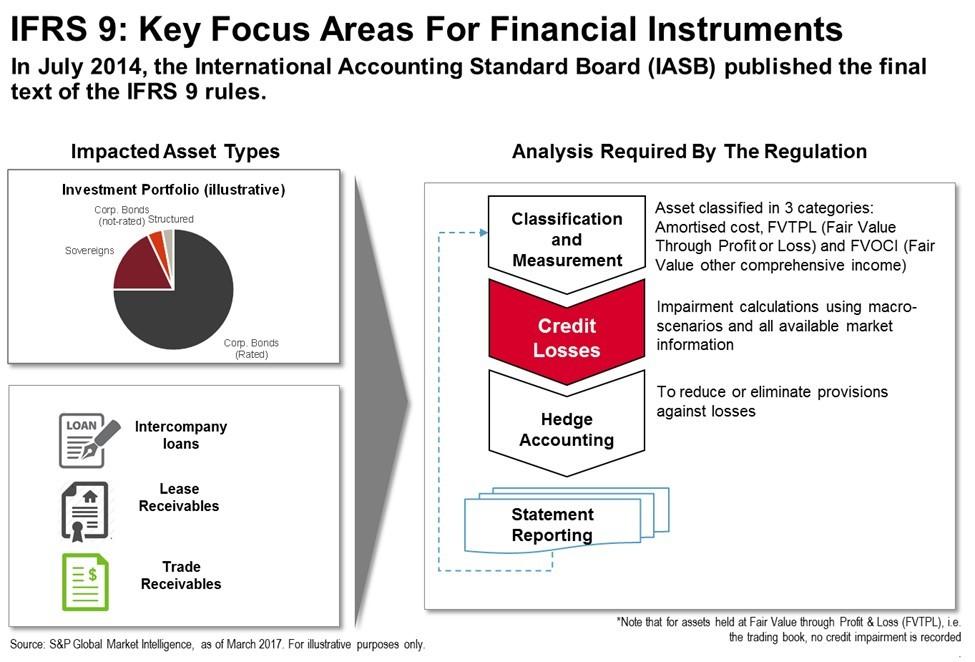

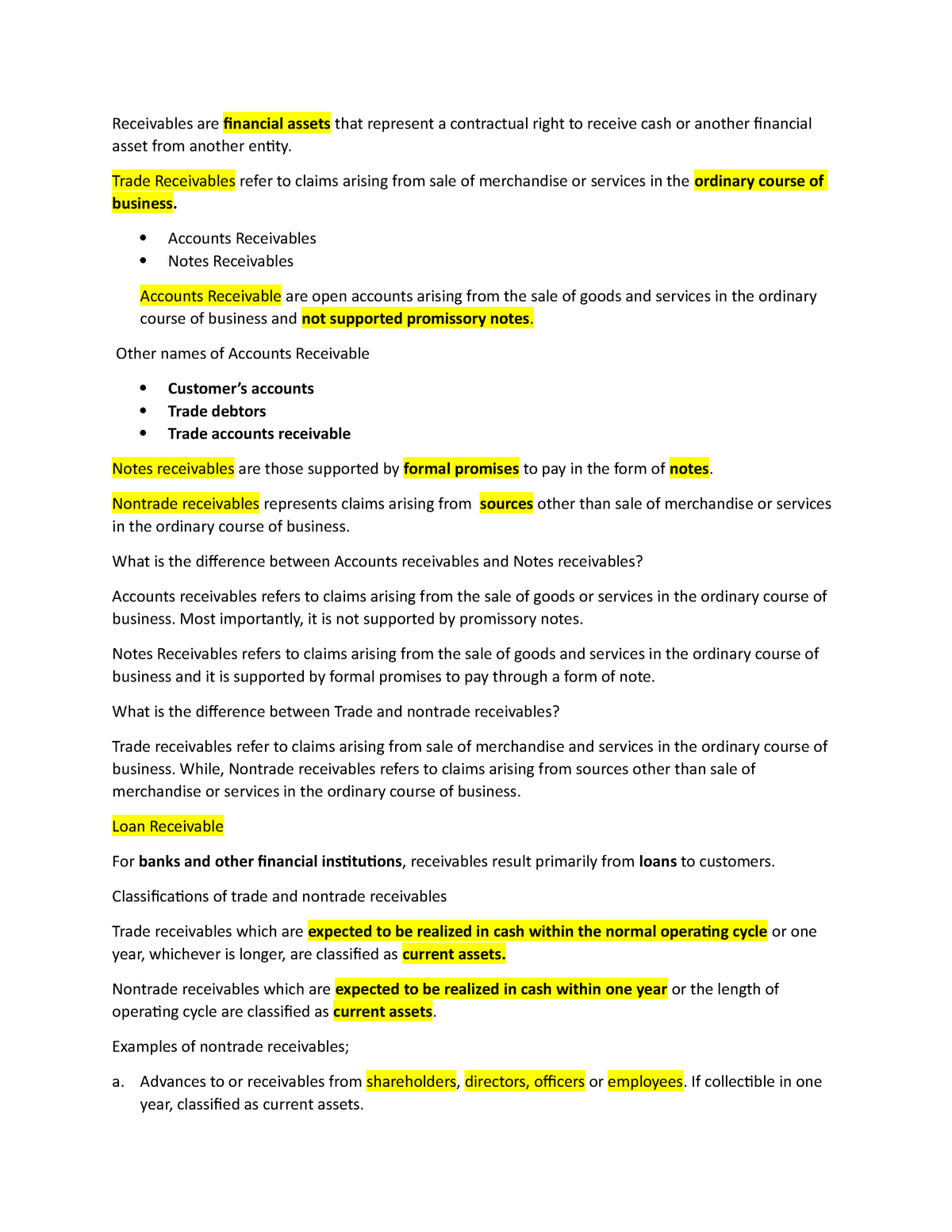

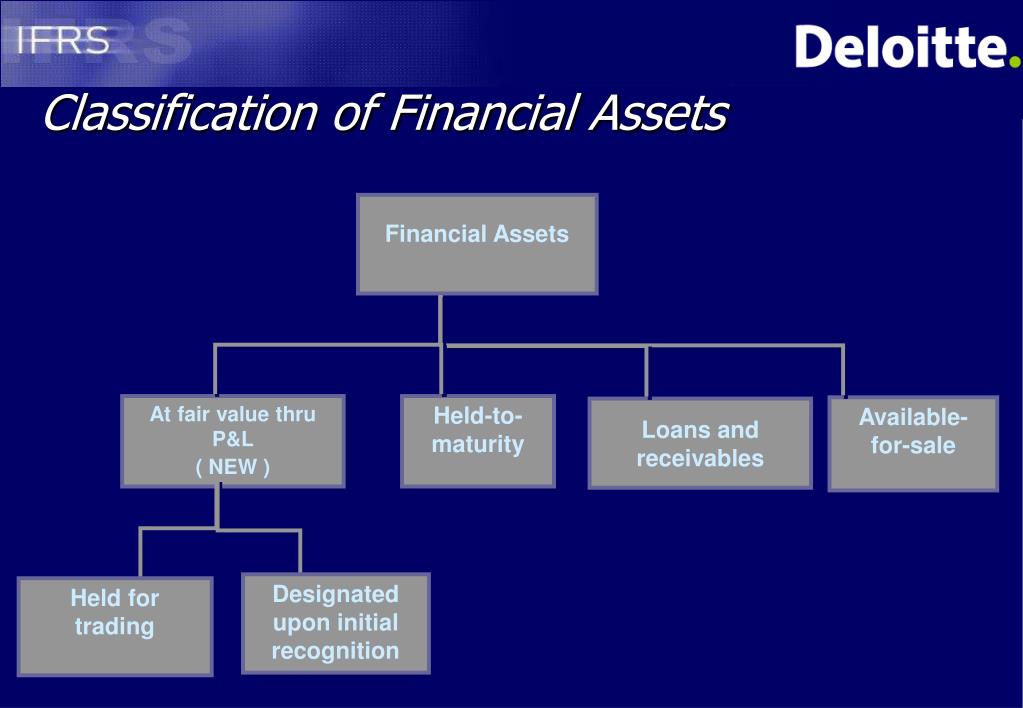

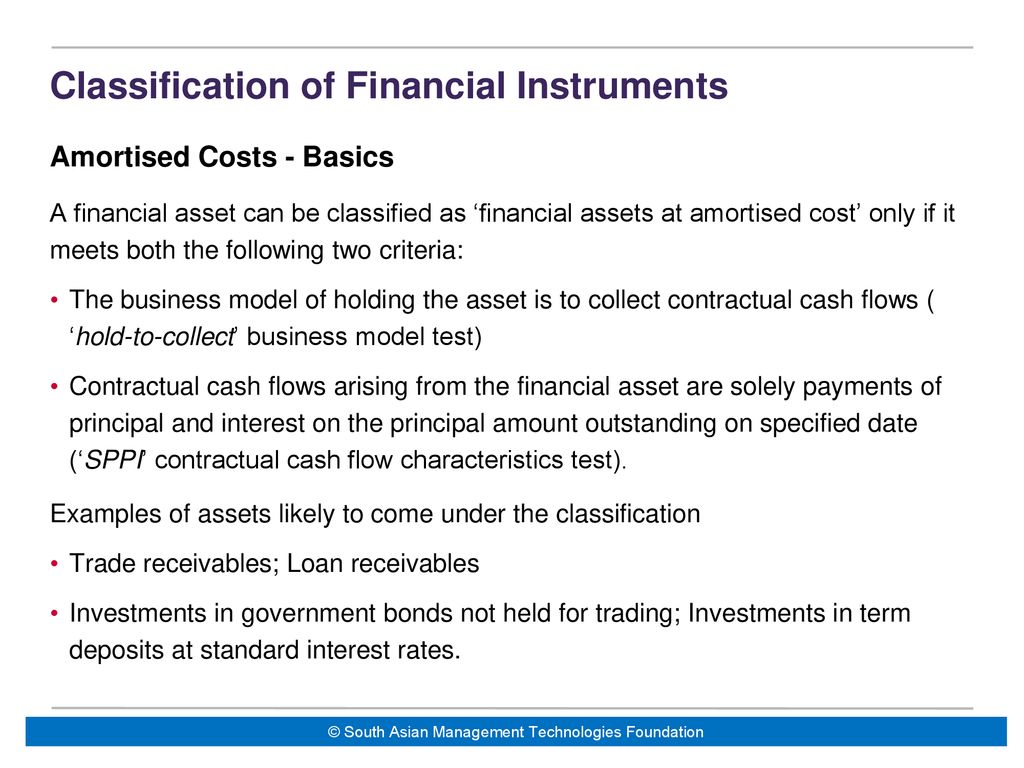

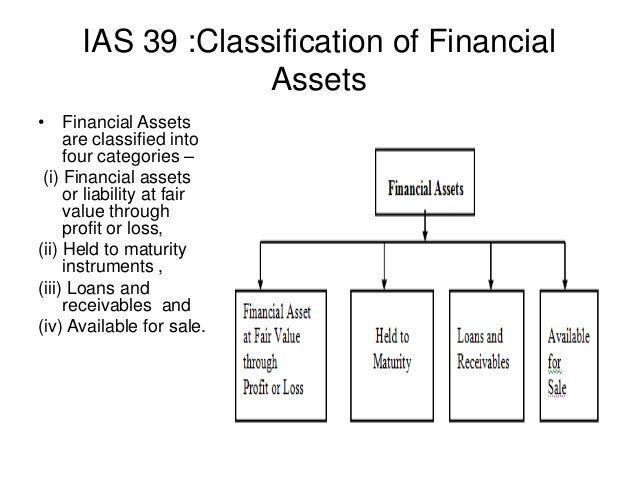

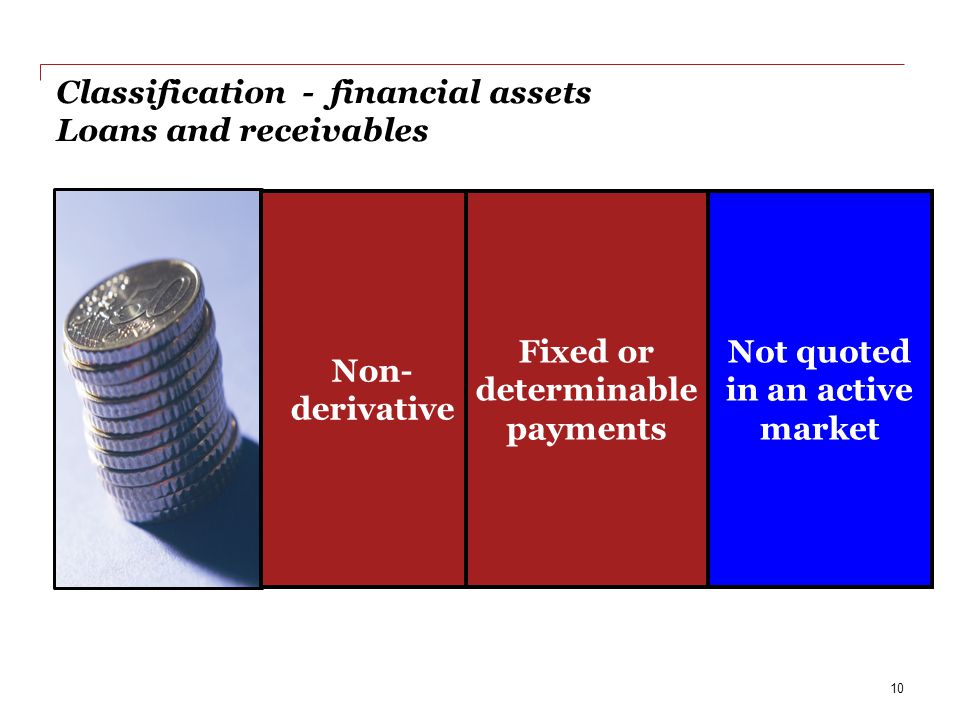

Loans and receivables classification. Loans and receivables including short term trade receivables. Ias 39 is superseded for the periods starting on or after 1 january 2018 and you have to apply ifrs 9 financial instruments. Receivables is an asset designation applicable to all debts unsettled transactions or other monetary obligations owed to a company by its debtors or customers. As discussed in section 11 assigning a financial asset to a business model is a new requirement under the new standard that did not exist under ias 39.

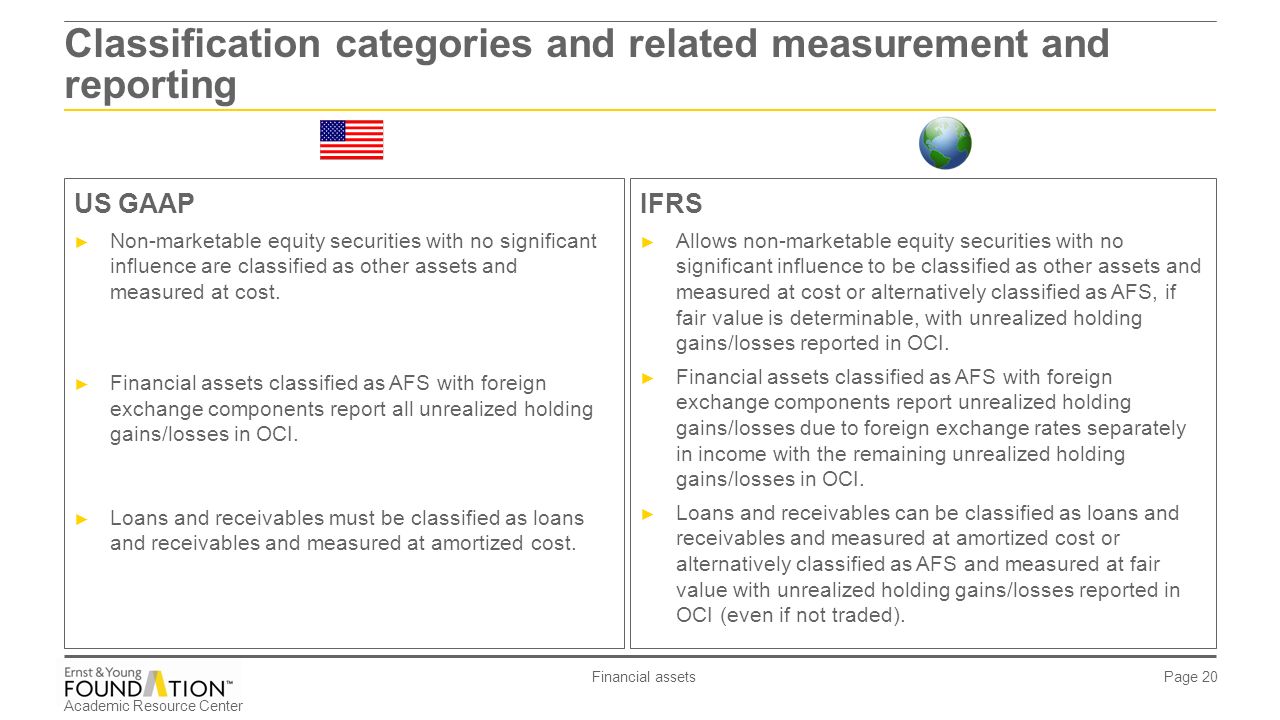

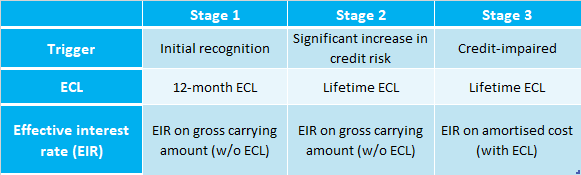

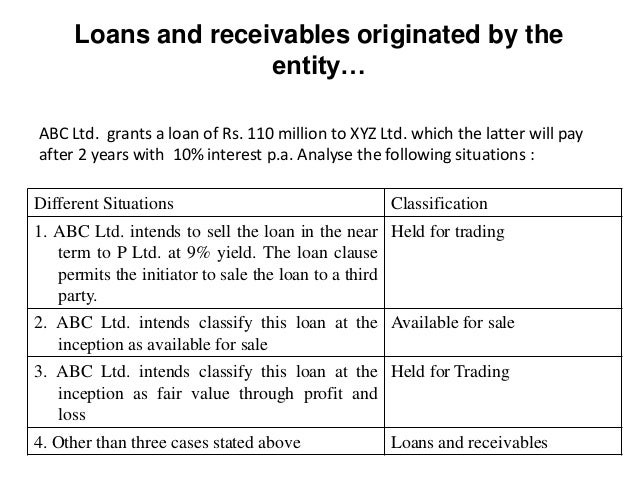

Ias 39 outlines the requirements for the recognition and measurement of financial assets financial liabilities and some contracts to buy or sell non financial items. On the other hand ifrs 9 establishes a new approach for loans and receivables including trade receivablesan expected loss model that focuses on the risk that a loan will default rather than whether a loss has been incurred. A loan is an asset but consider that for reporting purposes that loan is also going to be listed separately as a liability. Farhats accounting lectures 30559 views 4155.

Loans refer to a debt provided by a financial institution for a particular period while advances are the funds provided by the banks to the business to fulfill working capital requirement which are to be payable within one year. Ias 39 is a standard fully replaced by the new standard on financial instruments ifrs 9 applicable from 1 january 2018. The loan amount is required to be repaid along with the interest either in lump sum or in suitable instalments. If you would like to know more about this process please read our article ias 39 vs.

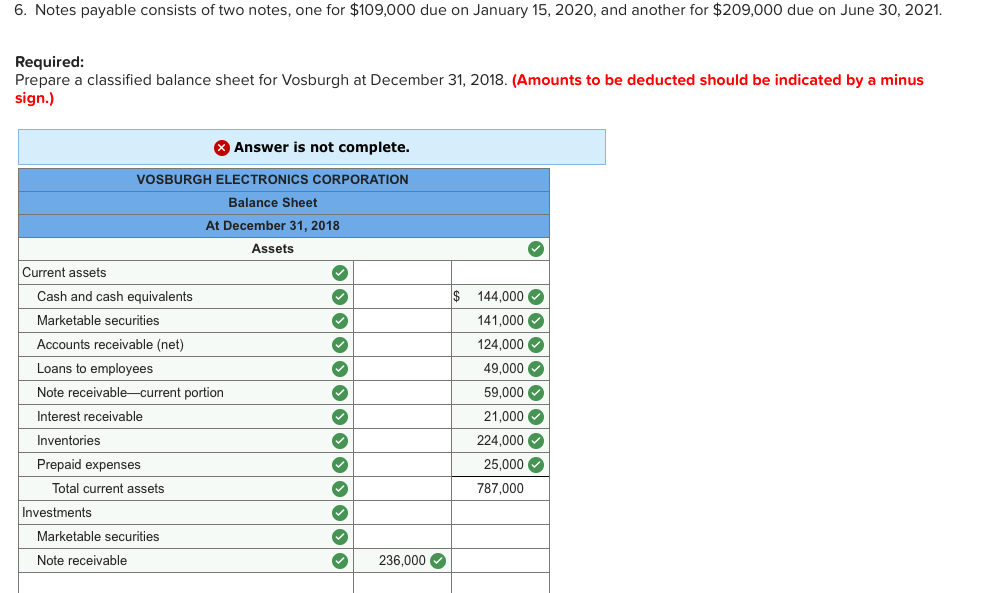

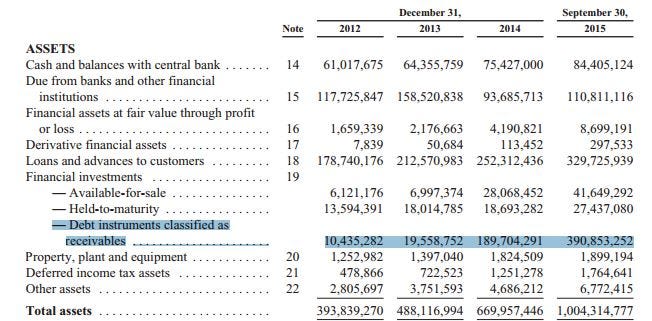

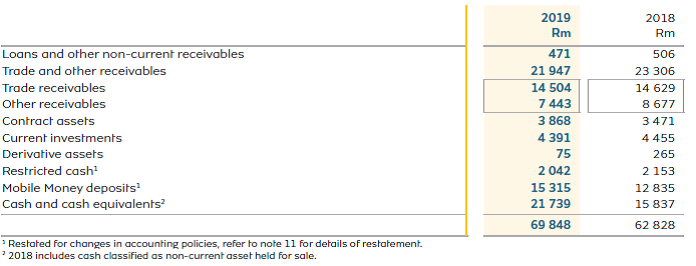

Take that bank loan for the bicycle business. The heading loans and receivables loans and advances to customers in the accompanying consolidated balance sheets also includes certain mortgage loans that as mentioned in note 35 and pursuant to the mortgage market act are considered a suitable guarantee for the issue of long term mortgage covered bonds. Under ias 39 many loans and trade receivables are classified as loans and receivables and measured at amortised cost. The company borrowed 15000 and now owes 15000 plus a possible bank fee and interest.

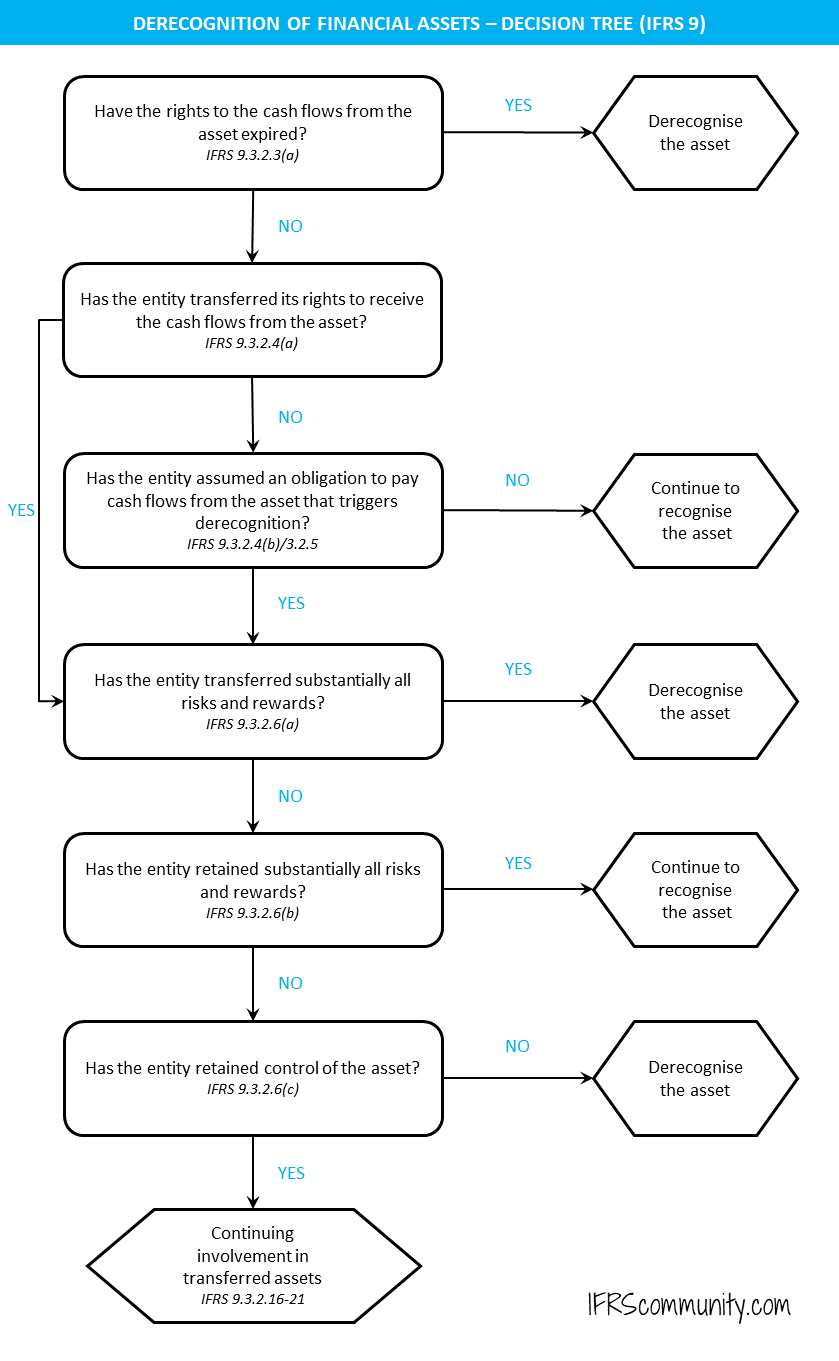

Liability for loan is recognized once the amount is received from the lender. Financial instruments are initially recognised when an entity becomes a party to the contractual provisions of the instrument and are classified into various categories depending upon the type of instrument which then. The new model can produce the same measurements as. This heading also includes some loans that have been securitized and not.