Government Loans Home

How government loans work.

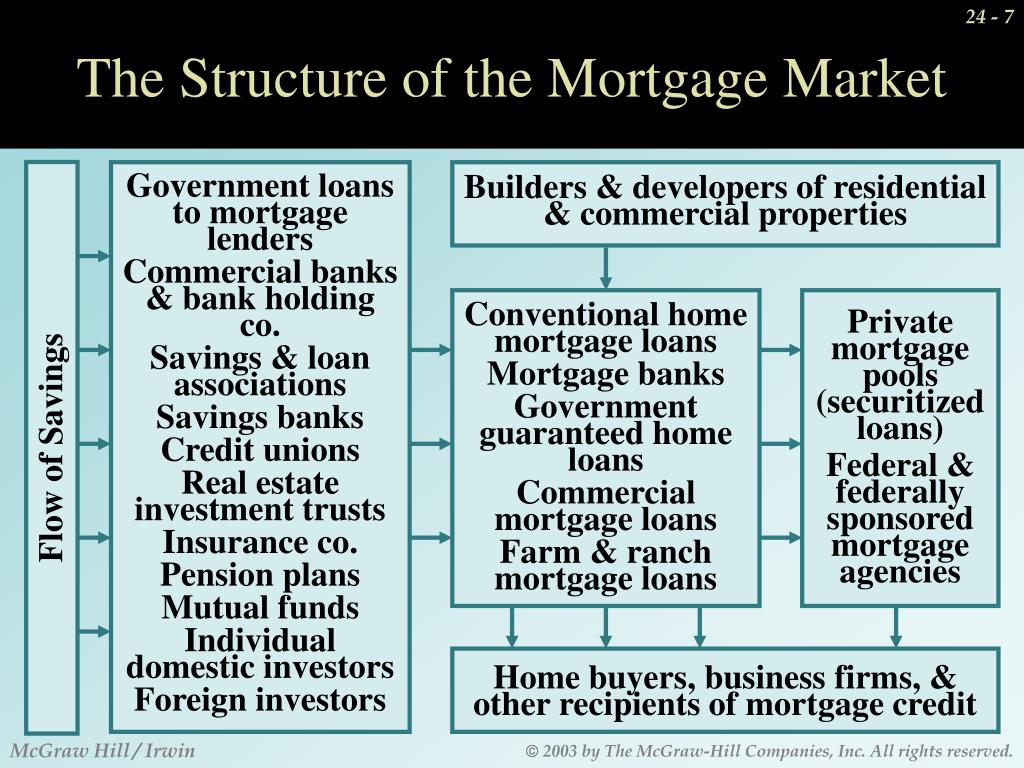

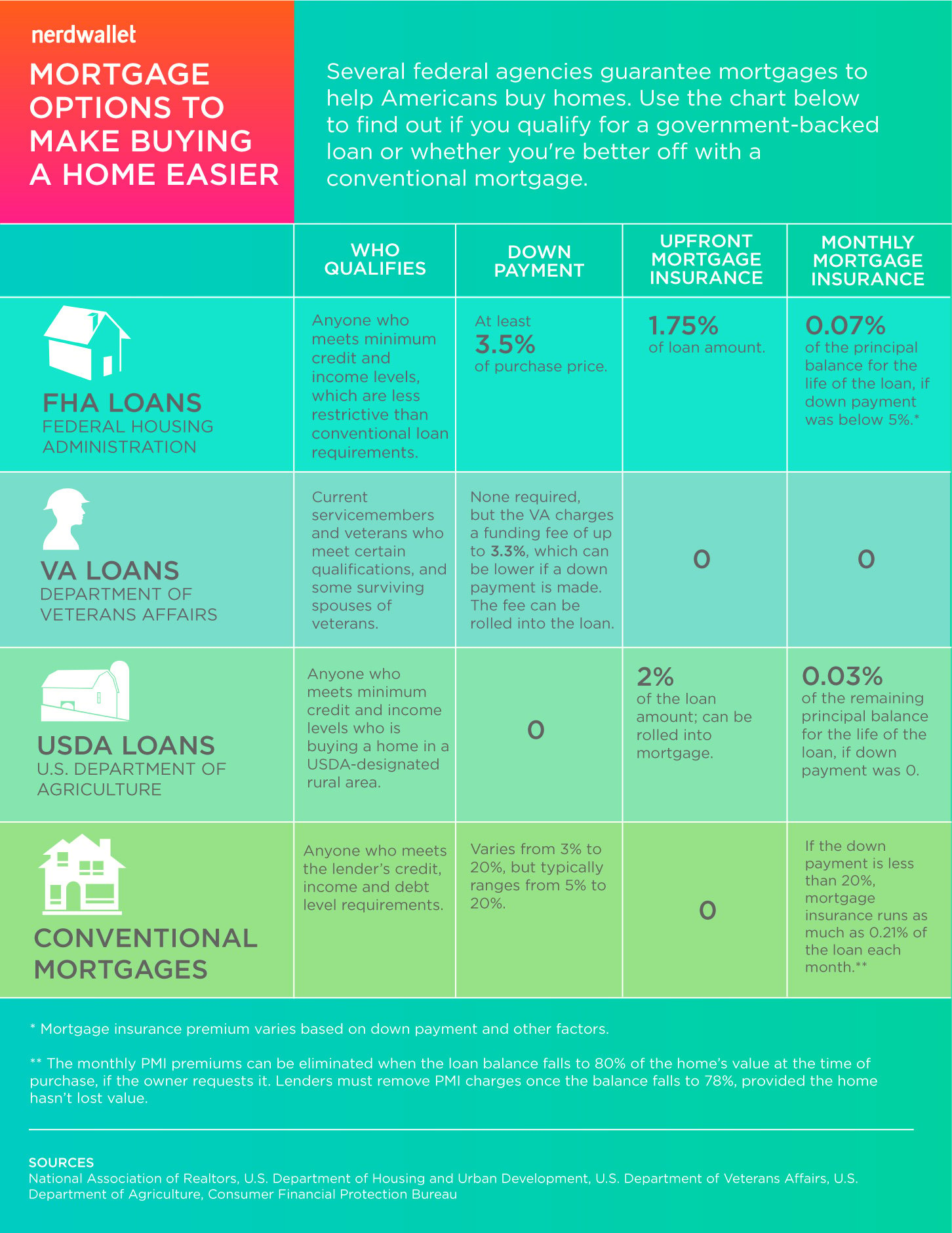

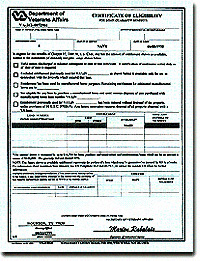

Government loans home. Instead private lenders like banks and finance companies provide funding and the us. Government home loans are issued or guaranteed by a federal agency. Browse housing loan assistance programs on govloansgov. Fha loans are amongst the most popular government loans for first time home buyers.

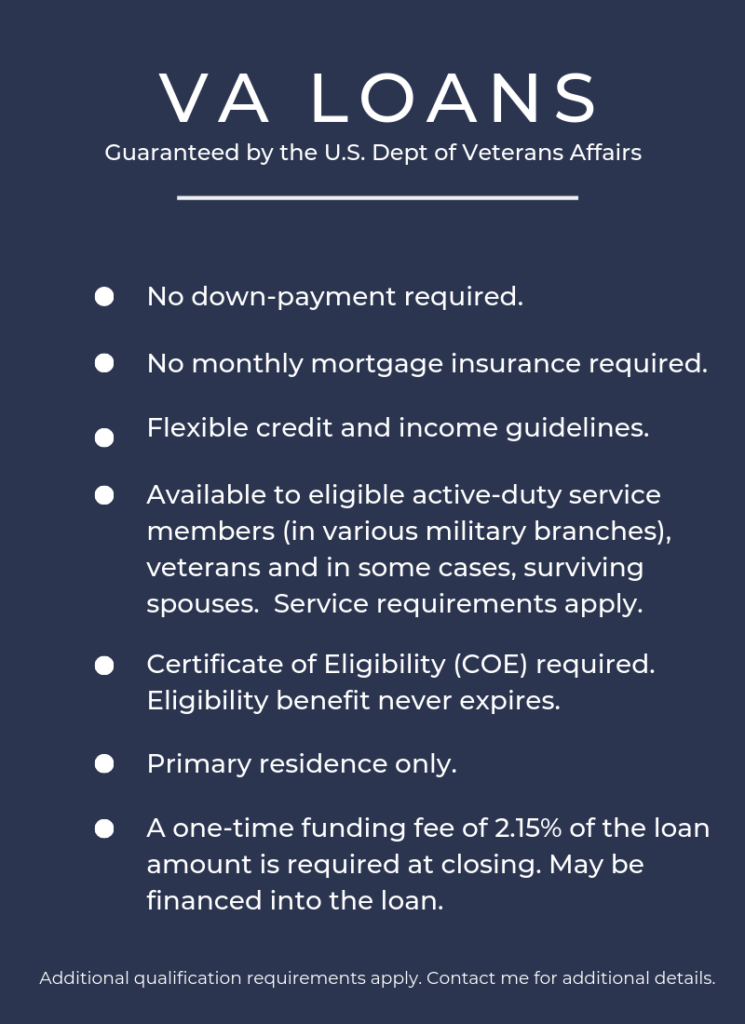

Loans are different than grants because recipients are required to repay loans often with interest. If you qualify and have a credit score of at least 580 you can. While there are well over a dozen variations of government loans the three highest loan volume programs are backed by the. This category has the largest number of loan programs including loans for buying homes making homes energy efficient.

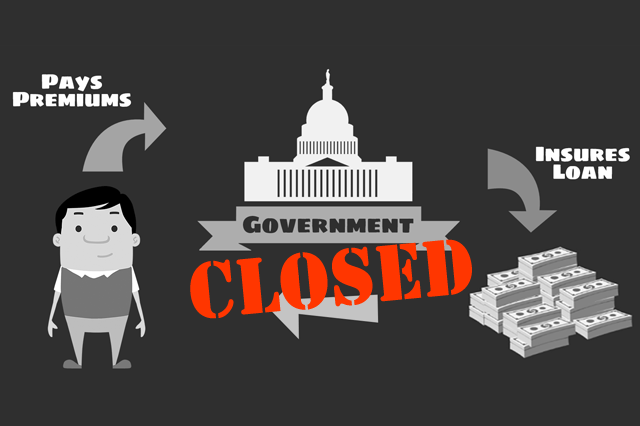

Government loans serve a specific purpose such as paying for education helping with housing or business needs or responding to an emergency or crisis. Originated by fha approved lenders and insured by the federal housing administration these home loans are a great choice for both first timers and other borrowers with low to moderate incomes. Put another way the government promises to repay your lender if you the borrower fail to do so. Government guarantees the loan.

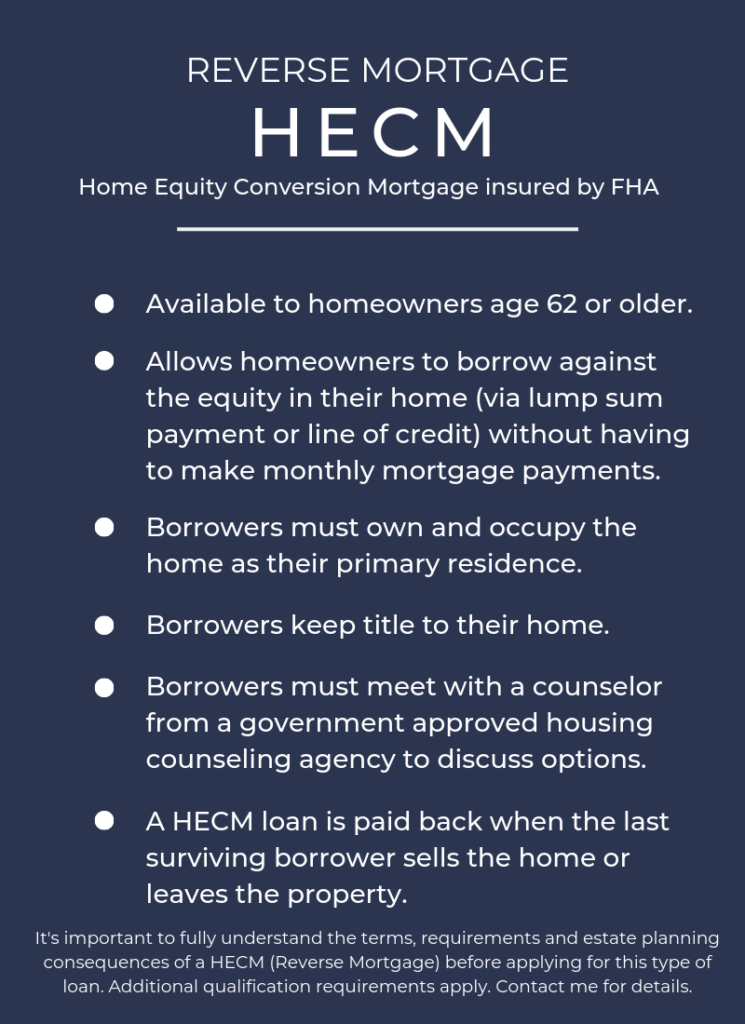

These loans can be used as strictly cash at closing to payoff debt make home improvements and pay off liens.

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)